MUMBAI (Commoditiescontrol) – Tur, Urad, Masoor, Chana and Kabuli Chickpea moved higher during the week ended Saturday ( May 13-18) on good buying support. While, White/Green Pea along with Moong remained almost unchanged due to limited trade activity.

Week Highlights

#Monsoon To Be Delayed By 5 Days; Likely To Hit Kerala On June 6: IMD.

# Canada 2019-20 pea exports may slip to 3 million tonnes (Mt) compared to 3.1 million tonnes in 2018-19, according to AAFC’s April outlook.

# For 2018-19, Canada’s lentil supply is nearly 3.0 Mt and exports are forecast to rise sharply from 2017-18 to 1.8 Mt. For 2019-20, producers intend to decrease the area seeded to lentils in Canada by 10% to 1.38 Mha, due to the sharp decline in large farmgate prices in April 2018. Carry-out stocks are forecast to fall to below 0.8 Mt. The average price of lentils in Canada is forecast to fall sharply from levels recorded for the previous year despite an increase in import demand, particularly from Bangladesh and India.

.png)

.png) Burma Lemon Tur:

Burma Lemon Tur:

Tur Lemon variety of Burma origin gained by Rs 150 to Rs 5,650/100Kg in Mumbai amid improved millers, traders and consumer demand.

Demand and sales counters in Tur Dal from consumption centres were reported good.

Similarly, domestic tur in bilty trade at Akola traded higher by Rs 150 at Rs 6,200-6,225/100Kg as millers were active in purchasing Tur for crushing amid consistent decline in domestic arrivals.

Prices extended rally due to lower domestic arrivals down, rise in consumption demand for dals because of higher vegetable prices and lower output of mango, supply squeeze from overseas and on concerns over monsoon.

Government had committed earlier to give Tur delivery around 3 lakh ton to Tamil Nadu Civil supply and also had committted some quantity to other states. Government holding last stock around 5.78 lakh ton and current year procured stock around 2.72 Lakh ton. If government give delivery of Tur for crushing to major states then there will be no buffer stock left with government.

Myanmar and a few African countries are the only producers of tur apart from India. The availability of tur from African countries has declined as India had put import restrictions. Lower sowing in the last kharif season, restrictions on imports and concerns over the monsoon have driven prices of Tur.

As per market sources, Tur prices may slow down if Nafed begins the sale of procured Tur. Prices of Tur are likely to remain firm in the coming days, with the progress of the monsoon.

NAFED has successfully procured 272351.52 MT of Tur at Minimum Support Price of Rs 5,675/100kg as on May 15, 2019. Telangana:70300, Karnataka:110610.75, Gujarat:29600.55, Maharashtra:53953.97, Tamil Nadu:399.9, Andhra Pradesh: 4935.95, Madhya Pradesh:2550.4.

Latur origin new Phatka variety traded higher at Rs 8,350-8,500/100Kg for spot. Gujarat origin Wasat new phatka variety ruled at Rs 8,850-9,150/100Kg, Khamgaon origin new Phatka variety at Rs 8,250-8,450/100Kg (spot), Jalna origin new phatka variety at Rs 8,650-8,850/100Kg (spot) and Solapur origin new phatka variety at Rs 8,350-8,550/100Kg (Spot).

Burma Urad:

Burma Urad:

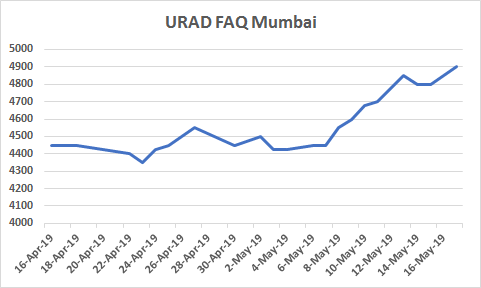

Burma Urad FAQ variety traded higher by Rs 50 to Rs 5,050/100Kg at the Mumbai market amid better millers trade for crushing due to limited imported stock in Mumbai and following firm cues from Chennai.

Delayed in imports of Urad from overseas and concerns over monsoon had supported the prices.

Similarly, In Chennai, Urad FAQ variety traded higher by Rs 150 at Rs 5,000/100Kg in ready delivery as per condition. SQ variety also gained by Rs 300 at Rs 6,200.

In forward business, Urad FAQ traded firm at Rs 5,050/100Kg for whole May and Rs 5,275/100Kg for whole June month delivery on buyers option. Urad SQ variety also moved higher at Rs 6,400/100Kg for whole June month delivery on buyers option.

As per market sources, this rise is speculative in Chennai as some cartel is active in the market to push the prices higher as they were holding stock at lower rates. Still around 1800-2000 containers stock of imported Urad were availibility in the Chennai market.

No buyers were active to purchase in ready business by paying 10% advance payment. Buyers were interested in purchasing without paying advance payment in forward business.

However, demand for processed urad remained limited during the ongoing summer season from consumption centers.

Bikaner origin branded Urad dal ruled higher at Rs 6,250-6,550/100Kg for spot. Tiranga brand of Mumbai also traded up at Rs 7,050/100Kg for Mumbai delivery, Parivar brand of Jalgaon at Rs 6,550/100Kg for spot.

NAFED has successfully procured 10815.55 MT of Urad 1n Rabi-2019 Season at Minimum Support Price of Rs 5,600 as on May 15, 2019. Tamil Nadu:3376.35, Andhra Pradesh:7030.3, Telangana:408.9.

.png) Chana Kantewala (Indore):

Chana Kantewala (Indore):

New Chana gained by Rs 75 at Rs 4,550-4,600/100Kg in Indore due to better millers buying support as per quality, firm trend from futures and other pulses, increased pace of procurement by government at MSP.

Domestic arrivals were also reported less as farmers preferred to sell to government at MSP of 4,620/100Kg and also due to the ongoing marraige season.

Flour millers were active in purchasing chana due to cheaper prices and easy availability compared to White Pea.

Australia origin Chana in ready business at Mumbai and Mundra port moved higher by Rs 200-250 each at Rs 4,550-4,600/100kg, respectively amid millers buying support due to cheaper prices compared to domestic chana and also availability of very limited stock.

Burma origin chana also gained by Rs 200-225 at Rs 4,500/100Kg.

NAFED Procured 430888.68 MT Chana In Rabi-2019 Season as on May 15,2019.Telangana:34500, Rajasthan:65860.95,Maharashtra:15088.97, Madhya Pradesh:301627.27,Andhra Pradesh:1147.9, Gujarat:12663.59.

Balance Stock of procured Chana during Rabi-18 season with Nafed is 1634599.16 MT as on 25 April, 2019.

Chana for June delivery on National Commodity and Derivatives Exchange (NCDEX), settled lower by 0.7 percent or Rs 33 at Rs 4,600/100kg. Earlier, in the day, the contract hovered in the range of 4,596 and 4,648 on Friday.

Chana stocks at NCDEX accredited warehouses stood at 91,843 metric tonnes (Indore: 161, Bikaner 67,098, Jaipur 24,584) as on 16th May, up 91,661 metric tonnes from the previous session, the exchange data showed.

Australian chana dal priced higher by Rs 50-100 at Rs 5,500/100 Kg for spot on limited trade activity. Domestic chana dal of Pistol brand also ruled firm at Rs 5,700 for Spot, Angel brand at Rs 5,900 for Spot, Samrat brand at Rs 6,000 for Spot. Chana besan also moved up by Rs 100 at Rs 3,260/50Kg, Vatana besan by Rs 25 at Rs 2,890/50 Kg and Vatana dal by Rs 100 at Rs 5,400.

In Mumbai, Russia/Sudan/Ethiopia/Burma origin kabuli chana gained by Rs 150-200 each at Rs 4,400/100Kg, Rs 4,500-4,525, Rs 4,475 and Rs 4,650, respectively.

Kabuli chana of 40-42, 42-44 and 44-46 counts traded firm by Rs 50 at Rs 6,450/100Kg, Rs 6,250 and Rs 6,050, respectively at Indore market amid local buying and ongoing arrivals.

As per a Indore based trader, prices of Kabuli Chickpea are under pressure despite lower prices and lower crop compared to last year due to regular supplies, carry over stock in godowns/cold storage and dull demand.

Stockists those had purchased 44-46 count at Rs 6,800/100Kg are now bearing losses against current market prices.

Around 40% of total crop this season had been brought by farmers in the market. But there is still balance stock left with farmers. Farmers are holding their crop in godowns and cold storage. Carry over stock is expected to be approximately at 1.5 to 2 lakh tonnes. Meanwhile, export demand from Colombo/Algeria is also less compared to last year.

Stockists/Traders/Farmers are expecting export demand likely to come in July-August.

Prices are likely to get support at existing lower levels compared to last year.

In forward business, Russia Kabuli Chickpea offered at $405 and Burma FAQ at $625 per ton in container on CNF basis JNPT for ready shipment.

As per market talk,sustainability of this rise will depend on pace of Nafed procurement in spot markets and demand for Chana Dal/besan. However, chana is cheaper pulses compare to other pulses. Moreover, output of chana is likely to be lower by about 10-15 per cent this season in the country, according to trade estimates. Meanwhile, import restriction on peas has been extended for another one year. Import quota for peas has been restricted to 1.5 lakh tonne/annually. Earlier it was 1 lakh tonne/quarterly. Lower import quota for this year may also support chana prices.

.png) Imported Masoor (Mumbai):

Imported Masoor (Mumbai):

Canada crimson variety red Masoor in vessel/container along with Australia red Masoor moved higher by Rs 100-150/100Kg at Mumbai due to millers buying support, following firm trend in Tur and other pulses, below expectation arrivals of domestic Masoor.

Canada origin red Masoor in vessel/container new priced higher at Rs 4,100/100Kg and Rs 4,200, respectively.

Similarly, Australia origin red Masoor also gained by Rs 100 to Rs 4,300/100Kg against limited stock.

Demand in Canada yellow Masoor was reported good and priced at Rs 4,800/100Kg in Chennai/Kolkata following firm trend in Tur because of shortage of Tur.

However, demand in processed masoor from consumption centres was reported limited. Canada Masoor Khopoli spot traded firm by Rs 50 at Rs 4,950/100Kg.

In forward business, Canada crimson variety masoor new offered at $440 per ton in container on CNF basis JNPT for June-July shipment.

NAFED Procured 22377.70 MT Masoor In Rabi-2019 Season as on May 15,2019. Madhya Pradesh:22377.70.

Ready stock of imported Masoor and regular supply from overseas will limit the gains.

Overall prices of Masoor are likely to get support on long term basis on further rise in Tur as both are substitutes for each other.

.png) Imported White Pea (Mumbai):

Imported White Pea (Mumbai):

Canada and Ukraine origin White Pea new priced steady to firm in Mumbai due to thin buying activity despite low stock.

Millers and traders are preferring to purchase domestic chana or various origin kabuli chickpea due to cheaper prices as compared to white pea.

Moreover, demand in matar dal/besan remained thin at prevailing rates.

Canada and Ukraine origin White Pea new traded each at Rs 4,875/100Kg and Rs 4,775, respectively.

Vessel MV Great Link carrying White Pea from Canada is discharging cargo at Kakinada port.

Importers were not ready to sell at current market prices in Kakinada due to limited ready stock of Canada White Pea.

As per Kolkata based trader, ready stock of Canada White Pea is low. Millers/traders prefers to purchase from Chennai with additional expenses of transportation Rs 360-370. Meanwhile, due to higher prices and thin demand in Vatana dal, millers prefers to purchase filter quality ready stock of Ukraine/Russia White Pea due to low prices compare to Canada White Pea.

In near future, millers/traders will prefers to purchase Canada White Pea from Kakinada instead of Chennai due to lower cost of transportation of Rs 310-320.

Consumption of White Pea had been declined in Kolkata from 2500 Ton to 600 ton on daily basis due to premium prices of White Pea compare to Chana. Meanwhile, consumption had reduced more from 600 ton to 300 Ton on daily basis.

However, prices are likely to get support in near future due to limited imported stock and also on less domestic arrivals as farmers are not interested to liquidate at lower rates. Meanwhile, Matar quota has restricted to 1.5 lakh tonne/annually. Earlier it was 1 lakh tonne/quarterly resulting in support to the prices.

In forward business, Ukraine origin White Pea offered at $270-$275 per ton on CNF basis JNPT for June shipment. Canada origin White Pea offered at $310-$315 per ton in container on CNF basis JNPT for June shipment.

.png) Moong (Jaipur):

Moong (Jaipur):

Moong prices traded flat at Rs 5,800-6,500/100Kg as per quality at Jaipur market amid limited millers trade activity and also summer crop arrivals of new moong in selected states.

However, decreasing stock with Nafed will supported the prices. A lot will depend on the monsoon. If it is delayed, then prices will remain firm. Major stock of Moong were witnessed in Rajasthan.

Similarly, Moong dal prices remained unchanged at Rs 7,800/100Kg, depending on the variety.

NAFED has successfully procured 10665.43 MT of Moong in Rabi 2019 season at Minimum Support Price of Rs 6,975 as on May 15, 2019.Tamil Nadu: 4275.28, Andhra Pradesh:5385.5, Gujarat:1004.65.

Canada Green Pea (Mumbai):

Canada origin Green pea priced unchanged at Rs 7,000/100Kg at Mumbai amid thin trade activity and availability of sufficient stock at Mumbai/Chennai cold storage and godowns.

(By Commoditiescontrol Bureau; +91-22-40015513)