MUMBAI (Commoditiescontrol) – Major pulses such as Tur, Urad, Chana, Kabuli Chana, Moong, Masoor and Green Pea moved higher during the week ended Saturday (March 25-30) due to fresh millers buying activity at lower rates as demand and sale counter in processed pulses was good. While, White Pea prices remained weak amid slack trade activity and overseas supply.

The prices of most pulses have been below the minimum support price levels.

Market men are expecting that government will renew the 1.5 lac tons import quota for moong and Urad each and 2 lac tons for Tur for for next finanacial year which begins for April 1.

The government set restrictions on pulses imports in August 2017. The free import of tur, moong and urad has been restricted by imposing a quota of 2 lakh tonnes import on tur and 1.5 lac tons quota for moong and Urad each.The government has introduced a quota system only for millers for the import of tur, moong and urad.

.png)

.png) Burma Lemon Tur:

Burma Lemon Tur:

Tur Lemon variety of Burma origin gained by Rs 300 to Rs 5,000/100Kg in Mumbai amid improved millers buying activity, following uptrend in domestic market due to negligible domestic arrivals as major markets closed till 1st April for financial year end.

Demand and sales counters in Tur Dal are good from consumption centres and likely to continue as retailers/wholesalers pipeline are empty and also due to negligible stock of old Tur dal. They are active in purchasing only as per immediate needs due to liquidity crunch and also awaiting the government policy on imports.

In Mumbai, Mozambique Tur Zebra variety quoted at Rs 4,000/100Kg, Gajri white variety at Rs 4,600-4,650 and red lakhota variety at Rs 4,400.

Tanzania origin Arusha Tur priced higher at Rs 4,600-4,650/100Kg.

Domestic tur in bilty trade at Akola also traded higher by Rs 250 at Rs 5,425-5,450/100Kg.

NAFED has successfully procured 221803.1 MT of Tur at Minimum Support Price of Rs 5,675/100kg as on March 28, 2019. Telangana:70300, Karnataka:108633.99, Gujarat:14898.7, Maharashtra:27672.49, Tamil Nadu:297.92.

Latur origin new Phatka variety traded higher by Rs 200 at Rs 7,700-7,800/100Kg for Mumbai delivery on better trade activity and also negligible stock of old Tur dal. Gujarat origin Wasat new phatka variety priced higher by Rs 200 at Rs 8,050-8,350/100Kg, Khamgaon origin new Phatka variety at Rs 7,500-7,700/100Kg (Mumbai Delivery), Jalna origin new phatka variety at Rs 7,900-8,100/100Kg (Mumbai Delivery) and Solapur origin new phatka variety at Rs 7,600-7,700/100Kg (Mumbai delivery).

In forward trade, Tur Phatka variety of Latur ( Pistol/Popat/Dollar) were moved higher by Rs 200 at Rs 7,900/100Kg spot for April and Rs 8,700 for Diwali.

.png) Burma Urad:

Burma Urad:

Burma Urad FAQ variety traded higher by Rs 200 at Rs 4,400/100Kg at the Mumbai market following firm cues from Chennai and also millers are active in purchasing imported Urad for crushing as major markets is closed for financial year end.

Moreover, demand and sale counters in processed urad remained good at prevailing rates. as retailers/wholesalers pipeline are empty.

Similarly, In Chennai, Urad FAQ/SQ varieties gained each by Rs 150-200 each at Rs 4,300-4,325/100kg and Rs 5,200-5,250, respectively in ready delivery as per condition.

In forward business, Urad FAQ/SQ priced at Rs 4,450/100Kg and Rs 5,300, respectively for whole April delivery.

Meanwhile, cargoes are being cleared by Chennai customs, but pace is very slow and it is expected that 50-60 containers will get cleared on daily basis.

Kolkata court has permitted clearance of Urad cargo against only 10% Bank Guarantee. As per clearing agent, after getting order copy, customs will take time of around 5-7 days to complete delivery procedure.

Bikaner origin branded Urad dal priced higher by Rs 200 at Rs 5,900-6,100/100Kg for Mumbai delivery. Tiranga brand of Mumbai also quoted up at Rs 6,300/100Kg for Mumbai delivery, Parivar brand of Jalgaon at Rs 6,000/100Kg for Mumbai delivery.

NAFED has successfully procured 3331.10 MT of Urad 1n Rabi-2019 Season at Minimum Support Price of Rs 5,600 as on March 28, 2019. Tamil Nadu:3331.10.

.png) Chana Kantewala (Indore):

Chana Kantewala (Indore):

New Chana prices rose by Rs 150-175 at Rs 4,250/100Kg in Indore followed firm cues from futures, good millers trade activity as demand in chana dal and besan from consumption centres was reported.

Arrivals of new domestic Chana was less as major domestic markets was closed from today onwards till April 1st for financial year end.

Prices were also firm due to report in the market that Nafed will stop selling old procured Chana in open markets and will begins procurement at MSP of 4,620/100Kg.

Flour millers were also active in purchasing chana due to cheaper prices and easy availability compared to White Pea.

Similarly, Burma origin chana also gained by Rs 50 at Rs 4,050/100Kg.

Australia origin Chana in ready business at Mumbai and Mundra port moved higher by Rs 100 each at Rs 4,100/100kg, respectively on fresh millers trade activity. However, quality was average and also not much stock left.

NAFED Procured 35109 MT Chana In Rabi-2019 Season as on March 28,2019.Telangana:34500, Rajasthan:597.9, Maharashtra:11.1.

Balance Stock of procured Chana during Rabi-18 season with Nafed is 1766395.30 MT as on 25 March, 2019.

Chana for April delivery on National Commodity and Derivatives Exchange (NCDEX), settled higher by 1 per cent or Rs 41 at Rs 4,349/100kg. Earlier, in the day, the contract hovered in the range of 4,285 and 4,366 on Friday.

Australian chana dal gained by Rs 20 at Rs 5,350/100 Kg for Mumbai delivery on good trade activity. Domestic chana dal of Pistol brand also offered higher by Rs 200 at Rs 5,600 for Mumbai delivery, Angel brand at Rs 5,800 for Mumbai delivery, Samrat brand at Rs 5,850 for Mumbai delivery. While, Chana besan priced flat at Rs 2,930/50Kg. On other hand, Vatana besan ruled weak at Rs 2,830/50 Kg and Vatana dal at Rs 5,150.

In Mumbai, Sudan/Russia/Ethiopia/Burma origin kabuli chana gained each by Rs 50-100 at Rs 4,075/100Kg, Rs 3,975-4,000, Rs 4,150 and Rs 4,350, respectively amid buying from besan flour millers and negligible domestic arrivals of new Chana.

Kabuli chana of 40-42, 42-44 and 44-46 counts traded higher by Rs 300 at Rs 6,800/100Kg, Rs 6,600 and Rs 6,400, respectively at Indore market.

As per market sources, prices of Chana are likely to get some support for the short term if government begins procurement at MSP of 4,620/100Kg and may stop sale of last year procured chana. New arrivals will also be slow as farmers will not be interested to sell chana at lower current rates in open market while preferring to sell to government at MSP. Procurement of Chana expected to began from last week of current month in Madhya Pradesh.

As per market view, government may extend curbs on matar import till 30th June 2019 will also support prices of Chana.

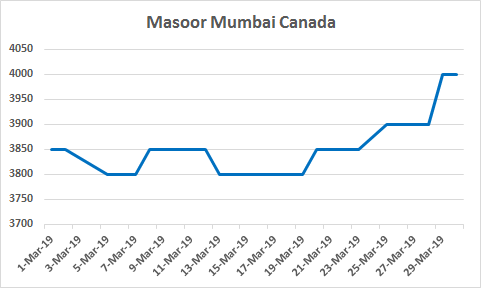

Imported Masoor (Mumbai):

Imported Masoor (Mumbai):

Canada origin Masoor in both container/vessel new along with Australia Masoor new moved higher by Rs 50-100/100Kg at Mumbai following firm trend in Tur, fresh buying support from millers at lower rates due to empty pipeline coupled with thin domestic arrivals as major markets is closed for financial year end.

Moreover, arrivals of domestic Masoor were below expectation in Madhya Pradesh/Uttar Pradesh as farmers were interested to liquidate Wheat and holding Masoor/Chana crop.

Canada crimson variety masoor in container/vessel new by Rs 50-100 to Rs 4,150/100Kg and Rs 4,000, respectively.

Australia masoor nugget variety new priced higher by Rs 50 at Rs 4,250/100Kg as per quality amid limited stock availability.

However, demand in processed masoor from consumption centres was reported limited. Canada Masoor Khopoli spot traded higher by Rs 50 at Rs 4,850/100Kg.

Overseas supply, Liquidity crunch and holding of Rabi 2018 crop by Nafed will limit the gains.

.png) Imported White Pea (Mumbai):

Imported White Pea (Mumbai):

Canada/Ukraine origin White Pea new slipped by Rs 25-50/100Kg in Mumbai in absence of buying support, ongoing domestic arrivals, overseas supply and also due to shifting of demand from traders, millers and flour millers to chana/Kabuli chana due to cheaper prices as compared to white pea.

Availability of new domestic White Pea from Uttar Pradesh at cheaper rates coupled with higher production estimates for this season also pressurised sentiments.

Moreover, Chennai cargoes in containers are being cleared by customs, but pace is very slow which has also dampened sentiments to some extent. Clearance has been given for Breakbulk cargo of White Pea at Chennai port.

Meanwhile, Kolkata court has also permitted clearance of peas cargoes against 10% Bank guarantee and 5% penalty. As per clearing agent, after getting order copy, customs will take time of around 5-7 days to complete delivery procedure.

Canada White Pea old/new traded lower by Rs 50 at Rs 4,400/100Kg. While Ukraine White Pea new eased at Rs 4,250/100Kg.

However, demand in matar dal/besan remained slow at prevailing rates.

.png) Moong (Jaipur):

Moong (Jaipur):

Moong prices traded higher by Rs 200 at Rs 5,600-6,000/100Kg as per quality at Jaipur market amid fresh millers buying support and following firm trend in other pulses.

Moong dal prices also gained by Rs 100 at Rs 6,800-6,900/100Kg, depending on the variety.

However, Nafed were active in selling old procured balance stock of Kharif 2017 in Rajasthan and also stock of Kharif 2018 in Maharashtra, Telangana and Karnataka.

NAFED has successfully procured 726.04 MT of Moong in Rabi 2019 season at Minimum Support Price of Rs 6,975 as on March 28, 2019.Tamil Nadu: 726.04.

Canada Green Pea (Mumbai): Canada origin Green pea moved higher by Rs 300 to Rs 6,800-7,100/100Kg at Mumbai as sellers remained reluctant to liquidate at lower rates.

However, availability of sufficient stock at Mumbai/Chennai cold storage and godowns and as cargoes are being cleared by Chennai customs will limit the gains.

(By Commoditiescontrol Bureau; +91-22-40015513)