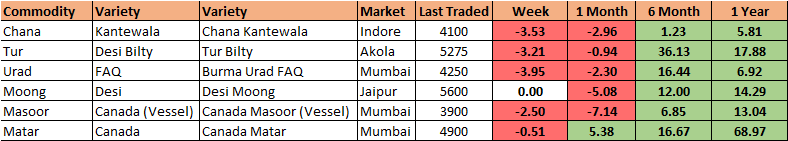

MUMBAI (Commoditiescontrol) – Major pulses such as Tur, Urad, Masoor, Chana, Kabuli Chana and White Pea declined during the week ended Saturday (February 18-23) due to dull buying support from mills. While, Moong and Green Pea prices remained more or less steady on thin activity.

Ongoing domestic arrivals, supply from overseas, sluggish sale counters in processed pulses and liquidity crunch have been pressurising the sentiments.

Week Highlights

# President on Thursday promulgated the Banning of Unregulated Deposit Scheme Ordinance which seek to curb the menace of ponzi schemes and make such unregulated deposit scheme punishable.

# Markets regulator Securities and Exchange Board of India (Sebi) on Friday declared the commodity broking arms of Motilal Oswal and India Infoline (IIFL), as not ‘fit and proper’ for undertaking commodity derivative trades, as part of action in the Rs 5,600 crore payment default at National Spot Exchange Ltd (NSEL).

# Madras HC Allows Pulses Importers To Take Delivery With 10% Bank Guarantee of invoice value. The court will give its final order on Monday. As per clearing agent, after getting copy of final order, customs will take time of around 8-10 days to complete delivery procedure.

# Canada has joined the United States in a challenge of India’s support prices for peas (Matar), Chickpea (Chana) lentils (Masoor) and a number of other crops.

# Pulses production is estimated to be around same level of 25 million tonnes.

.png) Burma Lemon Tur:

Burma Lemon Tur:

Tur Lemon variety of Burma origin declined by Rs 200 to Rs 4,750/100Kg in Mumbai amid dull buying support from mills as demand and sale counters in processed Tur were sluggish from consumption centres and also on liquidity crunch.

Similarly, domestic tur in bilty trade at Akola remained weak by Rs 125 at Rs 5,250-5,275/100Kg.

As per market sources, those resellers were active in the market who had purchased the tur stock earlier at lower rates.

Tur millers are facing disparity in crushing new domestic tur due to moisture content/higher prices and preferring to crush old dry stock procured from Nafed.

Stockists, small traders and millers had maintained good stock of Tur in anticipation that prices may rise more due to lower output this year compared to last year.

Arrivals of domestic tur are less as farmers are not in a hurry and holding stock and were selling to Nafed at MSP as per financial requirements. Current market prices are almost around MSP.

NAFED has successfully procured 125137.45 MT of Tur at Minimum Support Price of Rs 5,675/100kg as on February 21, 2019. Telangana:70300, Karnataka:52833.04, Gujarat:853.35, Maharashtra : 1099.51, Tamil Nadu:51.55.

Latur origin old Phatka variety Tur dal priced unchanged on weak undertone at Rs 7,100-7,200/100Kg for Mumbai delivery, Gujarat origin Wasat old phatka variety offered at Rs 7,100-7,300/100Kg, Khamgaon origin old Phatka variety at Rs 7,150-7,350/100Kg (Mumbai Delivery) and Jalna origin old phatka variety at Rs 7,100-7,300/100Kg (Mumbai Delivery).

Similarly, Latur origin new Phatka variety also offered steady at Rs 7,500-7,600/100Kg for Mumbai delivery, Gujarat origin Wasat new phatka variety offered at Rs 7,900-8,200/100Kg, Khamgaon origin new Phatka variety at Rs 7,300-7,500/100Kg (Mumbai Delivery), Jalna origin new phatka variety at Rs 7,800-8,000/100Kg (Mumbai Delivery) and Solapur origin new phatka variety at Rs 7,400-7,500/100Kg (Mumbai delivery).

In forward trade, Tur Phatka variety of Latur ( Pistol/Popat/Dollar) were priced at Rs 7,800/100Kg spot for March and Rs 8,000 spot for April and Rs 9,000 for Diwali.

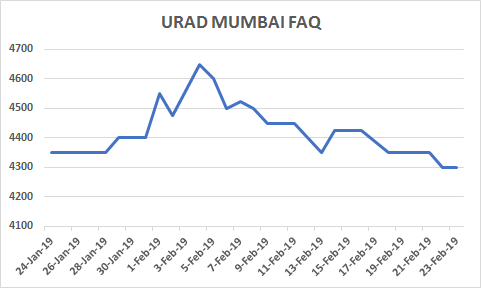

Burma Urad:

Burma Urad:

Burma Urad FAQ variety fell by Rs 200 at Rs 4,200/100Kg at the Mumbai market amid dull buying support from mills as demand for processed urad from consumption centres remained sluggish at prevailing prices.

Moreover, the Madras High Court completed hearing on importers plea challenging the DGFT order to restrict import of pulses. As per our source, after completion of hearing, the court has allowed pulses importers to take delivery with 10 percent bank guarantee of invoice value.

The court will give its final order on Monday. As per clearing agent, after getting copy of final order, customs will take time of around 8-10 days to complete delivery procedure.

Similarly, In Chennai, Urad SQ/FAQ varieties ruled weak by Rs 50-75 each at Rs 5,150-5,175/100Kg and Rs 4,150-4,175, respectively in ready delivery as per condition.

Meanwhile, customs on February 16 released 275-300 containers (1 Container = 24 MT) those were already given out of charge certificate (OOC).

More 20 containers were released by custom on February 21 those who were having licence.

However, around 2,200 containers have yet to get clearances from Customs.

However, sufficient stocks of imported urad at Chennai godowns and upcoming arrivals of domestic crop from Southern markets (Tamil Nadu/Srikakulum) will pressurised the sentiments.

Bikaner origin branded Urad dal priced weak at Rs 5,800-6,000/100Kg for Mumbai delivery. Tiranga brand of Mumbai also quoted at Rs 6,350/100Kg for Mumbai delivery, Parivar brand of Jalgaon at Rs 6,200/100Kg for Mumbai delivery.

NAFED has successfully procured 422818.87 MT of Urad 1n Kharif-2018 Season at Minimum Support Price of Rs 5,600 as on Feb 21, 2019. Rajasthan: 77444.94, Maharashtra :7741.7, Telangana:578.39, Madhya Pradesh:298599.69, Uttar Pradesh:29742.95,Karnataka: 10.1, Gujarat: 8701.1.

NAFED has successfully procured 267.40 MT of Urad 1n Rabi-2019 Season at Minimum Support Price of Rs 5,600 as on Feb 21, 2019. Tamil Nadu:267.40.

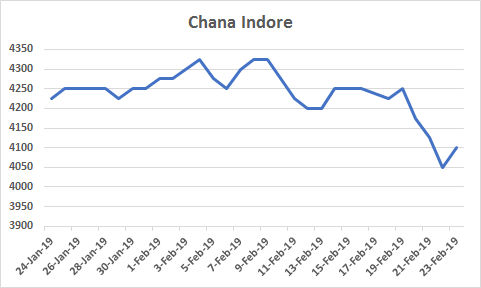

Chana Kantewala (Indore):

Chana Kantewala (Indore):

Chana prices remained weak by Rs 100-150 at Rs 4,050-4,100/100Kg in Indore amid dull physical trade activity, weak cues from futures and ongoing new arrivals.

However, demand in chana dal and besan was sluggish from consumption centres. Sentiments are still weak due to availability of the government stock and the rise in selling of chana by the NAFED, especially in the states of Madhya Pradesh and Rajasthan.

Similarly, Australia origin Chana in ready business at Mumbai and Mundra port offered lower by Rs 75 each at Rs 4,100/100kg, respectively due to average quality and also not much stock left.

Burma origin chana also ruled weak by Rs 50 at Rs 4,000/100Kg.

Chana for March delivery on National Commodity and Derivatives Exchange (NCDEX), was settled weak by 1.2 per cent or Rs 43 at Rs 4,154/100kg. Earlier, in the day, the contract hovered in the range of 4,133 and 4,208 on Friday.

Australian chana dal quoted flat at Rs 5,300/100 Kg for Mumbai delivery on dull trade activity. Domestic chana dal of Pistol brand also offered steady at Rs 5,600 for Mumbai delivery, Angel brand at Rs 5,900 for Mumbai delivery, Samrat brand at Rs 5,800 for Mumbai delivery. Chana besan also priced flat at Rs 3,030/50Kg, Vatana besan at Rs 2,960/50 Kg and Vatana dal at Rs 5,400.

In Mumbai, Sudan /Russia/Ethiopia and Burma origin kabuli chana quoted weak by Rs 50-75 each at Rs 4,100/100Kg, Rs 4,000, Rs 4,150 and Rs 4,400, respectively amid regular supply in containers from overseas, dull trade activity owing to less interest shown by besan flour millers and following weak trend in Chana.

Ongoing arrivals of new domestic Kabuli Chana were reported at the market which has also pressurised the sentiments.

Kabuli Chana dollar variety at Indore priced unchanged at Rs.5,500-6,600/100Kgs as per quality at Indore and also concerns of crop damage of upto 20-30% due to prevailing cold wave conditions.

Kabuli chana of 42-44 and 44-46 counts traded lower by Rs 200 at Rs 7,200/100Kg and Rs 7,000, respectively at Indore market. Arrivals of new Kabuli were reported in Madhya Pradesh.

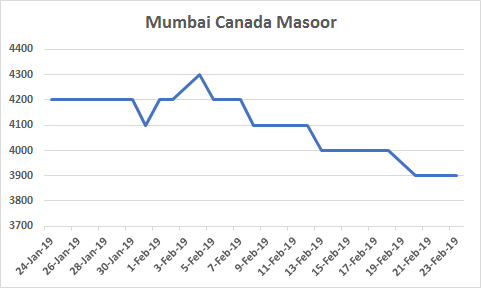

Imported Masoor (Mumbai):

Imported Masoor (Mumbai):

Canada origin Masoor in vessel/container both old/new along with Australia Masoor old/new slipped by Rs 100/100Kg in Mumbai amid sluggish buying, coupled with commencement of new arrivals in some markets of Madhya Pradesh and Rajasthan.

Nafed is also holding procured stock of Masoor around 161612.75 MT in Madhya Pradesh and 6953.50 MT in Uttar Pradesh.

Arrivals of new domestic Masoor are likely to increase from February end in Madhya Pradesh/Rajasthan and after festival of Holi in Uttar Pradesh.

Canada crimson variety masoor in vessel new/old fell by Rs 100 to Rs 4,000/100Kg and Rs 3,900, respectively.

Canada crimson variety masoor in container new/old also offered weak by Rs 100 at Rs 4,050/100Kg and Rs 3,950, respectively.

Similarly, Australia masoor nugget variety both old/new also quoted lower by Rs 100 at Rs 4,100/100Kg and Rs 4,200, respectively as per quality amid limited stock availability.

Demand in processed masoor from consumption centres was reported dull. Canada Masoor Khopoli spot traded lower by Rs 50 at Rs 5,100/100Kg.

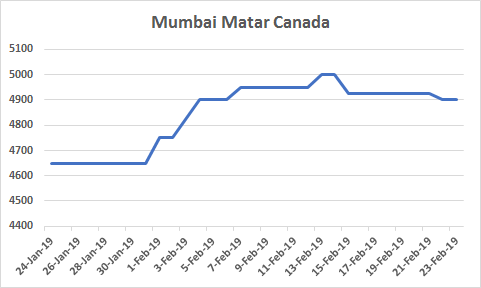

Imported White Pea (Mumbai):

Imported White Pea (Mumbai):

Canada origin White Pea and Ukraine White Pea new remained weak by Rs 25-50/100Kg in Mumbai in absence of buying support, average quality and also due to shifting of demand from traders, millers and flour millers to chana/Kabuli chana due to cheaper prices as compared to white pea.

Arrivals of new White Pea in few places of Uttar Pradesh (Bundelkhand areas) have also pressurised the sentiments due to lower rates and good crop compares to last year.

However, custom is still not given clearance of bill of entries pertaining to pulses at Chennai/Kolkata port. White pea were allowed to unload in custom Bond Chennai/Kolkata port warehouse.

Canada White Pea old/new traded at Rs 4,650-4,900/100Kg. While Ukarine White Pea new traded at Rs 4,700/100Kg.

However, demand in matar dal/besan remained slow at prevailing rates.

.png) Moong (Jaipur):

Moong (Jaipur):

Moong prices priced flat at Rs 5,400-5,600/100Kg as per quality at Jaipur market amid thin millers buying support.

Moong dal prices also traded unchanged at Rs 6,700-6,800/100Kg, depending on the variety.

However, Nafed were active in selling old procured balance stock of Kharif 2017 in Rajasthan, Madhya Pradesh and karnataka.

NAFED has successfully procured 295409.03 MT of Moong in Kharif 2018 season at Minimum Support Price of Rs 6,975 as on Feb 21, 2019. Rajasthan: 236277.28, Karnataka: 28950, Telangana: 13375.31, Maharashtra: 12252.03, Madhya Pradesh: 2650.96, Tamil Nadu: 364.9, Haryana: 224.9, Gujarat: 1313.65.

NAFED has successfully procured 31.65 MT of Moong in Rabi 2019 season at Minimum Support Price of Rs 6,975 as on Feb 21, 2019. Tamil Nadu: 31.65.

Canada Green Pea (Mumbai):

Canada origin Green pea ruled unchanged to Rs 7,000-7,100/100Kg at Mumbai amid dull buying support at prevailing rates and availibility of sufficient stock at Mumbai/Chennai cold storage and godowns.

However, no further supply pressure from overseas was reported as custom has stopped clearance of bill of entries pertaining to pulses at Chennai port. Green pea were allowed to unload in custom Bond Chennai port warehouse.

(By Commoditiescontrol Bureau; +91-22-40015513)