MUMBAI (Commoditiescontrol) – Domestic mills have restarted buying cotton in larger quantity in the second week of February, although not with intention to stock up, but to meet their immediate needs as prices have started looking up and are higher than they were in November to early January. During that period, MNCs had cornered most of the cotton that was available to build inventory and to meet export obligations. Mills were then procrastinating their buying for stocking, anticipating prices to drop in December/ January when arrivals pick up. However, they lost their wager as prices started rearing up rather than falling in this time of the season. Generally, prices are at their low levels when arrivals peak in December-February period.

Cotton Balance Sheet

This season, the circumstance is quite different from a normal year despite goods rains, remunerative prices for sowing, bright demand prospect and a larger crop. The crop balance sheet is encouraging. With production estimated at 340-345 lakh bales and opening stock of 140 lakh bales, the total availability is around 480 lakh bales. If India can export 80 lakh bales, the year will close at 90 lakh bales or so.

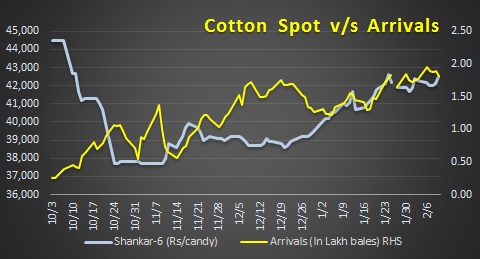

Arrival-Price Nexus

The 2016-17 marketing season was plagued by the demonetization policy of the government which disrupted trading in cotton market as the season was in its initial stage. Arrivals dropped to abysmal levels and prices followed through falling. By early January as the effect of demonetization faded, arrivals started rushing in while prices surged on global cues. As the chart below shows the nexus of prices and arrivals. It is very clear that despite rising arrivals, prices have not even receded, but have climbed back to their levels seen at the beginning of the season.

Global Opportunity

This sudden inverse relation raises many doubts. Why is the cotton market looking for global cues when domestic demand/supply fundamentals are strong enough to drive global market. Or is there enough surplus available for exports and a demand for that on the international markets. Bangladesh and Vietnam are growing markets for raw cotton, there is enough cotton in China, and a small shortfall in Pakistan. Against this, Australian cotton is bumper, US cotton crop is larger, South American and South African cotton is always surplus available on the global market.

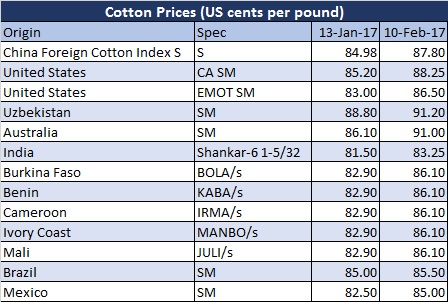

If Indian cotton has to be sold on the global market, than it obviously needs to be pegged below global prices. As of 10 February, they are ruling at US cents 8.25 per pound when US March cotton is available at US cents 75.85 per pound and May at US cents 77.09 per pound and July at US cents 77.94 per pound. However, India is just below Cotlook, which is at US cents 85.15 per pound. Indian cotton is at discount to Australia, Burkina Faso, Benin, Cameroon, Ivory Coast, Mali, Brazil and Mexico.

Mills Behaviour

Aggregate arrivals have touched 171 lakh bales in early February and still half the estimated crop is yet to arrive. Mills believe that prices were fall later in the season by the time all the crop enters the market. The same was the belief in 2015-16 season and neither mills or Cotton Corporation of India had plans to stock early in the season with smaller crop. Traders saw opportunities at remunerative pricing and exported large quantity of cotton, particularly to Pakistan where the crop had failed. As the season progressed, arrivals thinned and mills found negligible domestic cotton on offer at a very high price making domestic cotton uneconomical for mills. Mills resorted to import cotton which were cheaper than Indian cotton.

This year too, mills are apparently following the same belief, and are postponing buying for stocking to a later date anticipating prices to fall further from current levels. MNCs are buying volumes whenever prices drop for the moment. CCI has been buying cotton at commercial rates with an intention to purchase about 15 lakh bales. The Budget has armed it with Rs610 crore for the purpose. Its aim is to make the fibre available to mills during the lean season.

On an average mills consumption is 25-26 lakh bales a month, equivalent to 300-310 lakh bales a year. The cotton crop is estimated at 340-345 lakh bales and opening stock of 140 lakh bales, the total availability is around 480 lakh bales. If India can export 80 lakh bales, the year will close at 90 lakh bales after mills consumption.

This year the marketing season is expected to extend as half the crop is yet to come. Mills are waiting for that rush and prices to fall. In case, the crop is not as anticipated (340-345 lakh bales), mills will once again face the 2015-16 season’s vagaries.

(By Commoditiescontrol Bureau; +91-22-40015522)