Mumbai (Commoditiescontrol) – Indian mustard futures continue to slide during previous week however the losses were limited as increase in demand due to festive period and improving crush margins kept the trade on tight note. At the end of week, mustard seed Benchmark contract April’19 futures fell by around 0.5% and closed at INR 3747 compared to earlier week close of INR 3766 per quintal.

The average daily arrivals were down previous week as festive mood kept the market participation on lackluster note. Total average daily arrivals in country was observed near 2.50 lakh bags vs. 7.5 lakh bags reported previous week out of which Rajasthan accounted for 1.25 lakh, MP – 25 thousand bags, UP- 0.5 Lakh bags, Haryana and Punjab 10 thousand bags, Gujarat -15 thousand bags while other states contributing 25 thousand bags.

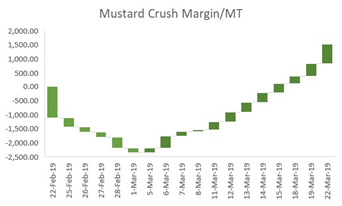

Moreover, demand from crushers at current price levels is likely to improve, as the crush margin pace has gone up in the last 2-weeks.  As shown in chart, crush margin used to be on negative side during previous month which has improved to INR 680/MT in previous week. With further improvement in demand from crushers, mustard seed prices shall continue to stay in current range bound note in coming weeks.

As shown in chart, crush margin used to be on negative side during previous month which has improved to INR 680/MT in previous week. With further improvement in demand from crushers, mustard seed prices shall continue to stay in current range bound note in coming weeks.

Further, as the prices are currently trading below MSP (4200/quintal), one might observe farmers reluctance to sell at further lower levels and shall encourage stock hoarding activity. However, huge production expectation this year (above 8 million tons) shall also resist any sharp upside bounce during peak arrivals period.

The Canola Council of Canada now says China has stopped buying all Canadian canola exports, including oil as well as seed and meal. The country had represented 40% of the global market for Canadian canola products. The strict restrictions by China shall have negative impact on overall global veg oilseed and oil market which shall in turn also keep Indian prices on subdued note.

Considering overall fundamentals, mustard futures are likely to trade in range bound note in coming weeks with improvement in crushing demand at lower levels supporting the prices from one end while bumper crop expectation pressuring from other side.