MUMBAI (Commoditiescontrol) – Major pulses such as Urad, White/Green Pea, Moong, Masoor, Tur and Kabuli Chana moved higher during the week ended Saturday ( Dec 2 - 7 ). While, Chana traded steady on limited trade volume.

Week Highlights

# Australia's 2019-20 Chana Production Likely to Touch 2.89 Lk Tonnes during the year 2019-20, despite the dip of 11.55% in planted area, according to ABARES crop report December 2019.

# Australia is likely to produce 3.38 lakh tonnes of Masoor (Lentils) during the year 2019-20 despite 21 percent decrease in acreage, according to ABARES December crop report.

# October Export shipments of red lentils from Canada sank as compared with the previous month, reveals the latest data from Statistics Canada.Total shipments for the month amounted to 72,505 metric tons (MT), down 64% from the previous month's total of 200,875.

# Canada's movement of yellow peas in October fell as against the previous month, according to data from Statistics Canada. Total shipments in the month amounted to 323,292 metric tons (MT), down 36% from the previous month's total of 508,182 MT.

# Shipments Of Russian Field Pea Export for the month of October totaled 67,764 metric tons (MT), up from 45,266 MT in September.

# Shipments Of Russian Chickpeas Export during October totaled 32,637 metric tons (MT), up from 20,789 MT the previous month. Even the shipments so far during the calendar year to 271,231, up 354% last year.

# 5% GST Slab May Be Raised To 6% As Govt Looks To Increase Revenue.

# Just 3% Of Pulses, Oilseeds Procured Under PM-AASHA Scheme: Govt.

# RBI Keeps Repo Rate Unchanged At 5.15%, Cuts GDP Growth Forecast To 5%.

# Rajasthan's 2019-20 Chana Sowing Up 42.5% Y/Y Till Dec 4.

# Floods in Mexico’s Chickpeas Producing belt puts Crop at Risk; 2020 Production likely to fall by 70%.

Burma Lemon Tur:

Tur Lemon variety of Burma origin moved higher by Rs 100 at Rs 4,950/100Kg in Mumbai due to millers buying support at lower rates despite average quality.

Buyers were finding difficulty in getting Tur in spot market for crushing as arrivals of old domestic Tur reported negligible and new domestic arrivals has been delayed by about a month.

Millers in Maharashtra/Karnataka are awaiting New Tur's arrival, in order to restart crushing operations.

On other hand, domestic Tur in bilty trade at Akola eased marginally at Rs 5,450-5,475/100Kg amid millers' weak participation.

Demand and sale counters in Tur dal reported subdued activity at higher rates.

Arrivals of new Tur in limited quantity were witnessed at interior markets of Karnataka and Gujarat.

Arrivals of new Tur likely to improve from mid-December. However, arrivals of good quality new Tur is expected to begin towards the end of December.

Government aims to procure 5,45,573 MT Tur during the 2019-20 (Oct-Sep) kharif marketing season.

According to the government's first advance estimate, 2019-20 Tur production has been pegged at 3.5 mln tn compared with 3.6 mln tn in the previous year.

Latur origin new Phatka variety ruled unchanged at Rs 8,050-8,250/100Kg for spot. Gujarat origin Wasat new phatka variety at Rs 8,450-8,650/100Kg, Khamgaon origin new Phatka variety at Rs 7,850-8,050/100Kg (spot), Jalna origin new phatka variety at Rs 8,350-8,550/100Kg (spot) and Solapur origin new phatka variety at Rs 8,050-8,250/100Kg (Spot).

As per trade sources, Tur prices likely to get support once arrivals of new Tur begans in domestic market.

Burma Urad:

Burma Urad FAQ new/old variety gained by Rs 600 each to Rs 7,600/100Kg and Rs 7,450, respectively at the Mumbai market amid shortage of ready stock. Customs Department refuses to issue clearance to the Urad containers stuck at various ports.

Market players will keep close watch on the hearing of stay order of The Jaipur high court on December 16.

Another reason behind the firmness of price is the scarce arrival of Kharif Urad; Average quality of domestic crop adds to the dependence on imported variety.

Millers, speculators and stockiest are inclined towards accumulation at lower rates as they foresee supply shortage of Urad, due to local crop failure.

Although, demand and sale counter in processed Urad reported thin participation at prevailing rates.

Similarly, In Chennai, Urad FAQ/SQ also up by Rs 800-900 to Rs 7,900/100Kg and Rs 8,550-8,600, respectively in ready delivery as per condition.

Bikaner origin branded Urad dal traded higher at Rs 9,800-10100/100Kg for spot. Tiranga brand of Mumbai also moved higher at Rs 10200/100Kg for Mumbai delivery, Parivar brand of Jalgaon at Rs 9,550/100Kg for spot.

Meanwhile, it’s feared that the harvest ready Urad crop may delay due to recent rains/cloudy weather in Tamil Nadu and Andhra Pradesh. Arrival of the new crop is anticipated within a few weeks’ time, in the aforementioned states.

Government aims to procure 2,35,550 MT Urad during the 2019-20 (Oct-Sep) kharif marketing season.

Chana Kantewala (Indore):

Chana prices remained almost flat at Rs 4,375/100Kg in Indore due to limited millers' buying at higher rates amid liquidity crunch.

Actual demand in chana dal and besan from consumption centres was reported to be thin.

Sentiments are reeling under pressure due to recovery in Rabi Chana sowing. NAFED's stock holding keeps the prices subdued. The Government agency intends to release its stocks over next few months.

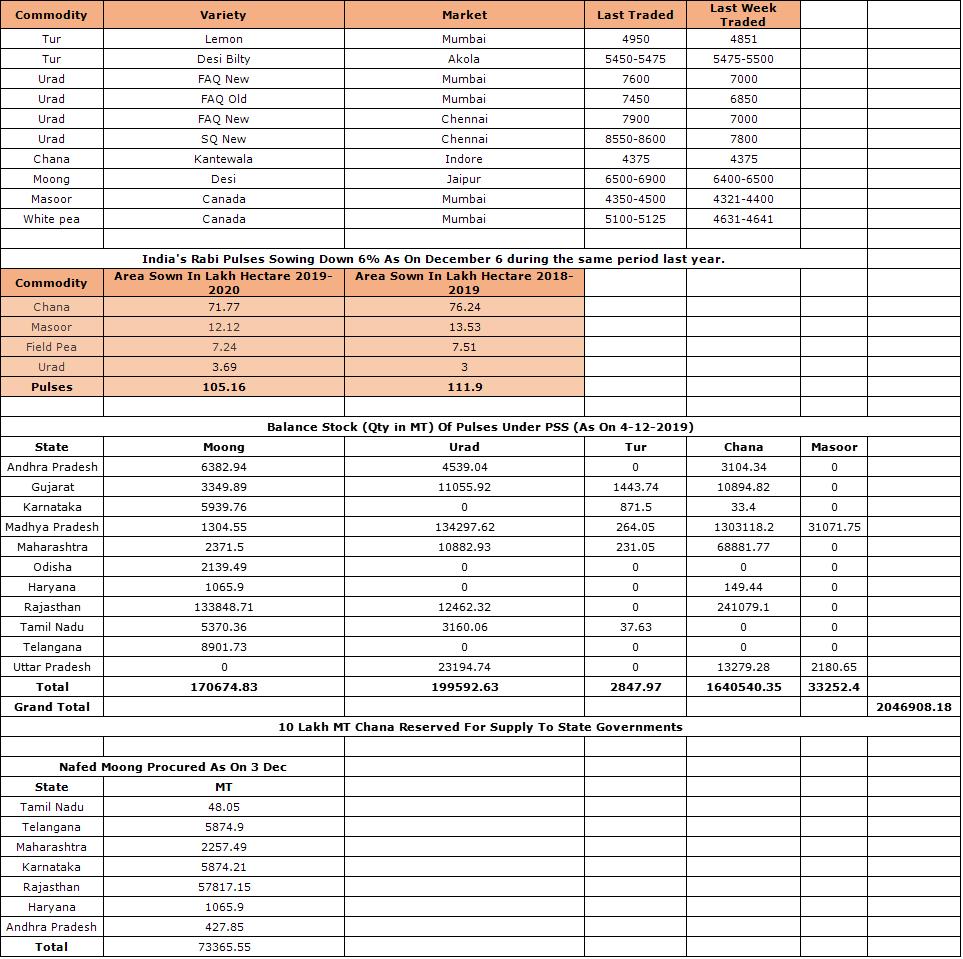

Rabi Chana Sowing is down 5.86 % as On December 6th against same period Last year (LAKH HA).

Australia origin Chana in ready business at Mumbai ruled unchanged at Rs 4,250/100kg due to average quality old crop and very limited availability.

While, Burma origin chana price lower by Rs 150 to Rs 4,050/100Kg.

On other hand, Tanzania Chana gained by Rs 25 at Rs 4,225/100Kg amid good quality from new crop. Millers prefers to crush Tanzania Chana new crop compare to Australia/Burma Chana old crop.

Chana for December delivery on National Commodity and Derivatives Exchange (NCDEX), settled higher 0.5 percent or Rs 24 at Rs 4,443/100kg. Earlier, in the day, the contract hovered in the range of Rs 4,400 and 4,454 on Friday.

Open interest for NCDEX December contract decreased to 21380 lots against 23810 lots.

On other hand, open interest for January contract increased to 36630 lots against 35420 lots.

Open interest of top 10 trading clients in the long side was 36760 MT whereas the short position of top ten clients was 36410 MT. The net position of top 10 clients was net long by 350 MT.

Australian chana dal priced flat at Rs 5,200/100 Kg for spot. Domestic chana dal of Pistol brand also ruled steady at Rs 5,400 for Spot, Angel brand at Rs 5,600 for Spot, Samrat brand at Rs 5,600 for Spot. While, Chana besan traded unchanged at Rs 3,150/50Kg.

In Mumbai, Russia/Sudan/Ethiopia/Burma origin kabuli chana traded almost unchanged each at Rs 4,150/100Kg, Rs 4,225, Rs 4,150 and Rs 4,300, respectively amid limited activity from besan flour millers. Besan flour millers prefers to purchase Sudan/Ethiopia kabuli Chana due to good and less moisture quality with consistent supply from overseas and availability in the market.

Kabuli chana of 40-42, 42-44 and 44-46 counts gained by Rs 300 each at Rs 6,700/100Kg, Rs 6,500 and Rs 6,350, respectively at Indore market amid local buying activity.

Dollar variety Kabuli Chana slipped by Rs 100 at Rs 5,500-6,000/100Kg at Indore on slack trade activity.

In forward business, Russia Kabuli Chickpea offered at $395-$400 per ton in container on CNF basis JNPT for ready shipment.

As per market sources, recovery in rabi Chana sowing may dampened the sentiments. Traders will keep close watch on weather condition during January-February month and also on Nafed policy on liquidation old procured stock.

Imported Masoor (Mumbai):

Canada crimson variety Masoor in both vessel/container along with Australia Masoor gained at Mumbai. Better demand by the millers, firm trend in other pulses and limited stock of ready imported Masoor continues lend support.

Canada origin red Masoor in vessel/container traded higher by Rs 25-100 each at Rs 4,350/100Kg and Rs 4,500, respectively.

Similarly, Australia origin red Masoor also ruled up by Rs 125 to Rs 4,575/100Kg.

Moreover, demand for processed masoor, from wholesaler/retailer counters, was reported good due to cheaper pulses.

Canada Masoor dal Khopoli spot traded up by Rs 100 at Rs 5,300/100Kg.

Prices of Masoor likely to get support as rabi Masoor sowing lagging behind by 10.42%, hike in MSP, increased in consumption due to cheaper pulses and no supply pressure from overseas.

In forward business, Canada crimson variety masoor new offered at $468 per ton in container on CNF basis JNPT for Dec/Jan shipment.

Australia Nugget variety masoor new offered at $470 per ton in container on CNF basis JNPT for Dec/Jan shipment.

Imported White Pea (Mumbai):

Canada and Ukraine-origin White Pea moved higher each in Mumbai market due to shortage of ready stock.

The containers at Mumbai port continue to be in Customs' Department custody due to non-issuance of clearance. Speculators are active in the market.

The pulses were ordered in the wake of a stay order of the High Court against the ban on imports.

Market players will keep close watch on the hearing of stay order of The Jaipur High Court on December 16.

Canada and Ukraine White Pea rose by 450-500 each at Rs 5,100-5,125/100Kg and Rs 4,950-5,000, respectively.

Rabi Field Pea Sowing is down 3.60 % as On December 6th against same period Last year (LAKH HA).

Even prices of White Pea Dal/besan trade higher following uptrend in raw White pea.Vatana besan priced higher by Rs 150 at Rs 3,200/50 Kg. While, Vatana dal also gained by Rs 350 at Rs 5,600.

Gains may be further capped as crushing in Chana/Kabuli Chana has risen, due to cheaper prices and easy availability as compared with White Pea.

Moong (Jaipur):

Moong prices traded higher at Rs 6,500-6,900/100Kg as per quality at Jaipur market amid improved buying from local and outside traders/millers.

Good quality moong was in demand by the millers to meet their immediate crushing requirement.

Similarly, Moong dal gained by Rs 200 at Rs 8,400-8,500/100Kg depending on the variety.

In Delhi, Rajasthan new kharif Moong traded firm at Rs 6,700-7,100/100Kg.

In Maharashtra, most farmers prefer to offload their produce in the open market instead of coming to government-run centres to sell at MSP of Rs 7,050/100Kg. Prices of Moong was trading around MSP due to crop loss because of unseasonal rain in September and October. Sowing was also low due to the delay in the onset of monsoon.

As on December 3, 2019, NAFED has successfully procured 73365.55 MT of Moong at Minimum Support Price of Rs 7,050.

Government aims to procure 3,44,654 MT Moong during the 2019-20 (Oct-Sep) kharif marketing season.

Procurement targets for pulses are lower this year as prices are ruling above the MSP.

According to the government's first advance estimate, 2019-20 moong output has been pegged at 1.42 mln ton against 1.84 produced last year.

Canada Green Pea (Mumbai):

Canada origin Green pea moved sharply higher at Rs 9,000-9,200/100Kg at Mumbai due unavailibilty of ready stock, as the containers are stuck at Mumbai port awaiting Customs' clearance. Speculators were active in the market.

The pulses were ordered in the wake of a stay order of the High Court against the ban on imports.

Market players will keep close watch on the hearing of stay order of The Jaipur High Court on December 16.

(By Commoditiescontrol Bureau; +91-22-40015513)

|