MUMBAI (Commoditiescontrol) - As assumed in the last week’s report (20th June, 2015), trend in Indian cotton prices remained more or less steady to easy during the week ending 27th June, 2015, owing to lackluster activity by market players. However, spot prices surged up Rs 10/maund (37.3kg each) in north Indian markets and Rs 100-200/candy (356kg each) in central zone on Saturday citing Friday’s increased selling by the Cotton Corporation of India (CCI).

The agency has sold around 80 percent of cotton put up earlier in the day amid strong demand. It sold 1,05,700 bales out of 1,13,500 bales offered though the bid prices were raised by Rs 200-400/candy (356kg each) in various centres throughout the country. It recorded sale of 77,000 bales in Maharashtra, highest in the day's auction.

During Saturday’s trading session, private traders and stockists stayed sidelined as they think the CCI will raise its floor prices on Monday (next week) in the backdrop of Friday’s good response, pulling prices up. That’s when, they intend to enter markets hoping to attract buyers.

Total estimated cotton arrivals as on 27th June, 2015 is at around 355.50 lakh bales compared to around 378.5 lakh bales in the corresponding period last year.

At present, players are uncertain about the market movement and awaiting a clarity. Kharif sowing of the cash crop is progressing at a faster pace in the country helped by widespread monsoon rain across the major producing regions of the country. Cotton sowing as on 26th June, 2015, rose to 34.87 lakh hectares compared to 29.07 lakh hectares same period a year ago, according to the Ministry of Agriculture. Increasing sowing is raising the possibility of timely arrival of next crop in domestic markets. With estimated carry-forward stock of around 70-80 lakh bales for 2015-16 by the South Indian Millers Association (SIMA), worries about supply almost rule out.

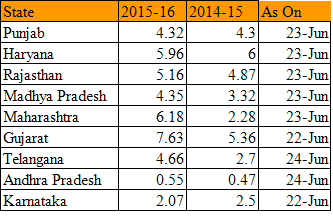

All India Sowing Figures As Per State Governments:

The Indian Meteorological Department (IMD) said that monsoon has covered the entire country, more than two weeks ahead of the normal schedule in a year that is forecast to see below average rains. The revival of monsoon rains in the grain bowl of northwest and central regions should help speed up sowing of main summer crops such as rice, corn, soybeans and cotton, the IMD said. Over a quarter higher rainfall since the start of the June-September season has eased concerns of a first drought in six years.

Movement in yarn market is disappointing at the moment, with slow demand from domestic and overseas buyers. During this week, yarn prices have witnessed loss of Rs 3-5/kg. Demand at current level is marginal as most of the big players have inventory to meet their urgent requirement. Hosiery market may also bend downward in the next week considering the overall downtrend.

Another factor that is a huge cause of the prolonged negative sentiment in the markets is the unsold stock of cotton. The CCI has an unsold stock of around 65 lakh bales and the Mahafed is sitting with an unsold stock of around 11 lakh bales. Therefore, expected timely arrival of next crop amid advancing monsoon in all major cotton belts along with a massive unsold stock has raised concerns about a supply glut situation in the domestic markets.

There are strong rumors in the markets that the Chinese government has approved state reserve release plans to lighten its massive stockpile, however official confirmation is awaited for the same. It is said that the country has decided to release around 1 million tons of cotton from its reserves, which was accumulated mostly from 2011. As published in one of China’s news portals, it will release 330,000 tons of domestic cotton from 2011 crop at 13,200 yuan per ton ($2125), while 470,000 tons from 2012 crop at 14,200 yuan per ton ($2286) and 200,000 tons from state reserve cotton imported in 2012 at 15,500 yuan per ton ($2495).

Further, the U.S. Agriculture Department (USDA) is set to release U.S. 2015-16 cotton planting report. Most of the market players expect a smaller U.S. crop report. If the planting report is on the lines of market expectation, there are possibilities of Indian cotton becoming competitive, market sources added.

Special Coverage During The Week

Cotton Acreage In Rohtak Lower Than Target

While assessing sowing progress of the crop in the country’s major cotton belts, commoditiescontrol.com has interviewed some of the veteran traders and few cotton growers in Haryana. According to them, most of the farmers in Rohtak district of the state are seemingly moving away from cotton cultivation after affected by adverse weather conditions and poor returns last year. Instead, farmers are growing sorghum, sugarcane, paddy and maize more in the district. New cotton crop is expected to arrive in the district by 15th October. According to the state government, cotton was sown in around 14,757 hectares (ha) in Rohtak district till 16th June, 2015, in which BT cotton was sown in around 14,550 ha and Desi hybrid cotton in around 107 ha and Desi cotton in around 100 ha. The state government has set cotton acreage target at 18,000 ha for the district this year.

(Click Here To Read The Interview)

India’s Cotton Exports To China In May Down Over 74 Percent

India’s exports of cotton to the world’s leading consumer, China in May, 2015 saw a slump of 74.19 percent to 18,673 tonnes, as per official customs data. Meanwhile, it exported around 169,109 tonnes cotton during the first five months of the year, Jan-May, which is down 72.91 percent compared to last year.

(Click Here To Read Full Story)

Stock Position At Exchange Warehouses

Cotton stocks at Multi Commodity Exchange (MCX) accredited warehouses reduced 8,400 bales to 75200 as on 25th June 2015 compared to 83,600 bales on 17th June, 2015.

Technical Weekly Update

MCX Cotton Bales Weekly: Sideways Volatility Likely To Be Witnessed

--MCX cotton bales weekly (Price In INR (Rs)/Bales)

--Sideways volatility around the DRV is likely to be witnessed.

--Traders long can keep the stop loss at 15670 and use rise to 16277-16747 to exit long.

--Sell on fall below 15670 with high of the week as the stop loss or 16110 whichever is higher.

--Click Here For Technical Report

NCDEX Coc July Weekly: Take Profits At Higher Range

NCDEX COC June :( Price in Rs/Quintal)

--Traders long can keep the stop loss at 1740.

--Resistance will be at 1852-1907.

--Traders long can take profits at resistance.

--A further breakout and close above 1907 can extend the rise.

--Re-enter long on breakout and close above 1907.

--In the event of a breakout and close above 1907, COC can rally to 2010 at least and amy extend to 2170.

--Click Here for Technical Report

NCDEX Kapas April’16 Weekly: Expect Higher Range To Be Tested

NCDEX Kapas April’16 (Price are in INR (Rs)/20 Kg)

--Traders long can hold the same with a stop loss of 890.

--Correction and slide in price can seen if sustains below 890.

--Cover short position at 918 or below.

--Weaker opening and correction to 918-919-899 can be used for buying with a stop loss of 890.

--Expect higher range of 928-957.

--Sell is below 890 with high of the week as the stop loss or 918 whichever is higher.

--Click Here for Technical Report

U.S. Market Through The Week

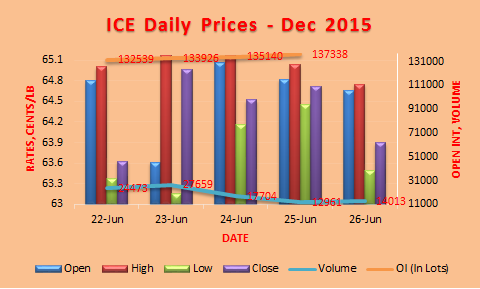

ICE cotton futures rose sharply during the last couple of sessions after trading in narrow range during most of this week. The benchmark December cotton rose to near two month high to 67.16 cents/lb, up over 6 percent from the previous week close.

Sharp rise in the last couple sessions were attributed to worries over U.S crop and tracking strong grain in oilseed and grain on U.S exchange. Excessive rains in the U.S. Midwest caused price rise in wheat, corn and soybean. Investor buying in these agricultural commodities have spilled over cotton in the past two days, an analyst said.

Weekly export sales released on Thursday morning were strong for the current season which is nearing an end, but trade sources are nervous about outlook for next year as China had announced to sell cotton from its state reserve at discount rate.

Certificated cotton stocks deliverable totaled 178,980 (480-lb) bales, up from 174,623 previous week.

In other news, ICE cotton speculators cut net long position by 2,212 contracts to 14,270 in week to 23rd June, 2015.

TOP STORIES THROUGH THE WEEK

Pakistan’s Non-Textile Exports Slumps 9.62 Percent In July-May

Pakistan’s exports of non-textile products between July 2014-May 2015 slumped 9.62 percent compared to a year ago same period, as per the Pakistan Bureau of Statistics. Export proceeds from these products fell to $9.472 billion during the period compared to $10.480 billion in the corresponding months of last year.

SEBI Mulls FPI Participation In Commodities Market

The Securities and Exchange Board of India (SEBI) is mulling including foreign portfolio investor (FPI) in commodities market. Investment of FPIs in commodity derivatives is being facilitated, as the finance bill cleared by the Lok Sabha included commodity derivatives in the definition of securities. The only concern could be raised is by the Reserve Bank of India (RBI) but sources indicate that RBI has already given an in-principle go ahead to the proposal.

India Can Grow Exports Of This Type Of Yarn - Banswara Syntex Ltd

Rajasthan-based Banswara Syntex Ltd believe that India has an edge in fibre-dyed yarn over other countries, a news agency reported. The company said that India can increase exports of this type of yarn. The advantages include color, continuity and true melange nature of colors that can be made, as per the company.

India May Be The Top Cotton Producer In 2015-16 - USDA

The USDA estimates 2015-16 world cotton output 6 percent higher to 111.3 million bales compared to last year. The agri department said that India may be the largest cotton producer in 2015-16, accounting 26.5 percent of total production.

Mali’s 2015/16 Cotton Output Target Of 650,000 Tons Threatened

Lack of rain threatens Mali’s target to achieve cotton output of 650,000 tons in 2015-16, according to a report. Mali’s cotton output in 2014-15 was at around 550,000 tons of raw cotton fibre compared to 400,000 tons the previous year.

Cotton May Remain Stable In 2015-16 Even If Output Drops - ICRA

The Information And Credit Rating Agency (ICRA) said in a report that cotton prices may remain stable in 2015-16 even if production declines by up to 15 percent. The rating agency believes that adequate domestic stock position is likely to keep the prices stable during cotton year (CY) 2015-16. It said that with global cotton demand largely being range-bound, supply remains the key driver of prices. ICRA added that China releasing cotton stock at market rates will further reduce its import requirement. This will lead to higher cotton stock levels in both global and Indian markets and further depress the international cotton prices, it noted.

Indonesia’s Yarn Producers Urge Govt To Impose Duty On Imported Yarn

Indonesia’s yarn producers urged the government to impose a temporary safeguard duty on imported yarn products. Imported products have severely damaged the market for locally made products. Local yarn products, especially some major types of polyester, were mostly unable to compete with the cheaper imported yarns due to their higher production costs.

Turkmenistan Expects 1.05 Mln Tons Raw Cotton Crop In 2015

Turkmenistan aims to harvest 1.05 million tons of raw cotton crop this year after a crop of 1.1113 million in 2014, said a cotton company. The state had originally set the same production target for this year as last year. Cotton has been sown on a total area of 545,000 hectares, unchanged from 2014.

PTEA Urges Govt To Save Textile Exports

The Pakistan Textile Exporters Association (PTEA) urged federal government to save textile exports from consistent decline, both in terms of value and quantity. Achieving targets to double textile exports appeared to be a herculean task in the perspective of 5.91 percent drop in textile exports in may over the same month of previous fiscal year.

Trade Promotion Authority Bill Approved By Senate; Awaits Obama’s Nod

The Trade Promotion Authority (TPA) bill has been approved by the US Senate, and now awaits President Barack Obama's nod. The bill is commonly known as “Fast-Track”. Supporters see it as critical to the success of a 12-Nation trade deal known as the Trans-Pacific Partnership (TPP). The authority means that Congress may only vote up or down on finalised trade agreements, not amend them. This Fast-Track bill brings the president a step closer to concluding the TPP deal with 11 other nations to remove or reduce barriers to trade and foreign investments.

Cotlook Cuts Global Cotton Output Estimates; But Raises Demand

Cotton has cut its estimate on world cotton output for 2014-15 by 63,000 tons to 25.7 million tons from last month's forecast. It said higher output from Australia and Uzbekistan more than offset cuts in China and smaller markets. It has cut 2015-16 global output forecast by 206,000 tons to 23.7 million tons from may, primarily due to decrease for China. But it raises world demand forecast for 2014-15 by 49,000 tons to 23.8 million tons citing higher consumption by Vietnam. Also, raised world consumption estimate for 2015-16 by 56,000 to 24.3 million tons. Going with new estimations, 2014-15 ending stocks totals around 1.9 million tons, while for 2015-16 stands at around 570, 000 tons.

China Aims To Bolster Textile, Garment Sector

The Chinese govt on Thursday issued a guideline to bolster country’s textile and garment industry in Xinjiang region with an aim to raise exports and employments. Government plans to set up industrial parks in Aksu, Shihezi, Korla and Alaer, and a focus on clothing, knitting and carpet industries in southern Xinjiang. As per the guideline, the government should nurture production of folk costumes and encourage leading apparel producers to transfer their business. Government expects the output of the industry to reach 212.5 billion Yuan (34.75 Billion U.S. Dollars) in 2023 and may provide jobs to one million people.

Rains In Saurashtra Damages Ongoing Sowing Of Cotton

Rains in Gujarat’s Saurashtra has damaged ongoing sowing, especially groundnut and cotton. Water logging in many cotton growing belts in Saurashtra may damage groundnut and cotton crops seeds, as per market sources. So far, sowing has been done on 1.34 million hectares in Gujarat, and out of it one million hectares area lies in Saurashtra region.

Lack Of Investment Hits Kharif Sowing

This year’s kharif sowing operations in Telangana have been hit by lack of investment and large tracts of lands, especially in tribal areas, can be found lying empty despite excellent rainfall so far, reported a news agency. Banks were unable to release fresh advances due to non-release of second instalment towards crop loan waiver by the state government. Also, many private moneylenders also shut shop due to failure of crops successively during the last two years.

Australia Cotton Output Lower Than Govt Expectation

The National Australia Bank (NAB) said that natural fibre producers in the country are likely to rise prices due cotton and wool output do not meet government’s expectations. Wool prices are likely to resume the uptrend and rise by 11.7 percent over 2015-16. NAB forecast Australian wool production to continue its slide, down 4.4 percent in 2015-16. The bank forecast cotton prices rising 9.3 percent seeing a limited recovery in production from the previous season’s 44 percent slump in output.

OUTLOOK FOR NEXT WEEK

Cotton prices will continue to move sideways in the coming week as movement in markets would remain largely restricted. Major tone in the market would be wait and watch. Detailed plan of China’s state reserve selling policy would be decide any significant movement in markets.

(By Commoditiescontrol Bureau; +91-22-40015522)