MUMBAI (Commoditiescontrol) – Tur, Masoor and Urad (Chennai) moved higher during the week ended Saturday ( December 31,2018 - January 5, 2019) due to fresh buying support from mills. While, Chana, Kabuli Chickpea, White and Green Pea along with Moong prices ruled weak amid dull trade activity.

Week Highlights

# India Rabi Pulse Sowing down by 6.44 % as on January 4 to 143.56 lakh Ha vs 153.44 last year at the same period. Chana: 92.89 Vs 104.21, Masoor: 16.61 Vs 16.97, Matar: 10.10 Vs 9.17, Urad: 6.16 Vs 6.86, Moong: 3.65 Vs 3.67, Other Pulses:5.48 Vs 5.22.

# Gujarat Will Buy Tur From January 1-31 Through i-PDS Portal. Buying Will Also Take Place At 101 APMC From 15 January-14 April. Gujarat Tur Crop At 3.14 LT Vs 3.37 Last Year.

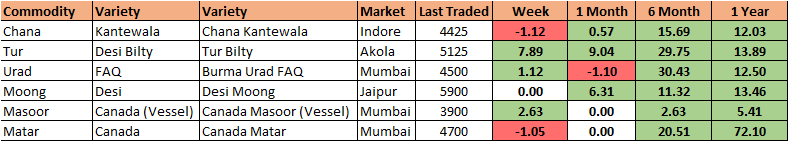

Burma Lemon Tur:

Burma Lemon Tur:

Tur Lemon variety of Burma origin gained sharply by Rs 350 to Rs 4,675-4,700/100Kg in Mumbai amid improved millers demand. Millers are buying imported tur mainly due to cheaper cost and poor supply of new tur in the country due to estimates of lower production.

Demand and sale counters in both old and new processed Tur reported good had supported the prices.

In Mumbai, Mozambique Tur both red/white also moved higher by Rs 200-300 to Rs 4,250/100Kg and Rs 4,500, respectively on good trade activity despite fresh supply at Mumbai port.

Vessel Sea Music from Mozambique had discharged 16693 MT Tur till date and 5351 MT Balance to discharge. Vessel carrying 22044 MT Tur At Mumbai port.

Further farmers having tur are not interested to sell tur in local market to private traders at lower rates and want to sell to government agencies at MSP rate of Rs 5,675/100kg.

NAFED has successfully procured 12207.10 MT of Tur at Minimum Support Price of Rs 5,675/100kg as on January 3, 2019. Telangana:12207.10.

Domestic tur in bilty trade at Akola also gained by Rs 350-400 at Rs 5,100-5,125/100Kg following firm trend in imported Tur and better buying support from mills.

Latur origin old Phatka variety priced unchanged at Rs 6,500-6,600/100Kg for Mumbai delivery, Gujarat origin Wasat old phatka variety offered at Rs 6,600-6,800/100Kg, Khamgaon origin old Phatka variety at Rs 6,400-6,600/100Kg (Mumbai Delivery) and Jalna origin old phatka variety at Rs 6,700-6,800/100Kg (Mumbai Delivery).

On other hand, Latur origin new Phatka variety gained by Rs 100 at Rs 7,000/100Kg for Mumbai delivery, Gujarat origin Wasat new phatka variety offered at Rs 7,300-7,600/100Kg, Khamgaon origin new Phatka variety at Rs 6,900/100Kg (Mumbai Delivery) and Jalna origin new phatka variety at Rs 7,200-7,400/100Kg (Mumbai Delivery).

Limited holding of old stock by Nafed may also support prices in the long-term. Furthermore, Tur prices will depend on government procurement which has already begun in Telangana. The pace of procurement is still slow.

.png) Burma Urad:

Burma Urad:

Burma urad FAQ variety priced unchanged at Rs 4,500/100Kg at the Mumbai market amid limited buying by mills, ongoing domestic arrivals and also on regular import in Chennai/Kolkata.

On other hand, in Chennai, Urad SQ/FAQ variety moved up by Rs 150 each at Rs 5,350100Kg and Rs 4,350, respectively in ready delivery as per condition due to millers buying activity as they are facing difficulty in getting good quality of domestic urad stock. However, sellers were active due to regular supply from overseas.

In forward business, Urad SQ priced at Rs 5,400/100Kg for whole february delivery. While, FAQ variety offered at Rs 4,450/100Kg for whole february delivery.

Meanwhile, the Madras High Court has further extended the date of hearing till January 8, 2019 on a plea challenging the DGFT notification to restrict Urad imports.

Moreover, upcoming arrivals of domestic crop from southern markets (Kovilpatti in Thoothukudi District, Viluppuram district, Thanjavur and Machilipatnam of krishna district in Andhra Pradesh) in January may limit gains in Chennai.

However, demand for processed urad from consumption centres remained thin at prevailing prices.

Bikaner origin branded Urad dal priced flat at Rs 5,950-6,250/100Kg for Mumbai delivery amid slow trade activity. Tiranga brand of Mumbai also quoted at Rs 6,500/100Kg for Mumbai delivery, Parivar brand of Jalgaon at Rs 6,200/100Kg for Mumbai delivery.

NAFED has successfully procured 255774.33 MT of Urad at Minimum Support Price of Rs 5,600 as on Jan 03, 2019. Rajasthan: 70531.82, Maharashtra :7276.26, Telangana:578.39, Madhya Pradesh:156729.61, Uttar Pradesh:18573.5,Karnataka: 170.3, Gujarat:1914.45.

Statewise Rabi Urad Sowing Down 10.2 % As On Jan 2 Vs Same Period Last Yr (LAKH HA). Andhra Pradesh:2.10 Vs 2.95, Tamil Nadu:2.26 Vs 2.10, Odisha:1.56 Vs 1.58. Total:6.16 Vs 6.86.

Urad price is expected to trade positive in long term due to lower crop in the country, particularly tight availability of good quality urad and also if government restrict further Urad imports.

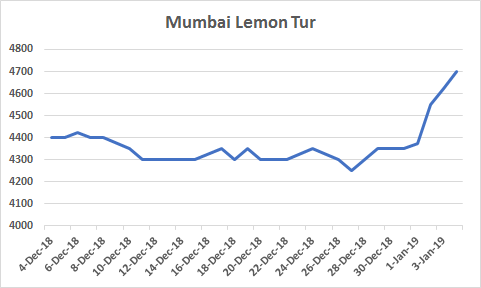

Chana Kantewala (Indore):

Chana Kantewala (Indore):

Chana prices traded lower by Rs 100 at Rs 4,400-4,425/100Kg in Indore following weak cues from futures and dull physical trade activity as demand and sale counters in Chana dal and besan remained slackened.

Favourable weather for Chana crop and nafed activeness in liquidating procured stock at lower prices also pressurised sentiments.

Similarly, Australia origin Chana in ready business at Mumbai and Mundra port fell by Rs 125 each at Rs 4,350/100kg, respectively.

Burma origin chana also declined by Rs 125 at Rs 4,350/100Kg on dull buying activity.

Chana for January delivery on National Commodity and Derivatives Exchange (NCDEX), was settled lower 0.8 percent or Rs 35 at Rs 4,275/100kg. Earlier, in the day, the contract hovered in the range of 4,222 and 4,291 on Friday.

Chana stocks at NCDEX accredited warehouses stood at 13,638 metric tonnes (Akola: 2,220, Bikaner 11,186 and Jaipur 232) as on 3rd January, down from 14,513 metric tonnes from the previous session, the exchange data showed.

Australian chana dal quoted flat at Rs 5,600/100 Kg for Mumbai delivery on dull trade activity. Domestic chana dal of Pistol brand also offered at Rs 5,850 for Mumbai delivery, Angel brand at Rs 6,200 for Mumbai delivery, Samrat brand at Rs 6,100 for Mumbai delivery. Chana besan also ruled steady at Rs 3,200/50Kg, Vatana besan at Rs 3,050/50 Kg and Vatana dal at Rs 5,400.

In Mumbai, Sudan/Burma origin kabuli chana declined by Rs 125-150 each at Rs 4,175-4,200/100Kg and Rs 4,450, respectively amid dull trade activity owing to less interest shown by besan flour millers and traders at existing rates, overseas supply from various origins and following weak trend in Chana.

Kabuli Chana dollar variety at Indore priced higher by Rs 100 at Rs.4,500-5,700/100Kgs as per quality at Indore.

Kabuli chana of 42-44 and 44-46 counts quoted firm by Rs 50 at Rs 5,950/100Kg and Rs 5,750, respectively at Indore market.

Prices may get support at lower rates as the government extended curbs on import of yellow peas till March 2019 and also on progress of rabi crop sowing, which has already lagging behind as compared to last year.

Earlier consumption of white Pea was better compared to chana due to its low prices and ample stock, but scenario has changed as consumption demand shifted to chana due to shortage and higher rates of white Pea compare to Chana and Kabuli chickpea.

Statewise Rabi Chana Sowing Down 10.86 % As On Jan 2 Vs Same Period Last Yr (LAKH HA). Maharashtra:11.89 Vs 18.07, Rajasthan:15.03 Vs 15.06, Karnataka:11.75 Vs 13.95, Madhya Pradesh:34.32 Vs 35.50, Uttar Pradesh:5.72 Vs 5.55, Andhra Pradesh:4.20 Vs 4.99, Telangana:1.02 Vs 0.97, Total:92.89 Vs 104.21.

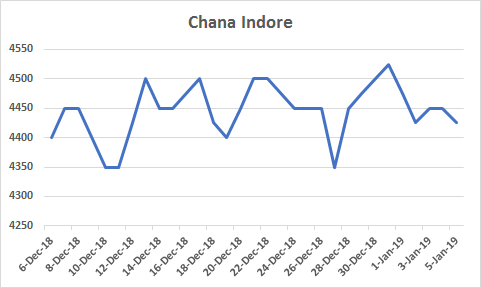

Imported Masoor (Mumbai):

Imported Masoor (Mumbai):

Canada origin masoor in container/vessel both old/new and MMTC old procured masoor along with Australia origin masoor gained by Rs 100-150/100Kg in Mumbai amid fresh buying support from mills at lower rates, unfavourable weather due to higher cold climate for standing crop in Madhya Pradesh and Uttar Pradesh and also following firm trend in Tur.

MMTC was active in selling old masoor stock, procured earlier at Rs 3,600/100Kg, up Rs 100.

Canada crimson variety masoor in vessel old/new (Sea Breeze) gained to Rs 3,800-3,900/100Kg and Rs 4,150, respectively. Similarly, Canada crimson variety masoor in Container old/new ruled firm at Rs 4,100-4,200/100Kg and Rs 4,250, respectively.

Similarly, Australia masoor nugget variety both old/new also quoted higher at Rs 4,100-4,200/100Kg and Rs 4,300, respectively as per quality amid limited stock availability.

Selling of procured Masoor by Nafed in Madhya Pradesh/Uttar Pradesh and overseas supply from Canada are likely to limit the gains for short term. But, further rise in Tur price may support masoor prices due to substitute and also cheaper prices.

Vessel M V Snowy carrying 11136.405 tonnes of Canada Masoor arrived at Kolkata port and likely to discharge soon at the port.

However, demand and sale counters in masoor dal remained limited. Canada Masoor Khopoli spot traded higher by Rs 50 at Rs 4,950/100Kg.

Statewise Rabi Masoor Sowing Down 2.12 % As On Jan 2 Vs Same Period Last Yr (LAKH HA). Madhya Pradesh:5.60 Vs 5.96, Uttar Pradesh:5.77 Vs 5.96, Bihar:2.08 Vs 2.13, West Bengal:1.85 Vs 1.46, Uttrakhand:0.15 Vs 0.15, Jharkhand:0.46 Vs 0.61, Total:16.61 Vs 16.97.

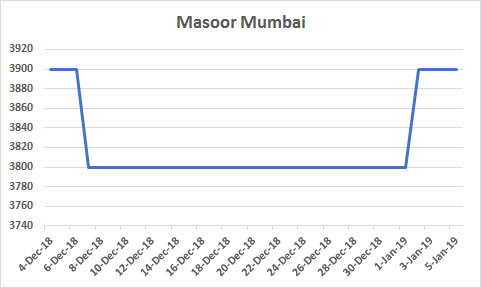

.png) Imported White Pea (Mumbai):

Imported White Pea (Mumbai):

Canada white pea at Mumbai/Mundra port along with Lithunia white pea at Mundra port and Ukraine White Pea at Mumbai/Mundra and Hajira port remained weak with a fall of Rs 50/100kg as per quality due supply from Canada at Kolkata and Chennai port.

Millers and traders are preferring to purchase domestic chana or Sudan/Burma origin kabuli chickpea due to cheaper prices as compared to white pea.

Moreover, demand in matar dal/besan remained slow at prevailing rates.

Canada White Pea old traded at Rs 4,700/100Kg at Mumbai and Rs 4,650 at Mundra port. Lithunia origin quoted at Rs 4,635 in Mundra. Ukraine White Pea ruled at Rs 4,650 at Mumbai, Mundra and Hajira.

Vessel M V Snowy carrying 21549.664 tonnes of Canada White Pea arrived at Kolkata port and likely to discharge soon at the port.

Vessel M V Josco Hangzhou Carrying around 53000 tonnes of Canada White Pea expected to arrive Chennai port on 9th January, 2019.

Statewise Rabi Field Pea Sowing Up 10.14 % As On Jan 2 Vs Same Period Last Yr (LAKH HA). Madhya Pradesh:3.69 Vs 2.91, Uttar Pradesh:4.50 Vs 4.16, Assam:0.36 Vs 0.37, Bihar:0.30 Vs 0.32, Chattisgarh:0.40 Vs 0.45, Total:10.10 Vs 9.17.

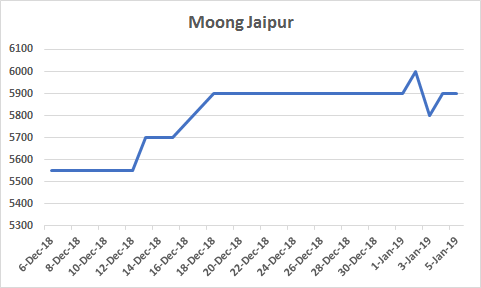

Moong (Jaipur):

Moong (Jaipur):

Moong prices eased at Rs 5,400-5,900/100Kg as per quality at Jaipur market amid thin millers buying support and slow arrivals in Rajasthan.

However, overseas supply from various origin at Chennai/Mumbai port and dull demand and sale counters in processed moong had weighed sentiments. Moong dal prices offered at Rs 6,700-6,900/100Kg, depending on the variety. Still no parity was reported in purchasing good quality as demand in dal were thin.

NAFED has successfully procured 270581.78 MT of Moong at Minimum Support Price of Rs 6,975 as on Jan 03, 2019. Rajasthan: 213614.64, Karnataka: 29136.74, Telangana: 13375.31, Maharashtra: 12828.31, Madhya Pradesh: 990.88, Tamil Nadu: 364.9, Haryana: 224.9, Gujarat: 43.9, Uttar Pradesh: 2.2.

Statewise Rabi Moong Sowing Down 0.54 % As On Jan 2 Vs Same Period Last Yr (LAKH HA). Andhra Pradesh:0.65 Vs 0.76, Tamil Nadu:0.40 Vs 0.44, Odisha:2.36 Vs 2.31, Total:3.65 Vs 3.67.

Canada Green Pea (Mumbai):

Canada origin green pea at Mumbai slipped by Rs 500 at Rs 6,300/100Kg as per quality due to sluggish trade activity at higher rates and supply from overseas at Mumbai (JNPT) and Chennai port.

(By Commoditiescontrol Bureau; +91-22-40015513)