MUMBAI (Commoditiescontrol) – Crude oil prices jumped 2% weekend ahead of meeting of the world’s top oil producers to demonstrate compliance to a global output cut deal, but rising US drilling activity limited gains. Brent crude ended Friday up US$1.33 a barrel but added only US cents 4 week on week at US$55.49 a barrel. US crude for February delivery closed up by US$1.05 on Friday and US cents 5 on the week at US$52.42 a barrel before expiring. The more active March contract settled at US$53.22 a barrel.

MEG

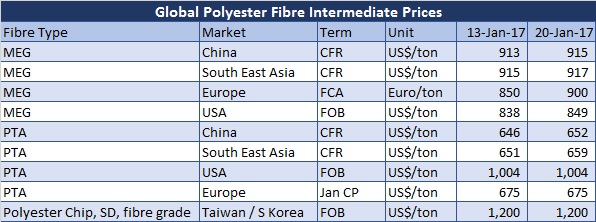

Mono ethylene glycol prices inched up in Asian markets despite short supply. However, prices are expected to surge after Lunar New Year holidays. In China, MEG market fluctuated amid lusterless negotiating and trading sentiment. Markers were up US$2 week on week, with CFR China at US$915-920 a ton while CFR South East Asia marker was up at US$917-919 a ton.

In US, MEG spot firmed up following higher Asia and the assessment marked the highest level since the same point in July 2015. US MEG was assessed at US cents 38.50-39.50 per pound (US$849-871 a ton) FOB USG, up US cent 0.50 from last week. MEGlobal is set to increase its February North American benchmark for MEG by US cents 3 to US cents 47 per pound (US$1,036 a ton).

European MEG prices continued to climb as availability continued to remain tight. Spot was up Euro50 on the week to Euro900 a ton FCA NWE.

PTA

Purified terephthalic acid prices gained in Asian markets in line with the rise in raw material paraxylene cost and amid talks of tightening supply. Sources indicated that there were buying inquiries seen from India recently, but prices in China's domestic market remained more attractive than exports. In India, supply tightness in PTA market is set to ease slightly as a major plant resumes production and import cargoes start arriving at its ports. PTA markers were up US$8 on the week with CFR China at US$652-654 a ton while CFR Southeast Asia marker was assessed at US$659-661 a ton.

In US, PTA January remained unsettled and is expected to be flat to up. Prices were assessed this week at US cents 45.52 per pound (US$1,004 a ton), FOB USG.

Meanwhile, European PTA January contract price were at US$675-709 a ton.

POLYESER CHIP

Asian polyester chip markets were quiet and weak. Semi dull chip market fluctuated up this week om early trading. But despite firming MEG, downstream demand declined as downstream plants started to operate at lower rates ahead of Chinese Spring Festival, and thereby, chip offers dropped. In the second half of the week, some producers lowered offers further but trading remained lukewarm.

Asian marker for semi-dull continuous spinning fibre grade chip rolled over on the week at US$1,200-1,250 a ton FOB Taiwan/Korea.

(By Commoditiescontrol Bureau; +91-22-40015522)