MUMBAI (Commoditiescontrol) – Most imported raw pulses, such as Tur, Urad, Chana, Masoor, Kabuli Chana, White/Green Pea marked softer closing to the week, ended 22nd February, on higher crop estimates, crop arrivals and dull buying by millers and traders.

Moong prices were steady-to-weak owing thin purchase by the millers and lower output.

Week Highlights

# NCDEX To Revise Margin Framework For Commodity Derivatives Segment.

# Total Pulses production during 2019-20 is estimated at 23.02 million tonnes which is higher by 2.76 million tonnes than the 5 years’ average production of 20.26 million tonnes.

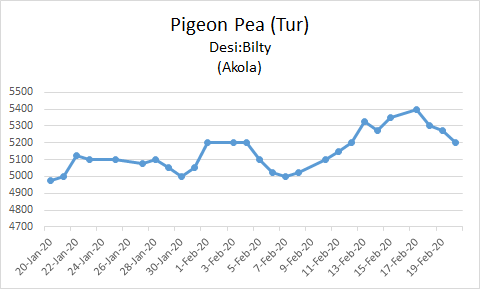

Burma Lemon Tur:

Tur Lemon variety of Burma-origin declined by Rs 150 at Rs 4,850/100Kg in Mumbai following weak cues from domestic markets. Negligible buying from mills in imported Tur, due to dull demand in Tur dal and millers' preference for new domestic Tur,weighed upon the imported one.

Increasing domestic arrivals with reduced moisture content, of around 10-11 percent, higher output estimates of Tur and supply from Mozambique in January month has pressurized the sentiments.

Similarly, new domestic Tur in bilty trade at Akola traded weak, by Rs 200-250 at Rs 5,125-5,150/100Kg.

Malawi-origin Tur traded at Rs 4,000/100Kg, Mozambique/Arusha Tur at Rs 4,350. Mozambique origin Tur dal Phatka variety traded at Rs 6,400/100Kg and Sava No variety at Rs 6,200.

Meanwhile demand and sale counter witnessed slow activity in Tur dal.

Latur-origin new Phatka variety traded weak by Rs 200 at Rs 7,650-7,850/100kg, for spot. Gujarat-origin Wasat new Phatka variety at Rs 8,150-8,350/100Kg, Jalna-origin new Phatka variety at Rs 7,950-8,150 (Spot), Khamgaon-origin new phatka variety at Rs 7,450-7,550/100Kg and Solapur-origin new phatka variety at Rs 7,550-7,650/100Kg (Spot).

As per trade view, Tur prices are likely to get support at lower rates due to empty pipeline. The millers/traders have been trading hand-to-mouth due to liquidity crunch and government policy. Meanwhile, the pace of Tur procurement by government from producing states has stepped up.Some buying from stockiest was reported. However local market players were active in purchasing new Tur for outstation traders and millers. Bulk buyers are yet to be seen.

.png)

Burma Urad:

Burma-Urad FAQ new/old variety slipped by Rs 300, each, at Rs 6,500/100Kg and Rs 6,350, respectively, at the Mumbai market.

Similarly In Chennai, Urad FAQ/SQ varieties moved southward, each by Rs 400, to trade at Rs 6,700-6,750/100Kg and Rs 7,700-7,750, respectively in ready delivery, as per condition.

Sluggish offtake in Urad dal/gota variety and fresh supply of nearly 400-450 containers (each container = 24 MT) from overseas, continues to weigh on prices.

Direct vessels from Burma, loaded on 13-14 February, are expected to arrive in Chennai on 29th February.

Market is observing caution in ready trade at prevailing rates, tracking weak prices in forward deals in Chennai, new domestic arrivals in Andhra Pradesh (Srikakulum district) and upcoming arrivals from Prakasham/krishna district.

Meanwhile, Jaipur High Court postponed the hearing on pulses import restriction till March 6, 2020. The hearing is regarding non-issuance of Customs clearance to containers of urad imported against the stay order.

Jaipur High Court has given an option to the importers/DGFT to take their case to the Supreme Court.DGFT has moved to Supreme Court for the same. Importers filed cases in various High Courts for stay orders. DGFT has requested High Courts to transfer all these cases to Supreme Court, so the hearing can happen at one place. If Supreme Court admits case for hearing, it will mean more time for the decision to take place.

Meanwhile NAFED has been active in selling procured Urad in selected states.

Bikaner-origin branded Urad dal traded down at Rs 8,700-8,900/100Kg for spot. Tiranga brand of Mumbai priced at Rs 9,200/100Kg for Mumbai delivery, Parivar brand of Jalgaon at Rs 8,700/100Kg for spot.

As per trade source, Urad prices may get support after settlement in forward trade of current month, negligible supply pressure from Burma and lower output in kharif and rabi crop.

.png)

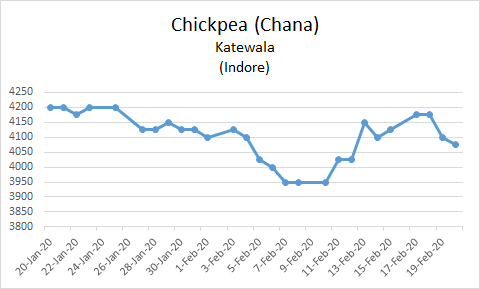

Chana Kantewala (Indore):

Chana prices traded slid Rs 100 at Rs 4,050/100Kg in Indore due to higher output estimates and cautious buying by millers.

NAFED is selling its old stock, in selected states, whilst availability of new domestic Chana is pressurising buyer sentiments.

Meanwhile the ongoing marriage season supports demand for chana dal and besan from consumption centres, available at cheaper rates as compared to White Pea dal, besan.

In Mumbai, Tanzania-origin Chana fell by Rs 50 to Rs 4,025. While Burma origin chana down by Rs 50 at Rs 3,800/100Kg.

Chana for March delivery on National Commodity and Derivatives Exchange (NCDEX), settled weak by 1.2 percent or Rs 48 down to Rs 3,975/100kg. Earlier, in the day, the contract hovered in the range of 3,960 and 4,043 on Thursday.

Open interest for NCDEX March contract decreased to 15960 lots against 16460 lots.

On the other hand, open interest for April contract increased up to 20960 lots against 20450 lots.

Open interest of top 10 trading clients in the long side was 16010 MT, whereas the short position of top ten clients was 23520 MT. The net position of top 10 clients was net short by 7510 MT.

Chana stocks at NCDEX accredited warehouses reported nil.

New Domestic chana dal of Pistol brand ruled weak by Rs 100 at Rs 5,050 for Spot, Angel brand at Rs 5,350 for Spot, Samrat brand at Rs 5,300 for Spot. Similarly, Chana besan traded lower by Rs 50 at Rs 3,000/50Kg.

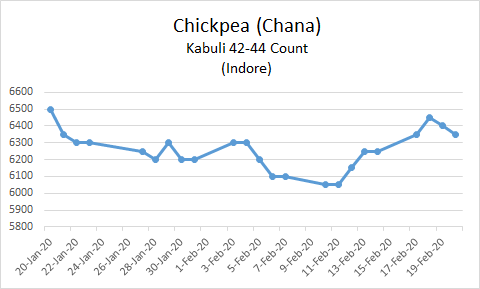

In Mumbai, Russia/Sudan and Ethiopia-origin kabuli chana fell by Rs 25-125 each at Rs 3,950/100Kg, Rs 4,000 and Rs 4,000, respectively, due to dull trade activity. Liquidity crunch owing to lesser interest shown by besan flour millers and weak trend in Chana prices are weighing on Imported Kabuli Chana prices. While, Burma Kabuli Chana remained unchanged at Rs 3,850.

Similarly, Kabuli chana of 40-42, 42-44 and 44-46 counts declined by Rs 50 each at Rs 6,500/100Kg, Rs 6,300 and Rs 6,150, respectively at Indore market amid slack local buying activity.

On other hand, Dollar-variety Kabuli Chana remained flat at Rs 5,500-6,100/100Kg at Indore.

As per market view, millers' purchase follows their immediate requirement for crushing. Government is likely to raise its procurement target of Chana, at MSP, this year due to bumper crop. Arrival pressure of new domestic Chana will be witnessed after holi in Maharashtra, Madhya Pradesh and Rajasthan.

Chana prices will depend on Government's stock liquidation to make space for fresh procurement and quantity of new crop procurement. Meanwhile, medium-term outlook for chana is bearish. Sell on rise is reckoned to be the best strategy for trade.

Imported Masoor (Mumbai):

Canada and Australia Masoor prices at Mumbai, along with Canada Masoor at Mundra and Hajira port dipped Rs 25-125/100Kg.

Millers refrained from purchasing, while following weak sentiments in other pulses. Selling pressure of old stock as arrivals of new domestic Masoor is likely to begin soon.

Meanwhile demand in processed masoor from consumption centres was reported to be slack.

Canada-origin red Masoor in container traded weak by Rs 25 at Rs 4,725/100Kg.

Canada crimson variety Masoor fell by Rs 100-125 at Rs 4,525/100Kg and Rs 4,550 at Mundra and Hajira port, respectively.

Similarly, Australia-origin red Masoor priced lower by Rs 25 to trade at Rs 4,775/100Kg.

Canada Masoor dal Khopoli spot ruled down by Rs 50 at Rs 5,650/100Kg.

As per market talk, Masoor prices are likely to find support in near future due to cheaper pulses, limited stock of imported and domestic Masoor.

In forward business, Canada crimson variety masoor new offered at $515 per ton in container on CNF basis JNPT for March/April shipment.

.png)

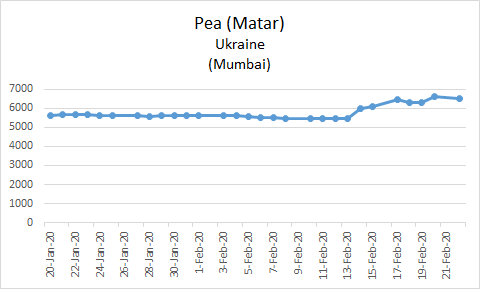

Imported White Pea (Mumbai):

Canada-origin White Pea at Mundra port, remained weak by Rs 250-300 to Rs 6,200-6,250/100Kg, amid dull buying, following weak trend in Chana and also new White Pea arrivals began in selected markets of Uttar Pradesh. Arrivals of White Pea may pick up pace after Holi.

The reason behind this dullness lies in the shift of White pea's trading volume, as the preference stays with Chana/Kabuli Chana due to cheaper prices and easy availability.

Even consumption in Chana dal/besan was reported to be thin, despite lower prices.

The peas could not find support, despite tightness in ready stock.

However, Imports of yellow peas will be negligible this year as Government imposed the CIF value of Rs 200 per kg as Minimum Import Price for peas.

Meanwhile, Jaipur High Court postponed the hearing on pulses import restriction till March 6, 2020. The hearing is regarding non-issuance of Customs clearance to containers of White Pea imported against the stay order.

Even prices of White Pea dal traded weak following downtrend in raw White pea. Vatana dal traded lower by Rs 200 at Rs 6,800. Similarly, Vatana besan of second quality dropped by Rs 100 at Rs 3,450/50 Kg.

Moong (Jaipur):

Moong prices traded steady to weak at Rs 7,900-8,200/100Kg, as per quality, at Jaipur market due to thin buying activity at higher rates.

Trade activity was reported thin following weak sentiments in other pulses.

Moreover, Demand and sale counters in processed Moong was reported to be slow.

NAFED has been actively selling procured Moong in selected states.

At Naya bazaar market of Delhi, Rajasthan new kharif Moong traded weak at Rs 7,600-7,900/100Kg.

Ongoing arrivals of Moong was reported at Srikakulum district of Andhra Pradesh.

As per trade sources, prices of Moong are likely to stay rangebound on slow demand at higher rates and the arrival of summer crop from various states (Odisha, Bengal and Bihar).

Meanwhile, arrivals of new Moong have begun in Kenya, while in Tanzania/Mozambique the arrivals will commence from February-end/March.

.png)

Canada Green Pea (Mumbai):

Canada-origin Green pea dips at Rs 13300-13500/100Kg at Mumbai, amid dull buying at higher rates. The pea followed weak sentiments in other pulses, despite tightness in ready stock.

However, customs is yet to issue clearance to containers, imported against the stay order.

This matter is already in Jaipur High Court, with hearing postponed on 6th March 2020.

Also, Government has imposed the CIF value of Rs 200 per kg as Minimum Import Price for peas.

.png)

.jpg)

(By Commoditiescontrol Bureau; +91-22-40015513)