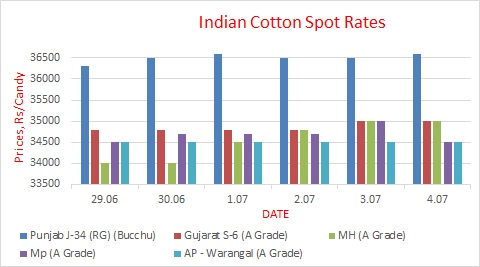

MUMBAI (Commoditiescontrol) - The primary tone in Indian cotton prices remained sideways in the week ended 4th July, 2015, as predicted in our last week’s report (27th June, 2015). Absence of any major guiding factor is attributed as the reason behind market players remaining hesitant in making significant deals.

Prolonged restricted movement in yarn market seems adding huge pressure on cotton prices. Both, domestic and overseas demand in yarn is visibly thin at the moment. Yarn prices traded steady to negative this week too, with average demand from textile mills. A south-based mill has reduced hosiery yarn prices by Rs 10-13/kg in this month’s price list, as per market sources. As per the Textile Ministry, prices of cotton yarn complex, including hank, cone and hosiery reduced about 9-12 percent this year compared to last year.

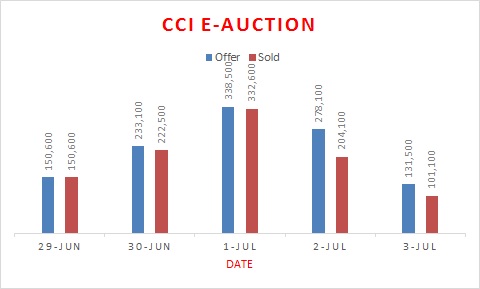

However, prices were moving continuously on the upside in Maharashtra during the week mainly tracking the selling pattern of the Cotton Corporation of India (CCI). Here, spot prices gained up to Rs 1,000 to touch Rs 34,000-35,000/candy (356kg each). Throughout the week, the government nodal agency sold 10,10,900 bales out of 11,31,800 bales in the wake of rising demand. Of the total, it sold the highest quantities in Maharashtra.

Selling pattern of CCI evoked positive sentiment among participants, with most of the spot markets tracking the CCI sale policy. However, no major demand was seen from textile mills. Many buyers are uncertain about the future prospects and opted to wait and watch as they anticipate prices may come under pressure now given that China has started selling cotton from state reserve. China likely holds 11.3 million tons of cotton in its state reserve.

The major buyers for CCI cotton were Multi National Companies (MNCs) and traders, which indicates that Indian cotton may become competitive in overseas markets. It also suggests that the MNCs have sold in forward and are now sourcing cotton for delivery purpose.

However, private traders across the country are left with an unsold stock of around 8-10 lakh bales, CCI is sitting with an unsold stock of around 57 lakh bales and Mahafed has a stock of around 10 lakh bales. And with only three months left for the current cotton season to end, such huge unsold stock seems to be an alarming situation. This could be balanced if CCI manages to offload its stocks into the global market. Cotton yarn exports on the other hand have revived back to above 100 million kg in June 2015 unlike May, when exports fell to new seasonal lows.

But then, private traders seem unwilling to liquidate their stocks at present. CCI has so far sold around 30 lakh bales, including 1 lakh bales exported to Bangladesh, Mr. B.K. Mishra, CCI MD told a news agency. Bangladesh is one of the top importers of Indian cotton. A delegation will be visiting Thailand to promote Indian cotton, he added.

Total all India arrivals as on 4th July, 2015 is estimated at about 356.35 lakh bales compared to around 384 lakh bales during the corresponding period last year.

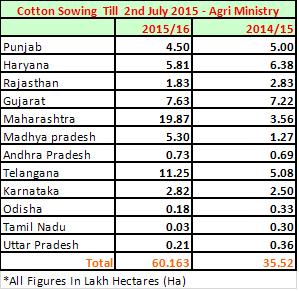

Weather pattern could play an important role in molding market sentiment ahead. So far, monsoon showers have been helping sowing progress in many major producing areas, with many states already completing sowing. But rain has halted in many of the cotton belts now, evoking concerns about normal growth of the planted crop. Cotton was on in around 60.16 lakh hectares on 3rd July, 2015 across the cotton belts compared to 35.42 lakh hectares last year same time.

Below is the state-wise cotton sowing data as on 2nd July, 2015:

Further, the private weather forecaster Skymet has forecast that north interior Karnataka and south interior Karnataka, Tamil Nadu and Marathwada would continue to observe prolonged dry weather in July also. However, it said that north, east, west and central India are likely to witness normal rainfall.

Special Coverage Through The Week

Cotton Sowing In Marathwada Hit A Roadblock Amid Scant Rainfall

Cotton growers in Maharashtra’s Marathwada region are likely to witness tough times ahead, especially in Beed and Jalna districts of Aurangabad division, with their crop finding it difficult to progress in a normal manner. As per trade sources, its been nearly 17 days Marathwada received the last rainfall. Erratic and irregular rains in the districts have prevented cotton crop from germinating. Also, high temperatures are affecting cotton seedlings on some fields. Most of the farmers here began sowing cotton in June after timely and good onset of monsoon rains. Farmers have been suffering a drought like situation continuously from the last 3-4 years. However, after the normal start, the area recorded scattered and isolated rainstorms which failed to put enough moisture on the fields. (Click Here To Read The Full Story)

Confusing Sowing Data Likely To Spur Speculation

If the latest cotton sowing available with the authorities anything to go by, the provide lot of ambiguity to the trade. There are lot of confusion in the data released by union ministry of agriculture and state agriculture departments, which may spur speculative activity in the domestic markets. Officials revealed that such anomaly is caused by the delay in reporting of sowing data. A lack of coordination between various government agencies and lethargic attitude of government machinery causes major hurdle for real time data updation in the regime of virtual connectivity and making mockery of data digitization process. (Click Here To Read The Full Story)

ICAC Ups 2015/16 World Cotton Consumption To 24.9 Mln Tons

In its July estimate for 2015-16 cotton crop, the International Cotton Advisory Committee (ICAC) has increased its forecast on world cotton consumption by 2 percent to 24.9 million tons compared to 24.3 million tons same month last year. China’s consumption is expected to remain stable at 7.7 million tons. Though China’s share of total world consumption may decline 31 percent, which is the sixth consecutive season of reduction since 2009/10 when it accounted for 40 percent of world consumption. The committee says that international cotton prices may remain stable, though this will depend in part on changes in world cotton stocks. In 2014-15, world ending stocks are forecast up 9 percent to 21.9 million tons, reflecting a stock-to-use ratio of 90 percent. (Click Here To Read The Full Story)

India Cotton Yarn Output Till April Rises Over 7 Percent

Cotton yarn production in India in April 2015 posted a growth of around 7.74 percent to 354.15 million kg compared to 328.68 million kg in April 2014, as per a provisional data provided by the Textile Commissioner’s office. However, cotton yarn production decreased 1 percent in April from 357.39 million kg in March 2015. Cotton consumption in April 2015 rose 7.31 percent to 26.1 lakh bales compared to 24.32 lakh bakes in April 2014. During the period from October 2014-April 2015, total cotton consumption rose 4.8 percent to 178.13 lakh bales compared to 169.95 lakh bales during Oct 2013-April 2014. (Click Here To Read The Full Story)

Stock Position At Exchange Warehouses

Cotton stocks at Multi Commodity Exchange (MCX) accredited warehouses reduced 4,200 bales to 71,000 as on 2nd July 2015 from 75,200 bales on 25th June, 2015.

Weekly Technical Update

MCX Cotton Bales Weekly: Expect Higher Range To Be Tested

Swing bottom appears to have been formed on weekly chart as per bias theory. The trend shown is also up as a result of closing above the DRV. Addition of long position has been witnessed. Weaker opening and correction to 16053 or below can be used for accumulation with a stop loss of 15450. Traders already long and holding the same can keep the stop loss at 15450. Expect higher range of 16397-16987 to be tested. The recent peak was at 16890 and the same could be tested.

Extended rally can happen whenever breakout and close above 16890 is witnessed. For near term, if rise is seen and 16890 is tested then traders can take profits first before thinking of re-enter again. Re-entry can happen if weekly close is above 16890 with bullish candle. Downside momentum can resume below 15400. The band is 15400 to 16890.

--MCX Bales Weekly Technical Update. Click Here

NCDEX Kapas April’16 Weekly: Expect Higher Range To Be Tested

Traders long can hold the same with a stop loss of 890. Expect higher range of 930-954 to be tested. A breakout and close above recent lower top of 967 is to be crossed for any meaningful rally. Upside can be capped to 936-967 as the supply zone to take profits. Downside momentum can resume on fall below 890.

--NCDEX Kapas Weekly Technical Update. Click Here

NCDEX Coc Weekly July: Take Profits At Higher Range

Traders long can keep the stop loss at 1740. Sideways movement has been witnessed above 1740. The resistance points are 1818-1855 and 1894-1907. Traders can buy above 1855 with low of the week as the stop loss or 1790 whichever is lower. Traders long can take profits if any on rise to 1800-1818-1855 as the opportunity arises. Expect lower range of 1772-1726 to be tested.

--NCDEX CoC Weekly Technical Update. Click Here

U.S. Market Through The Week

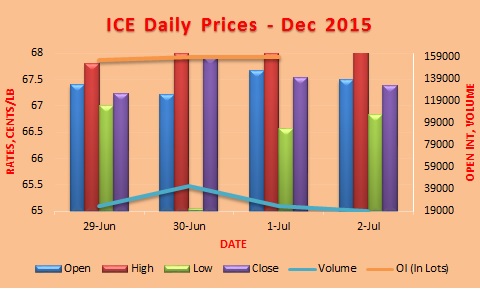

Cotton futures on Intercontinental Exchange (ICE) hit 11-month high, but profit booking at the higher level push down prices to close this week with loss of 1.19 percent amid profit booking at the higher level.

Cotton prices started the week with negative bias on Monday, but then on Tuesday it moved in wide range of 65.05 to 67.99 cents/lb as the U.S. government cut its estimate for cotton plantings to the lowest in over 30 years, reversing large losses seen earlier on news from Beijing about its plan to offload inventories.

U.S. cotton farmers have dedicated just under 9 million acres to cotton this year, the U.S. Department of Agriculture said on Tuesday. That is down 20 percent from a year ago and the lowest acreage since 1983.

The USDA's estimate was down from the 9.55 million acres the agency forecast in March and well below the 9.43 million acres that analysts polled by Reuters were expecting.

U.S. net cotton export sales for the 2014-15 crop year reached 80,500 bales last week, up 22 percent from the prior four-week average, according to U.S. government data. Shipments reached 230,400 bales, down 9 percent from the prior four-week average.

TOP STORIES THROUGH THE WEEK

Textile Units In Maharashtra Relieved As Govt Cuts Tariff

Electricity intensive units in Maharashtra including, textile, steel and cement have expressed their happiness over the state government’s decision to cut electricity tariff by 14 percent. Earlier, many electricity intensive businesses had to shut down their operations and others had migrate to other cities such as Gujarat due to higher rates of electricity.

Indian Govt Approves Online National Agri Market

Indian government on Wednesday approved setting up of an online national agriculture market. The online market will provide more options to farmers for selling their produce. Currently, farmers are restricted to selling their produce at market committees that charge various taxes on producers. With an online platform, farmers will be able to sell and buy fruits, vegetables and other produce from across the country. It will also focus on creating godowns and facilitating transportation of the farm produce after the online trade, sources added. With this, farmers get choice to sell the farm produce both in physical mandis or online platform.

New Textiles Policy To Be Announced This Month

Government of India will announce a new national textiles policy this month after the cabinet approval, said Textiles Secretary, S.K. Panda. The policy aims at creating 35 million new jobs by attracting foreign investments. The new policy aims at addressing concerns over lack of enough skilled workforce and labour reforms besides attracting investments and provide a roadmap for the textile and clothing industry. The Ministry also sought Rs 12,000 crore for the Technology Upgradation Fund (TUF) scheme for the ongoing 12th plan (2012-17), he said.

Govt Mulls Interest Subsidy Benefit For Textiles Sector To Boost Exports

The Commerce Ministry of India is thinking over considering interest subsidy benefits for textile sector, including garments. The aim to help boost country’s exports, which is on the downfall from the last many months. In May 2015, India's exports shrank by about 20.19 percent to US $22.34 billion, marking a fall for the sixth straight month.

(Click Here To Read The Full Story)

Cabinet Clears Scheme For Providing Irrigation

In an effort to lower agriculture sector's dependence on monsoon, the Central government has approved a scheme – 'Pradhan Mantri Krishi Sinchayee Yojana (PMKSY)', whereby it would provide irrigation facility to every village by bringing them under ongoing scheme implemented by various ministries. (Click Here To Read The Full Story)

Skymet Firm On Forecast Of 104% Of Normal Rainfall In July

Private weather forecaster Skymet said that it is firm on its forecast of 104 percent of normal rainfall for July. July has a standard rainfall deviation of ± 16%, and we see the cumulative rainfall for the month remaining in the same limit (84% to 116% of the July LPA of 289mm is normal). According to Skymet, north, east, west and central India are likely to witness normal rainfall in July. However, it said that south/Peninsular India could be at a loss, with north interior Karnataka and south interior Karnataka, Tamil Nadu and Marathwada observing prolonged dry weather. It said monsoon will take a breather between the 2nd and 6th of July. It forecasts three spells in July (6th-8th, 14th-17th, 23rd-26th) and a fourth around 30th July & August 2nd which might spill into August. The first spell between 6-8 July will be concentrated in north, central and east India, it said.

Fitch Ratings Slashes India’s Growth Estimate To 7.8% For This Year

Fitch Ratings has slashed India’s growth forecast for the current and next fiscal year. India’s growth estimate has been cut to 7.8 percent this fiscal and 8.1 percent next year, Fitch said. The ratings agency’s earlier forecast was 8.0 percent and 8.3 percent, respectively. However, the nation’s gross domestic product this fiscal year will outperform china’s growth for the first time since 1999, Fitch said. Fitch currently rates India investment grade BBB- with a stable outlook.

Sudden Rise In Export Demand Pulls Cotton Prices Up

Cotton prices over the last two weeks surged up due to sudden jump in export demand from overseas markets. Prices of S6 gained 3 percent to Rs 9,617/100kg from Rs 9,336/100kg around two weeks ago. As against the current price of 69 cents per lb on ICE, FOB (Free On Board) price of S6 works out to 69.30–70.10 cents per lb. Considering other expenses, India’s cotton stands competitive in Bangladesh.

Cotton Prices In Brazil Drop As Harvesting Begins

Brazilian cotton prices decreased in the last days after four weeks of highs due to the industries retraction. Purchasers should receive cotton from previous contracts in early July. Besides, they expect supply to increase with the harvesting beginning in many Brazilian regions. However, traders in need to accomplish contracts are buying, bidding lower prices. (Click Here To Read The Full Story)

Global Cotton Stocks Rise To Nearly Record-High Level - USDA

The USDA in a report stated that global cotton stocks rose to nearly record-high level mainly due to increasing stocks in China. Stocks in China at the end of 2014-15 (August/July MY) are estimated at a record 65.6 million bales, or 60 percent of global stocks. China’s policies supported national reserve purchases of domestic cotton and significant imports of raw cotton. In 2015-16, policy adjustments in China are expected to reduce stocks slightly to 62.6 million bales, with its share of world stocks remaining unchanged. As per the USDA, global cotton stocks are likely to fall in 2015-16 for the first time in 6 years, however may remain more than double the level in 2010-11. As a result, the 2015-16 world cotton prices may remain near the current season’s average of about 71 cents per pound, the lowest in 6 years, said the USDA.

U.S. 2015-16 Cotton Plantings Lowest In More Than 30 Years - USDA

The USDA released the planting report of the soft commodity that showed that the U.S. cotton growers have planted 9.0 million acres of cotton this season, much below its earlier expectation of 9.549 million acres and 18% below year-ago planting levels. The plantings were the lowest level in more than 30 years, which was last recorded in 1983, according to the USDA’s data.

West Bengal To Attract Around Rs 37k Cr For Textile Clusters

The West Bengal government is hoping to attract around Rs 37,000 crore in the state through 10 textile clusters or parks under integrated textile development project over the next 3 years. The project is likely to provide employment to around 6-10 lakh people. The textile cluster, including parks, involving hosiery, ready-made garments and knitting, will come up at Barasat, Bankura, Metiabruz, Uluberia, Salt Lake, among other places.

El Nino Event Still Significant For This Autumn - World Weather Inc.

U.S. based World Weather Inc. stated that El Nino event is still significant for this autumn and is still expected to be a significant feature well into the Northern Hemisphere. Though, recent rainfall increases in Australia, the Philippines, India and mainland areas of Southeast Asia have given some false indication that El Nino is weakening.

Asia’s Apparel Production To Grow Over 60% Of Global Output

The Vietnam Cotton and Spinning Association (VCOSA) said that apparel production scale in Asia will expand 2.4 percent by 2030, accounting for over 60 percent of global output. Several free trade agreements such as the trade pacts Vietnam and South Korea were reached, and they will turn the country into one of the primary destinations of the global supply chain and open up huge opportunities for the domestic garment industry.

IMD Forecasts Less Than Normal Rainfall In July, Aug

IMD has forecast that monsoon rains during July and August will be less than normal and advised Agri Ministry to keep ready a contingency plan. The weather agency said that rainfall could be deficient by eight and ten per cent in the next two months. However, Skymet has predicted "above normal" rainfall (104 percent) in July, "normal" rainfall (99 percent) in August and (96 percent) in September.

Potential For Textile Exports To African Countries Is Huge - Texprocil

Cotton Textiles Export Promotion Council (Texprocil) Chairman Mr. R.K. Dalmia said that potential for textile exports to african nations is huge, though currently its share is less than 5 percent. However, he said export of value-added cotton textile products such as dyed and printed fabrics and made-ups to African countries will be affected as the New Foreign Trade Policy has removed the benefits extended so far on these exports. Although, the newly-introduced merchandise exports from India scheme has allowed duty credit scrip of two percent, three percent and five percent to exports of notified products to specific countries, said Mr. Dalmia. The scheme does not include export of products such as the dyed and printed cotton fabric and made ups to African countries.

APTMA Says Millers Decide To Shut Down Units Voluntary

An emergent meeting of the general body of All Pakistan Textile Mills Association (APTMA) has decided that to shut down Pakistan’s textile units voluntarily because of the viability issue. The textile units have decided to close down operations due to rising cost of doing business, along with incidental Taxes, Provincial Cess, system inefficiencies and punitive withholding tax regime, as per the association. It said the government has not brought the unorganised sectors into tax net and billing the textile industry.

OUTLOOK FOR NEXT WEEK

We at commoditiescontrol.com see cotton prices trade sideways to negative during the next week. Although, CCI’s selling pattern evoked positive sentiment but thin demand from textile mills at the current rates may pressure prices. Most of the buyers may prefer holding wait and watch approach on hopes of some correction in prices.

From a long-term view, we assume prices to move range-bound with a negative bias in July in the backdrop of likely huge carry forward stock and dependency on weather.

(By Commoditiescontrol Bureau; +91-22-40015534)