Mumbai (Commoditiescontrol): Cotton on Call report Monday February 8 2016

Introduction to Cotton on Call Report

Cotton on Call report is released by US Commodities Futures Trading Commission (CFTC) week on week every Thursday evening. The report shows the quantity of call cotton bought or sold or contracted to buy or sell in the New York spot cotton market. Price however for call cotton is not fixed. Price is fixed later based upon the future month’s price.

Call cotton means physical cotton which is either bought or sold or it is under contract to buy or sell. Data is reported as unfixed call sales or the amount of cotton sold for which price is not fixed.

Unfixed call sales contract is undertaken between the cotton merchant and mill owner. The cotton merchant sells cotton and the mill owner buys cotton. At the time of the contract, quantity and period for delivery is fixed. However price, which is decided by the mill owner, maybe fixed or may not be fixed. If the price is fixed then the merchant undertakes a long position in either futures or options on ICE for equivalent amount. The merchant holds this position till the time he receives the payment from the mill owner and on receipt of payment he squares off his futures or options position. If the price is unfixed then the merchant does not undertake any position in the futures or options till the time the price is fixed. Prices have to be fixed latest by one day before the futures contracts first notice day for delivery.

Unfixed call purchases contract is undertaken between the cotton merchant and the grower of cotton. The cotton merchant buys cotton from the grower. At the time of the contract, quantity and period of delivery is fixed. However price, which is decided by the grower, maybe fixed or may not be fixed. If the price is fixed then the merchant undertakes a short position in either futures or options on ICE for equivalent amount. The merchant holds this position till the time the entire transaction is settled with the grower and squares off his futures or options position. If the price is unfixed then the merchant does not undertake any position in the futures or options till the time the price is fixed.

The difference between the price at which the merchant purchases cotton from the grower and sells to the textile mill is the profit or loss made by the merchant. This difference is price is called the basis price.

Cotton on call report published by CFTC tries to capture the amount of cotton futures or options which could be purchased or sold by the merchant for the given futures contract on ICE. Using this we can make an estimation of price movement in the given futures or options contract and also get a view into demand and supply of physical cotton in New York spot market.

Unfixed Call Sales

.bmp)

Unfixed Call Sales (Data from 31 December to 29 January) Source: Cftc.gov

.bmp)

Total Call Sales (Data from 31 December to 29 January) Source: Cftc.gov

March Cotton options on ICE expire on 12th February and first notice date for March futures is 23rd February. Hence all unfixed March contracts need to be fixed latest by 22nd February due to which we are seeing a sharp drop in volumes in the March contract. Unfixed call sales for May futures also saw reduction for week ended 29th January 2016 while July, December and March futures volumes remained almost unchanged.

Total Call Sales volumes also saw a sharp drop as reduction in volumes in March has not translated into a pick-up in volumes in the remaining future months. Drop in call sales volumes indicate lowering levels of purchases by textile mills.

Unfixed Call Purchases

.bmp)

Unfixed Call Purchases (Data from 31 December to 29 January) Source: Cftc.gov

July and December 2016 unfixed call purchases volumes did see an increase indicating forward purchases by merchants from cotton producers. Near months of March and May 2016 saw reduction in volumes.

.bmp)

Total Call Purchases (Data from 31 December to 29 January) Source: Cftc.gov

Total Call Purchases also dropped mainly on drop in volumes in March.

.bmp)

Total Call Sales to Purchase ratio is seen decreased again with a larger decrease in unfixed call sales. Hence drop in volumes is mainly associated with drop in purchases by textile mills.

Prices and Open Interest

.bmp)

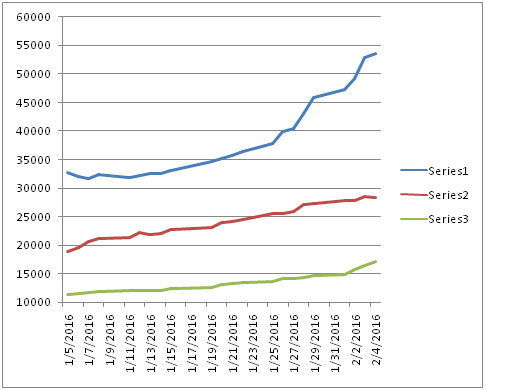

Prices on ICE Futures (31 December to 4 February; Green – March 2016, Blue – May 2016, Green – July 2016 and Purple – December 2016) Source:Reuters

Open Interest of First Month Continuous on ICE Futures (31 December to 4 February) Source:Reuters

Prices have been seeing sharp decline from 27th January onwards. Open interest in March has also been reducing while open interest has been increasing in the far months (chart below). This clearly indicates a roll-over of short positions from March contract to further month contracts – mainly the May contract.

Open Interest of ICE Futures (31 December to 4 February Blue – May 2016, Brown – July 2016 and Green – December 2016) Source:Reuters

Impact

Sharp reduction in unfixed call sales represent drop in demand from textile mills which is clearly being reflected in prices. However pick up in unfixed call purchases especially in December 2016 is expectation of merchants for demand to increase in those months. The same is also reflected by moderate increase in unfixed call sales in July 2016 onwards. Hence prices, which are right now at the support region of 58 to 60 cents, may weaken further in the near term till the expiry of March contract. However further months especially December 2016 onwards would see prices firming up.

(By Commoditiescontrol Bureau; +91-22-40015523)