MUMBAI (Commoditiescontrol) - The primary tone in cotton prices across the major markets of India remained bullish over the week ending March 28, 2015. At large, supply crunch pulled the prices higher in major markets of the country throughout the week. Higher prices of kapas have held back farmers to bring their produce in the markets, said an Ahmedabad-based trader. He added that farmers are not keen to sell their crop at the current rates on hopes of better returns in case of a further surge in prices. Till date, total arrivals in the country is estimated at 302 lakh bales.

Another factor that pulled the fibre prices higher is the report that the Cotton Corporation of India (CCI) has lowered its estimates on cotton output for 2014-15 to 360-370 lakh bales. The corporation’s estimate on cotton production is much lower than the estimates issued by the cotton advisory board (CAB). CCI has attributed weak arrivals of cotton and low sales for its lowered output estimate. According to the CAB’s first estimate released in October, cotton production for 2014-15 was seen at 400 lakh bales. Members of CAB are set to meet for its second estimate on output for the year shortly.

CCI’s cotton floor prices at its E-auction remaining on the upside for most of the week added to the bullish movement in cotton prices, especially at Akola centre of Maharashtra, where cotton was sold at Rs. 700/candy (356kg each) higher than its set floor price. Then on, CCI increased its floor prices by Rs. 300-400/candy across the country. Even after increased floor prices, CCI could manage to sold more than 50% of the cotton which it put for sale. As per B.K. Mishra, Chairman, CCI, the agency has sold nearly 2.7 lakh bales cotton so far this season through E-auction at various centres across the country. The agency began its E-auction in January end.

Backing the constant price rise, most of the sellers continued to remained muted during the week. Lesser participation by the sellers created a vacuum on cotton markets and provided enough room for prices to rise gradually. They are not offloading their stocks at the current rates on hopes of further price rise in times to come. Sellers anticipate prices to increase to around Rs. 34,500/candy in the near-term, as per traders.

Prices of cotton seed, kapas and khal also gained Rs. 20-50/100kg during the week due to strong demand in spot markets in the midst of concerns over reduced output.

The Cotton Association of India (CAI) also released its estimates on cotton output for 2014-15 at 396 lakh bales compared to 397 lakh bales estimated in January. The lower output estimate is attributed to fall in production in central parts of India. Total crop in the central region in January is estimated at 219.25 lakh bales compared to 235.75 lakh bales last year. The association has estimated 2014-15 total cotton supply at 465.90 lakh bales, while domestic consumption is estimated at 310 lakh bales, leaving an available surplus of 155.90 lakh bales. CAI supply-demand estimate doesn't include export figure. CAI President Mr. Dhiren N. Seth, however said that CCI will have to offload its cotton stock as early as possible as it still holds a substantial portion of cotton procured from farmers this season. He stressed that if the entire quantity of cotton held by CCI is to be sold during this season i.e., by September 30th, the agency will have to sell around 15 lakh bales every month. Prices may come under stress next season too if the carry over stock is large in quantity.

Domestic cotton exports is gradually picking up as Indian cotton is comparatively cheaper in overseas markets. Market sources believe that country’s cotton exports could reach around 60 lakh bales this season. At present, most of the exports are happening to Bangladesh and Vietnam, they added. On the other hand, the Cotton Advisory Board (CAB) expects cotton exports to stand at 90 lakh bales. Anand Poppat, Chairman and Managing Director of Jalaram Cotton and Proteins in Gujarat said that Indian cotton is at least 5 cents/pound cheaper than the U.S. cotton and 2-3 cents than African cotton, a news agency reports. Indian cotton finds good demand when it rules 3-5 cents below the global Cotlook A Index.

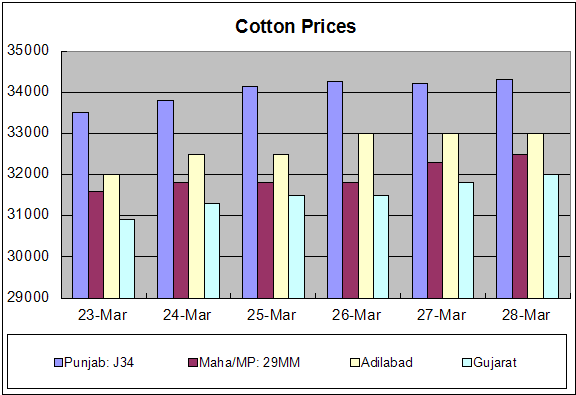

In north India, cotton prices gained Rs. 58-90/maund (37.3kg each) or 2.5 per cent, to settle in the range of Rs. 3,425-3,515/maund during the week. Similarly, cotton prices in central India increased by Rs. 700-1,200/candy or 2-3 per cent to Rs. 31,800-33,500/candy. In south Indian markets, prices posted gains of Rs. 1,000-1,200/candy at Rs. 32,000-33,500/candy, a rise of 3 per cent.

Note: Prices/candy

Ginners were seen actively involved to procure kapas during the week as prices of bales, seed and khal are constantly on the rise and prices of kapas have increased more than the minimum support price (MSP), hence CCI had moved out of markets.

Cotton Output To Be At 350-375 Lakh Bales - Special Coverage

On this estimation of CAI, commoditiescontrol.com has interviewed some of the country’s veteran traders to know their opinion on the crop for the year. A fraction of traders have said that cotton output this year could be at 350-375 lakh bales.

According to Dilip Patel, President of All India Cotton Ginners Association, in the beginning of the season, cotton output was estimated at 385 lakh bales but now it is at around 375 lakh bales. Cotton consumption in the country is projected at nearly 360 lakh bales. Mr. Dilip said that New York cotton futures also showed signs of improvement, suggesting gradual improvements in domestic markets. He said that if domestic yarn industry attracts orders aggressively following the gains in international markets, domestic cotton prices will certainly see an upside in times to come.

On the other hand, Mr. Deepak Poldia, Chief Official of Marathwada Cotton Ginners Association said that cotton crop output in the country will not be more than 340-350 lakh bales. He said that average yield from per hectare remain very poor this year, due to which exact assessment of the crop could not be known.

Cotton Price Settlement At Exchanges As On March 20

Cotton final settlement prices of National Commodity and Derivatives Exchange (NCDEX) contracts which expired on March 20, 2015 stood at Rs. 14,887.75/bales. On ACE Commodity Exchange, cotton final settlement prices of contracts that expired on March 20 were at Rs. 31,300/candy.

Meanwhile, prices of kapas khali (CoC) prices on NCDEX settled at Rs. 1,582.95/100kg.

Stock Position At Exchange Warehouses

Cotton stocks at NCDEX accredited warehouses stood at 1,600 bales,while CoC stocks stood at 34,219 tonnes as on March 27. At Multi Commodity Exchange (MCX) accredited warehouses, cotton stock as on March 26 was at 1,05,400.

NCDEX, MCX Weekly Update

|

MCX COTTON UPDATES

|

|

Date

|

Contract Expiry

|

Open(Rs)

|

High(Rs)

|

Low(Rs)

|

Close(Rs)

|

PCP(Rs)

|

Volume(In Lots)

|

OI(In Lots)

|

|

23-Mar

|

30-Apr-15

|

15150

|

15530

|

15100

|

15490

|

15130

|

2520

|

5019

|

|

24-Mar

|

30-Apr-15

|

15470

|

15560

|

15280

|

15340

|

15490

|

2231

|

5746

|

|

25-Mar

|

30-Apr-15

|

15380

|

15540

|

15350

|

15470

|

15340

|

3308

|

6392

|

|

26-Mar

|

30-Apr-15

|

15430

|

15640

|

15430

|

15560

|

15470

|

2965

|

7066

|

|

27-Mar

|

30-Apr-15

|

15540

|

15650

|

15530

|

15570

|

15560

|

3005

|

7546

|

|

NCDEX COTTON OIL CAKE UPDATES

|

|

Date

|

Prev Close Price

|

Open Price

|

High Price

|

Low Price

|

Close Price

|

Volume

|

Open Interest

|

|

23-Mar

|

1576

|

1580

|

1628

|

1580

|

1626

|

58390

|

93880

|

|

24-Mar

|

1626

|

1621

|

1635

|

1618

|

1626

|

28490

|

93640

|

|

25-Mar

|

1626

|

1627

|

1653

|

1613

|

1642

|

59960

|

89780

|

|

26-Mar

|

1642

|

1640

|

1656

|

1633

|

1637

|

38880

|

83740

|

|

27-Mar

|

1637

|

1638

|

1678

|

1635

|

1672

|

53500

|

82760

|

Top Stories Of The Week

Telangana government will not impose Value Added Tax (VAT) on textiles traders, said Commercial Taxes Minister Talasani Srinivas Yadav. He said that there is no point in taxing small traders. The proposal to levy VAT on saree and textile products has been dropped by the state government.

The Tamil Nadu government in its Budget presented on 25, March, announced withdrawal of Input Tax Credit on inter-state sale of goods to make manufacturing industries in the state more competitive with their counterparts in the neighboring states. The government also announced VAT exemption on works contract relating to sizing of cotton yarn. He also said that VAT on air compressors, pump sets up to 10 Hp (Horse Power) and their parts will be reduced to 5 per cent from 14.5 per cent to encourage MSME sector and benefit farmer.

Cotton farmers in china could reduce the area under the fibre by 20 percent to 3.4 million hectares this year compared to last year. According to China’s state reserves’ survey, the reduction is attributed to a change in govt policy that led to lower subsidies for farmers last year. lower acreage will result in lower output in the country but traders said that it may not have any impact on demand for imports as china restricts shipments through a quota system. The biggest drop in area will take place in Shandong province, where farmers may plant almost a third less than last year.

U.S. Market Through The Week

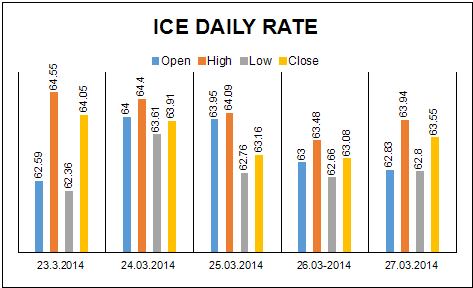

ICE cotton futures opened the week lower at 62.59 cents/lb on Monday and touched high of 64.55 cents/lb on the same day after a report from China’s State Reserves showed that China cotton acreage reduced 20 per cent to 3.4 million hectares this year. The market moved on to rule sideways by the middle of the week and touched the week low of 62.66 cents/lb. The front-month May contract closed at 63.08 cents/lb on Friday.

ICE cotton speculators raise net long position by 3,079 contracts to 21,960 in week to March 24, according to U.S. Commodity Futures Trading Commission (CFTC).

Cotton Market Outlook For Next Week

Cotton prices during the next week may continue to trade upside as the new financial year will kick start and fresh demand from mills could be seen. Also, mills will highly be interested to build up their inventory after fall in production reports dampened the market sentiments.

(By Commoditiescontrol Bureau; +91-22-61391533)