MUMBAI (Commoditiescontrol) – All imported raw pulses, such as Tur, Urad, Chana, Masoor, Kabuli Chana, White/Green Pea and Moong moved higher for the week ended 15th February due to postponement of Jaipur High Court’s hearing to 6th March. Fresh buying by millers and regular demand and sale counter in processed pulses was witnessed supported the prices through the week

Week Highlights

# Canada's 2020-21 Pea Production May Rise To 4.3 Million Tonnes

# Canada Pitches For Consistency In India's Trade Policy On Pulses

# Trade Body Sees Indian Pulse Imports Declining By 60%

# NAFED Gears Up For Good Procurement Of Chana

# India's IIP Growth Contracts 0.3% In December

# India On Track To Become Self-Sufficient In Pulses Production: Agriculture Minister.

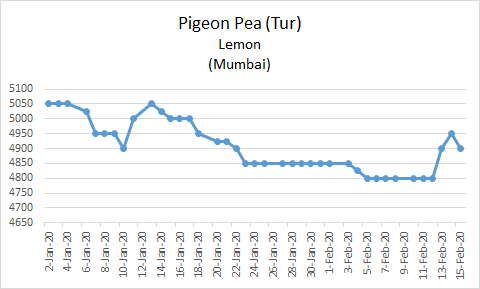

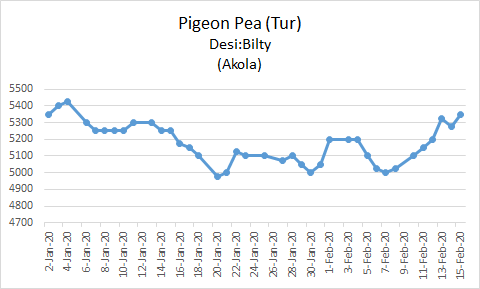

Burma Lemon Tur:

Tur Lemon variety of Burma-origin moved higher by Rs 150 at Rs 4,950/100Kg in Mumbai amid millers' buying support following firm cues from domestic markets.

Similarly, new domestic Tur in bilty trade at Akola traded higher, by Rs 200-250 at Rs 5,325-5,350/100Kg, due to better buying support. Even the moisture content has started to subside with steady arrivals.

Pace of Tur procurement by government from producing states has stepped up providing cushion to the prices.

Regular demand and sale counter witnessed some activity in Tur dal at prevailing rates.

Latur-origin new Phatka variety traded at Rs 7,800-8,000/100kg, for spot. Gujarat-origin Wasat new Phatka variety at Rs 8,300-8,500/100Kg, Jalna-origin new Phatka variety at Rs 8,100-8,300 (Spot), Khamgaon-origin new phatka variety at Rs 7,600-7,700/100Kg and Solapur-origin new phatka variety at Rs 7,700-7,800/100Kg (Spot).

As per trade view,muted buying from stockiest was reported due to cash crunch. Local market players were active in purchasing new Tur for outstation traders and millers for crushing. Stockiest and bulk buyers will likely commence purchases of new Tur at lower rates.

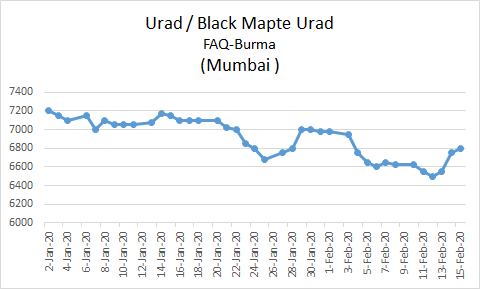

Burma Urad:

Burma-Urad FAQ new/old variety gained by Rs 200, each, at Rs 6,800/100Kg and Rs 6,650, respectively, at the Mumbai market amid millers' purchase at lower rates and shrinking domestic arrivals.

Similarly In Chennai, Urad FAQ upped Rs 200 to trade at Rs 7,100/100Kg in ready delivery, as per condition. SQ variety gained Rs 600 to Rs 8,200/100Kg due to shortage of ready stock.

Meanwhile postponement of Jaipur High Court’s hearing to 6th March turned out to be a big reason for the pulses' northward rally. The hearing is regarding the non-issuance of Customs clearance to containers of urad, imported against the stay order.

Jaipur High Court has given an option to the importers/DGFT to take their case to the Supreme Court.

Meanwhile, regular demand and sale counter witnessed decent activity in Urad dal/gota at prevailing rates.

However trade is observing caution in ready trade at prevailing rates, tracking weak prices in forward deals in Chennai, new domestic arrivals in Andhra Pradesh and upcoming fresh supply from overseas at Chennai.

In Burma, no buying from India was reported in Urad despite millers receiving import licence from the Government and the import parity. As per local traders, direct vessel carrying Urad cargo on 7/8th Feb and 13/14th Feb has already set sail for India. two more direct vessels are expected to load Urad cargo for India on 20th and 25th February.

Tikamgarh-origin Urad gota variety was priced at Rs 9,500/100kg for Chennai delivery and Rs 9,300-9,400/100Kg for Andhra Pradesh delivery as per quality. Jalgaon-origin gota variety quoted at Rs 9,500/100Kg (spot). Guntur-origin Urad gota in spot traded at Rs 9,500/100Kg.

Bikaner-origin branded Urad dal traded at Rs 8,900-9,100/100Kg for spot. Tiranga brand of Mumbai priced at Rs 9,400/100Kg for Mumbai delivery, Parivar brand of Jalgaon at Rs 8,900/100Kg for spot.

As per trade source, Urad prices are likely to get further support due to lower output, shrinking domestic arrivals. Total supply of Urad from Burma, under quota, is unlikely to reach Indian ports before March-end due to delay in paper work.

Chana Kantewala (Indore):

Chana prices traded higher by Rs 150 at Rs 4,100-4,125/100Kg in Indore following firm futures and millers' buying activity.

Regular demand in Chana dal and besan from wholesale/retailer counters was reported due to ongoing marriage season.

Millers' purchase follows their immediate requirement for crushing. Market sees sellers on the sidelines at lower rates as prices of new Chana traded below MSP, of Rs 4,875/100Kg. Market expects Government to procure large quantities of Chana at MSP this year due to bumper crop. Arrival pressure of new domestic Chana will be witnessed after holi in Maharashtra, Madhya Pradesh and Rajasthan. Chana prices will depend on Government's stock liquidation and quantity of new crop procurement. However, sell on rise will be ideal strategy for trade.

Meanwhile sentiments continue to be under pressure as NAFED is selling its old stock, in selected states, while there's availability of new domestic Chana at lower rates.

In Mumbai, Tanzania-origin Chana gained by Rs 125 to Rs 4,075. While Burma origin chana rose by Rs 100 at Rs 3,750/100Kg.

Chana for March delivery on National Commodity and Derivatives Exchange (NCDEX), settled higher by 1.1 percent or Rs 44 up to Rs 4,060/100kg. Earlier, in the day, the contract hovered in the range of 3,995 and 4,060 on Friday.

Open interest for NCDEX March contract increased to 21230 lots against 20880 lots.

Similarly, open interest for April contract also up to 19670 lots against 18800 lots.

Open interest of top 10 trading clients in the long side was 15850 MT ,whereas the short position of top ten clients was 24360 MT. The net position of top 10 clients was net short by 8510 MT.

Chana stocks at NCDEX accredited warehouses reported nil.

New Domestic chana dal of Pistol brand ruled at Rs 5,100 for Spot, Angel brand at Rs 5,400 for Spot, Samrat brand at Rs 5,350 for Spot. On other hand, Chana besan traded firm at Rs 3,050/50Kg.

In Mumbai, Russia/Sudan/Ethiopia/Burma-origin kabuli chana gained by Rs 50-150 each at Rs 4,075/100Kg, Rs 4,025, Rs 4,025 and Rs 3,850, respectively. Sellers continue to stay on sidelines in the market, following firm cues in Chana futures and higher prices of White Pea. Good buying from besan flour millers was witnessed.

Meanwhile, consumption demand has shifted to chana/kabuli chana from white pea, due to cheaper rates and easy availability of Chana/Kabuli Chana.

Similarly, Kabuli chana of 40-42, 42-44 and 44-46 counts up by Rs 200 each at Rs 6,450/100Kg, Rs 6,250 and Rs 6,100, respectively at Indore market amid fresh local buying activity.

Dollar-variety Kabuli Chana also moved up by Rs 200 at Rs 5,200-6,000/100Kg at Indore.

.png)

.png)

Imported Masoor (Mumbai):

Canada crimson variety Masoor at Mumbai, Mundra and Hajira port, remained firm. While, Australia Masoor was unchanged.

Fresh buying interest from millers at lower rates, along with sellers' reluctance to release their stocks at the current rate, cushioned the prices. Limited stock of ready imported Masoor,higher import parity and a lag in rabi masoor's acreage lends much support.

However, demand in processed masoor from consumption centres was reported to be thin.

Canada-origin red Masoor in container traded up by Rs 25 at Rs 4,750/100Kg.

Canada crimson variety Masoor gained by Rs 50-100 at Rs 4,650/100Kg and Rs 4,625 at Mundra and Hajira port, respectively.

On the other hand, Australia-origin red Masoor priced unchanged to trade at Rs 4,800/100Kg.

Canada Masoor dal Khopoli spot ruled flat at Rs 5,700/100Kg.

As per market view, Masoor prices are likely to find support in near future as short sellers sold higher quantity against limited stock of ready imported Masoor, higher import parity and lag in sowing of rabi masoor.

In forward business, Canada crimson variety masoor new offered at $510 per ton in container on CNF basis JNPT for March/April shipment.

.png)

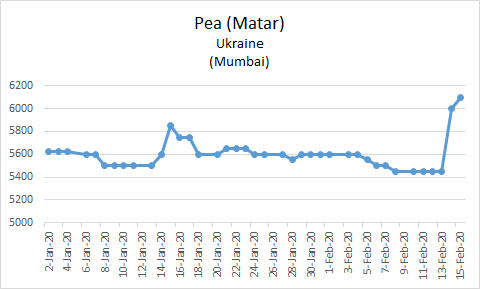

Imported White Pea (Mumbai):

Canada-origin White Pea at Mundra port, along with Ukraine- origin White Pea, in Mumbai market, rose sharply by Rs 600-650/kg, respectively.

Postponement of Jaipur High Court’s hearing, to 6th March, turned out to be a big reason for the White Pea to extend upward strength.

Reason behind the tightness of ready stock lies with the White Pea containers being stuck, at various ports, due to non-issuance of Customs' clearance.

Meanwhile imports are unlikely as Government imposed the CIF value of Rs 200 per kg as Minimum Import Price for peas.

Canada White Pea at Mundra port rose by Rs 650 to Rs 6,150/100Kg.

Similarly, Ukraine White Pea in Mumbai gained by Rs 650 at Rs 6,100/100Kg.

Even prices of White Pea dal traded higher following uptrend in raw White pea. Vatana dal traded higher by Rs 200 at Rs 6,800. Similarly, Vatana besan gained by Rs 150 at Rs 4,100/50 Kg.

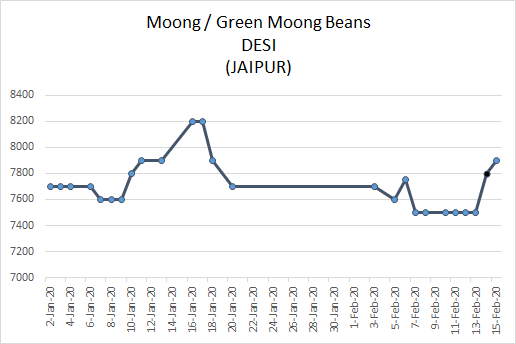

Moong (Jaipur):

Moong prices traded higher by Rs 300-400 at Rs 7,500-7,900/100Kg, as per quality, at Jaipur market amid better buying activity by millers. Buyers interest coupled with declining Kharif moong arrivals and lower crop output supported the price rise.

Moreover, Demand and sale counters in processed Moong were reported to be satisfactory.

Similarly, Moong dal traded at Rs 9,600-101,00/100Kg depending on the variety for Mumbai delivery.

At Naya bazaar market of Delhi, Rajasthan new kharif Moong traded at Rs 7,800-8,200/100Kg.

As per trade sources, prices of Moong likely to get further support at lower rates because of diminishing arrivals of Kharif moong, lower crop output, negligible stock of imported Moong and higher import parity.

Meanwhile, arrivals of new Moong has begun in Kenya and arrivals of new moong will start from February-end/March in Tanzania-Mozambique.

Canada Green Pea (Mumbai):

Canada-origin Green pea marched forward by Rs 1900 at Rs 13500-13700/100Kg at Mumbai due to limited ready stock and improved buying activity.

Postponement of Jaipur High Court’s hearing to 6th March turned out to be a big reason for the Pea to extend Northward move.

The Customs Department is yet to issue clearance to the containers stuck at Mumbai ports, lending support to the pea.

Also, Government had imposed the CIF value of Rs 200 per kg as Minimum Import Price for peas.

.jpg)

(By Commoditiescontrol Bureau; +91-22-40015513)