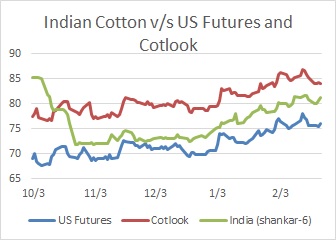

MUMBAI (Commoditiescontrol) – Cotton markets in India have been following the trends in US cotton futures since the beginning of this season. Entering the 2016-17 marketing season, cotton (Shankar-6, 29mm Gujarat) spot prices were at a premium of US cents 16 over US Futures and US cents 8 over the Cotlook A Index. By end-November, they were at a discount of US cents 7 to Cotlook and almost at par with the US Futures. This change is largely attributed to disruption of cotton trade by the government’s demonetization policy and was limping through December and January. Arrivals were much below normal for most of the period. Prices remained range bound periodically, raising their heads whenever arrivals were become sluggish.

As cash crunch eased in early February, arrivals started increasing but are still below normal. Meanwhile revised crop estimates of the government pegged cotton harvest at 325 lakh bales while Cotton Association of India said it was at 341 lakh bales. However, total arrivals until 22 February crossed 200 lakh bales, but were still 3 per cent below last year. A large fall was seen in Telangana where arrivals are 43 per cent below last year. If crop harvest is assumed at 340 lakh bales, it implies 140 lakh bales are yet to arrive, which indicates extension of marketing season until April.

As cash crunch eased in early February, arrivals started increasing but are still below normal. Meanwhile revised crop estimates of the government pegged cotton harvest at 325 lakh bales while Cotton Association of India said it was at 341 lakh bales. However, total arrivals until 22 February crossed 200 lakh bales, but were still 3 per cent below last year. A large fall was seen in Telangana where arrivals are 43 per cent below last year. If crop harvest is assumed at 340 lakh bales, it implies 140 lakh bales are yet to arrive, which indicates extension of marketing season until April.

Arrival should increase from 1.7-1.8 lakh daily now to more than 2 lakh bales in coming days, but their sluggishness will keep domestic prices firm. With mills consumption at about 300 lakh bales and another 50 lakh bales for exports leaves no inventory prospect from the 2016-17 crop. This will prompt India to import large volume to meet domestic consumption, which may play against prospect for prices to rise.

Indian cotton to follow US Futures

While sluggish domestic supply will keep prices firm, strong US Futures will only make room for Indian prices to rise at least for a couple of months. Cotton futures closed higher this week despite higher acreage projected by USDA. Other USDA statistics show plenty of cotton in US and in the global markets. However, the US position and the biggest world exporter is secured for this year as export demand remain strong. India has become a quiet seller as the country work internally on currency issue.

However, global markets are anticipating increased offers from Australia this year and South Africa to join in later in March-April with its supply. This can dampen global price prospect in coming months. For now, July Futures settled at US cents 77.50 per pound, almost one cent premium to May Futures.

What is strengthening US Futures

Another factor that will drive the bulls is the current situation between call sales and call futures. As per Commodity Futures Trading Commission, for March cotton, call sales are at about a 7:1 ratio, but for May and July cotton, that ratio climbs to 10:1. This means for every futures contract that must be sold, there are 10 others that have to be bought between now and July. This has created a tremendous pressure on the market. Textile mills doing extremely poor job of pricing their cotton, they are squeezed and will have to pay up.

A recent CFTC on-call report showed that there were still 11.52 million bales unfixed overall in the week ended 17 February, of which 8.03 million bales are on May and July. This is a record volume and by a huge margin till date. Comparatively, the last two seasons had less than 3 million bales still open on May and July at this date. The only other season that comes closer is 2010-11, when 5.98 million bales were unfixed. Thus, the underlying support is from mill fixations, with buy scales starting at 75.50 cents.

The downside is the abundant stocks in China that will mask a potentially bullish situation going forward and the market is already sensing it.

Advantage to manmade fibre

Polyester prices are also currently taking benefit of cotton demand. PSF prices in China have increased 20 per cent since October, largely due to the country closing a number of polyester mills because of pollution. However, support for US cotton at the mill level is also stronger and cotton’s sustainable benefits over polyester is beginning to take hold at other levels of the fibre supply chain.

(By Commoditiescontrol Bureau; +91-22-40015522)