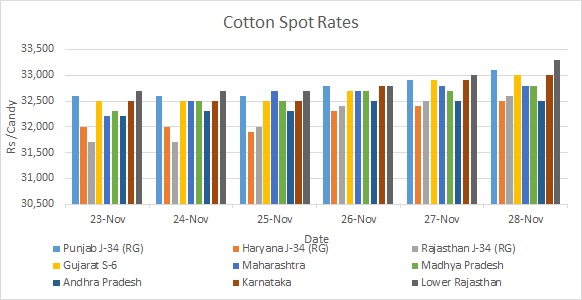

MUMBAI (Commoditiescontrol) - Cotton prices moved steady-to-firm in domestic markets during the week ending 28th November, 2015 on strong outlook triggering rally.

The commodity opened the week Rs 30/maund (37.3kgs each) lower in north Indian markets when compared to last weekend. Prices then remained stable for quite sometime and thereafter turned bullish to close the week in the range of Rs 3,450-3,475/maund. All in all, cotton prices gained Rs 55-60/maund in northern spot markets during the week.

In the similar fashion, prices gained Rs 400/candy (356kgs each) in central Indian markets, while prices in south India posted gains of Rs 100-200/candy today, weekend session.

One of the major reasons behind price rise is limited arrivals of new crop in domestic markets contributed to the rise in cotton prices. This season, the pace of arrivals has been comparatively slower than previous years.

Arrivals this time of the current season is said to be lagging nearly 20-30 percent compared to last year. Till 24th November, 2015, all India arrivals as per Cotton Corporation of India (CCI) is at around 38.583 lakh bales.

Mr. Arun Dalal, an Ahmedabad-based veteran trader and analyst when requested to comment on the current market scenario said “Nearly 50 percent of the total cotton arriving in the domestics markets are being bought by exporters. Exporters are bullish in the commodity in the wake of strong movement in USD. Major takers of India origin cotton at present are Pakistan, Bangladesh and Vietnam.”

In fact, exporters are still facing stock shortage for mid-December delivery as they have not been able to buy raw material for the delivery period, he noted.

After suffering steep disparity in margin for the last many sessions, ginners are now realising no major loss or significant gains due to positive movement in cotton seed and cotton bales over the last two days, Mr. Dalal said.

He added that production of good quality cotton is lower this year in China, Turkey, Brazil, U.S. and India. Further, recent rainfall in some of the major growing areas domestically and globally including Telangana, Texas and Pakistan, has damaged cotton crop to a large extent. Which is why there is likelihood that A-Grade cotton may always see strong demand in the current marketing season.

Commoditiescontrol's View On Current Market Scenario:

Going with the U.S. Department of Agriculture’s (USDA) latest attache report, Turkey, Pakistan and Brazil would witness lower cotton production in 2015/16 season, indicating an overall positive picture.

A Bullish Trend Building Up:

Good movement in futures in last two days has paved way for speculators to enter into market actively. A bullish trend seem to be building up on cotton futures on Multi Commodity and Exchange (MCX) cotton, Intercontinental Exchange (ICE) and National Commodity and Derivatives Exchange (NCDEX) cotton futures. The resistance level of Rs 16,600 has been breached this week and upside breakout of Rs 16,650 is expected in sessions to come, as per (MCX) cotton technical chart for Dec month.

The USDA’s weekly export sales data released on Friday also fared well for the soft commodity. The export sales data showed that sales of U.S cotton hit a marketing year high of 257,600 running bales in the week to Nov. 19, up 38 percent from the previous week. The weekly report was delayed due to the U.S. Thanksgiving holiday on Thursday.

Strong export demand prospect also is garnering backup from the fact that there are estimations that Indian Rupee may touch 67.30 level in the short-term against a dollar. If breached this crucial level, 68.80 can be challenged. In such a situation, exports would become further lucrative.

Currently, domestic cotton prices in Pakistan are at season’s high. Hence, nearly 70 percent of cotton arriving in Indian markets is being bought by Pakistan.

Kapas arrivals this time of the current season is said to be lagging nearly 20-30 percent compared to last year. There are high chances of cotton prices going upside to Rs 34,500/candy in the near-term.

CCI MARKET OPERATIONS

MSP Operations: The Cotton Corporation of India (CCI) started its minimum support price (MSP) operations across Andhra Pradesh, Telangana, Maharashtra and few centres in Madhya Pradesh. Till 23rd November, 2015, it has procured around 1,69,260 bales cotton through five states, according to its website. The government agency has opened 136 procurement centres in six states so far.

E-Auctions: At its e-auction this week, CCI has sold 42,900 bales of cotton from 2,00,200 bales put up for sale, nearly 21.5 percent of the total offer.

U.S. MARKET THROUGH THE WEEK:

The most-active contract on ICE, March contract closed the week at 63.93 cents per lb, gaining 81 cents, or 1.23 percent from last week’s closing.

Cotton futures on the exchange traded on the positive territory for most of the sessions this week on mixed fundamentals. U.S cotton crop harvest remained the highlight of the week. Harvest activity slowed down in some of the key growing regions.

Later in the week, activity calmed down as markets observed a closure marking “Thanksgiving Day”.

As per USDA’s weekly crop report, only 64 percent of Georgia's crop was harvested as of 22nd November, 2015, down from 87 percent at the same point the prior year and 80 percent on average during the past five years.

Besides, forecast of rain over the key producer Texas, lent added support to the upsurge in prices. Unfavorable weather forecast ignited fears of disrupted harvest activity during the current peak time the crop.

Additionally, bullish export sales data released by the USDA proved further beneficial for the momentum. The data showed that sales of U.S cotton hit a marketing year high of 257,600 running bales in the week to 19th November, up 38 percent from the previous week.

Vietnam (92,100 RB), Turkey (85,300 RB) and Thailand (25,500 RB) emerged as the major buyers for the U.S grown cotton. China once again remained largely muted in the business.

SPECIAL STORIES THROUGH THE WEEK

Turkey May See 17% Drop In Cotton Output; Imports To Rise 9% In 2015/16

Turkey, the second largest cotton buyer in the world, is likely to import 4.016 million bales cotton (480 lb), 9 percent more cotton in 2015/16 season. The U.S. Department of Agriculture (USDA) in its recent attache report estimated that cotton output in Turkey may drop nearly 17 percent to 2.7 million bales in 2015/16 compared to last year (Click Here For Full Report)

Brazil 2015-16 Cotton Output May Decline 9% On Lower Area

Cotton output in Brazil, the world's fifth-largest cotton producer, is likely to drop 9% on year to 6.4 million bales (480-lb) in 2015-16, thanks to the lower area under cultivation, according to the USDA attache report. Brazil is estimated to have produced 7 million bales in marketing year that ends July 2014, down 12% from 2012-13, the report said (Click Here For Full Report)

Cotton Prices In Brazil Down For Seventh Consecutive Week

Cotton prices decreased in Brazilian markets for the seventh consecutive week through 23rd November. Mills have cotton from previous contracts and they are trading gradually in spot markets, without pressuring demand (Click Here For Full Report)

TCP To Sell Balance Cotton Stock From 2014/15 Through Agents

The Economic Coordination Committee of the Cabinet (ECC) on Wednesday allowed Trading Corporation of Pakistan (TCP) to sell balance cotton stock from 2014/15 season on retail basis at minimum of the Karachi Cotton Association (KCA) spot rate for the day (Click Here For Full Report).

TOP STORIES THROUGH THE WEEK

India May Miss Export Target Of $325 Bln In 2015-16 - Com.Min Official

Ravi Kapoor, Joint Secretary, Department Of Commerce, Said India May Miss Export Target Of $325 Billion In 2015-16 Owing To Sluggish Global Demand And Falling Commodity Prices. If So, Current Season Will Be Second Year Of Contraction In Exports. Kapoor Even Said That India’s Exports Might End Below $300 Billion By The End Of 2015-16.

Textile Min Wants Bangladesh To Lift Jute Export Ban

Indian Textile Ministry urged government to request Bangladeshi government to lift jute export ban after prices rose over 30 percent. Ministry also requested jute commissioner to notify stock limits for raw jute.

Cotton Ginners Face Disparity Amid Sliding Cotton Prices

Cotton ginning units in Gujarat are under pressure due to disparity due to falling cotton prices. Cotton prices declined from Rs 32,800 to Rs 32,000/candy (356 kgs each) during November so far. Out of over 4,300 ginning units, about 1,300 are spread across the state, with about half of it being closed.

Telangana Too Declared Drought Hit

In line with many other states, Telangana too has been declared drought affected. State government said Mahbubnagar, Medak, Nizamabad, Ranga Reddy, Nalgonda, Warangal and Karimnagar are severely drought-hit. Telangana is the ninth state in India facing drought like condition this year. Moisture content in soil is less, affecting rabi sowing.

MAHAFED Buys 39,641 Quintals Cotton

MAHAFED bought 39,641 quintals cotton till 24 November, 2015 from 64 centres. Private traders bought another 33,000 quintals in the state. Earlier, the federation said it is ready to procure up to 100 lakh quintals this season against 27 lakh quintals last year. It has opened some 64 purchase centres in the state, which include 25 centres in Nagpur and 29 in Aurangabad.

Fall In Raw Material Prices Pressures Viscose Yarn Prices

Viscose yarn prices, especially of 40 s compact siro-spun yarn fell 2 cents/kg in China in November second week. prices of 30 s viscose yarn prices declined 1 cent/kg. Moderation in raw material prices (VSF) is attributed as the major factor for fall in yarn prices.

Texprocil Wants Extension In 3% Interest Subvention Benefit

Texporocil requested government to extend 3 percent interest subvention benefit to cotton yarn exports. Chairman R.K. Dalmia said benefits should be extended as cotton yarn exporters are facing intense competition from neighboring countries amidst sharp fall in demand, especially in China. The council said interest rates on export finance are high in India as compared to competing countries such as Bangladesh, Pakistan, Sri Lanka and Vietnam.

CCI Opens 5 More Procurement Centres In Telangana

CCI opened 5 more purchasing centres in Mahbubnagar of Telangana on Monday. It has opened the extra centres on the plight of cotton farmers. Joint Collector Ramkishan said government would purchase cotton at MSP of Rs 4,100 per quintal.

Plan To Restore “White Gold” Tag To Vidarbha On The Anvil

Maharashtra government Is Planning To Integrate Six Distressed Districts Of Vidarbha Through 80% Cotton Industry. Govt Plans To Earmark Special Allocation To Promote Cotton Based Industries In Vidarbha To Address Its Socio-Economic Problems In 2016-17 Budget. Chief Minister Devendra Fadnavis Directed The Officials To Expedite Work To Transform Amravati District As The International Textile Hub Of Country. All Cotton Related Small And Medium Scale Industries Would Be Promoted In The Region Including Maximum Cotton Spinning Mills In Akola, Buldhana, Yavatmal And Washim.

Pakistan Textile Exports Fall Over 10% In Oct YoY

Textile exports by Pakistan declined over 10 percent in October compared to same month last year. Decline in exports is mainly due to extreme energy shortage, higher cost of production and low prices globally. Pakistan textile exports were at $1.05 billion in October 2015 as against $1.18 billion same month last year, down 10.69 percent, as per PBS data.

Pakistan Allocates Rs 65 Bln For Textile Sector

Pakistan government allocated Rs 65 billion for textile sector under new textile policy. Pakistan President Mamnoon Hussain informed this while addressing a function at Faisalabad Chamber of Commerce and Industries (FCCI) on Wednesday.

U.S. Farm Income To Drop To 13-Yr Low In 2015 - USDA

USDA’S economic research service said U.S farm incomes are likely to fall 38 percent in 2015, lowest in 13 years due to lower crop and livestock prices. Incomes are likely to drop for second straight year to $55.9 billion. The consequent fall in incomes signals further pressure on sellers of agricultural inputs, equipment and land.

China Jan-Oct Cotton Yarn Import Reached 2 Mil Tons, China Customs Data

China Customs reported that October cotton yarn import totaled 174300 tons, down 20 percent from September and up 0.86 percent from a year ago. Cotton yarn export totaled 22200 tons, down 12.92 percent and 16.19 percent respectively. Net import registered 152100 tons, down 20.94 percent from a month ago and up 3.95 percent from a year ago. January through October, cumulative cotton yarn import reached 1.9994 million tons, up 21.93 percent from a year ago. Export totaled 28900 tons, down 20.21 percent.

China Issues New Target Price For 2015 Cotton

China issued new target price for 2015 cotton at 0.5 yuan/kg for Xinjiang farmers. Currently, these subsidies are still in issuing process.

China To Speed Up Reforms To Boost Economy

Chinese government said the it will expedite reforms to boost country’s economy. In this regard, Beijing is looking to give both international and domestic investors increased access to the world’s second-largest economy. China’s three anti-monopoly regulators, Ministry of Commerce, National Development and Reform Commission, and State Administration For Industry and Commerce, said in September that they would be widening market access for foreign firms.

Good Quality Cotton Production In Turkey Continues Fall

Production of good quality cotton in Turkey is constantly declining each year. In 2002, Turkey witnessed annual cotton output of around 8.50 lakh tons, which came down to 5.50 lakh tons in 2012. Turkey’s domestic cotton consumption is at around 17 lakh tons.

Mali Misses 2015/16 Cotton Output Target

Mali has missed 2015-2016 production target for raw cotton by 100,000 tons due to late rains, as per a news agency. The West African nation is the continent's second-largest producer after Burkina Faso. The country had produced 550,370 tons of raw cotton, about even with last year's crop but significantly less than its 650,000 tons target.

OUTLOOK FOR NEXT WEEK:

Cotton prices are likely to trade steady-to-firm during the next week owing to persistent export demand. Though we foresee marginal arrival pressure building up in domestic markets, good enquiry in cotton bales would keep the market balanced.

(By Commoditiescontrol Bureau; +91-22-40015532)