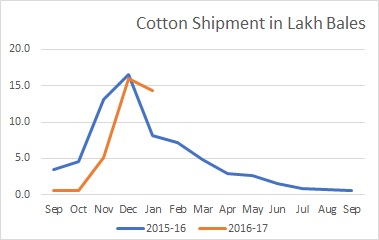

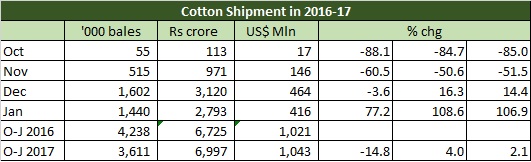

MUMBAI (Commoditiescontrol) – Cotton shipments during the first four months of 2016-17 marketing year declined 15 per cent to 36.1 lakh bales. Last year, the same period has seen shipment totaling 42.4 lakh bales. This year, exports were limited by the demonetization policy of the government which disrupted cotton trading in local mandis. Arrivals were severely affected as farmers refrained from bringing their harvest due to cash crunch and resistance to sell in deals through bank transactions.

However, there has been recovery in January after three months of sharp declines year on year. Shipment had declined 88 per cent in October, 60 per cent in November and 4 per cent in December. January saw shipment jump 77 per cent to 14 lakh bales.

However, there has been recovery in January after three months of sharp declines year on year. Shipment had declined 88 per cent in October, 60 per cent in November and 4 per cent in December. January saw shipment jump 77 per cent to 14 lakh bales.

Unit price realization has also come down. In October per pound of Indian cotton had fetched US cents 84 and this fell to US cents 77 in January. Bale wise, the realization was Rs20,715 per 170 kg bale in October and Rs19,400 in January 2017. Nevertheless, realization in January was 17 per cent higher than a year ago.

Bangladesh, Pakistan, China and Vietnam were the largest importer of cotton in January with aggregate volume at 12.51 lakh bales. Total imports in the first four months of 2016-17 by these countries stood at 30.87 lakh bales as against 38.15 lakh bales in same period last year.

Export to Pakistan dropped sharply from 17.60 lakh bales last year to just 4.4 lakh bales during October 2016 to January 2017. Shipment to Bangladesh was around 12 lakh bales in both years. China has sharply raised its import from India from 4.95 lakh bales to 8.64 lakh bales this year.

(By Commoditiescontrol Bureau; +91-22-40015522)