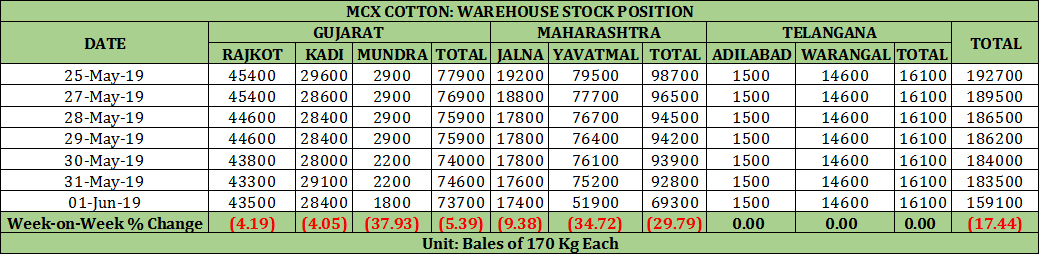

MUMBAI(Commoditiescontrol)- Cotton stocks deliverable as of 16 Sept’19 totaled 159100 bales, down from 192700 Bales in the previous week (1 Bale = 170 kg). Stock Position for the week ending 01 Jun’19:

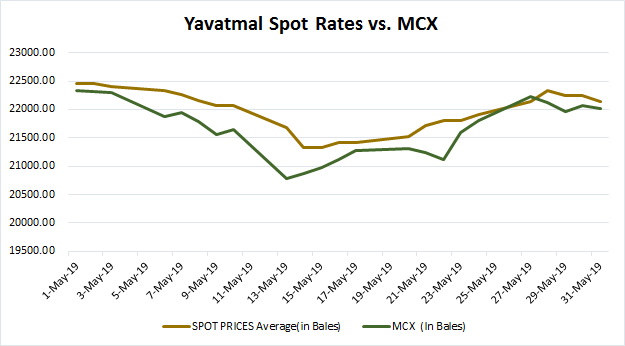

Yavatmal, a major deliver center in Maharashtra marked a downfall in stock by 34.72 percent this week. As per the data collected by Commodities Control, throughout last month, the prices in the spot markets of Yavatmal were higher than MCX prices. As of 31st May, cotton (29mm) in spot markets of Yavatmal was trading at Rs. 22143/Bale while on MCX it closed Rs. 22010/Bale. The spread between MCX and spot price was at Rs. 132.52. This was due to availability of premium quality of cotton in Yavatmal line of Maharashtra which supported the prices. If the spread widens further, there will be more withdrawal of stocks from the MCX warehouse.

Moreover, as per MCX norms the seller from Yavatmal bears a discount of Rs. 100/Bale on the price when sold. Because of this disadvantage, the seller prefers to withdraw the stock and sell it in the spot markets where he doesn’t bear the additional discount for buyers.

Meanwhile, the MNCs and Hedgers are also squaring off their position in MCX as the moisture regain in cotton after monsoon will increase the weight which will thereby reap profits. So, they’ll hold this stock till monsoon and start selling it off once the dry cotton regains the moisture. A weight gain of 2-3 per cent can result in a profit of about Rs. 380/Bale to Rs. 455/Bale at current rates.

Currently, the open interest as of May 31 is 13,416 lots or 3.35 Lakh Bales against the 1.59 Lakh Bales Stock position on MCX. If the withdrawal of stocks from MCX warehouse continues at this pace it is probable that with the closure of the June expiry speculators will be compelled to cover their short positions which will result in prices going up on MCX. There is a possibility that June cotton contract may go higher when it nears the expiry.

|