MUMBAI (Commoditiescontrol) – Major pulses such as Tur, Urad, Chana, Kabuli Chickpea, Masoor, Moong and White Pea slipped during the week ended Saturday (November 12-16) due to dull buying support from mills at higher rates. Furthermore, market is also reeling under liquidity crunch followed by slow circulation of payment from buyers to sellers.

Appreciation in rupee from 74.27 to 71.92 against USD may benefit pulses importers.

Week Highlights

# India Rabi Pulse Sowing down by 18 % as on November 16 to 69.95 lakh Ha vs 85.32 last year at the same period. Chana: 50.23 Vs 64, Masoor: 6.81 Vs 8.58, Matar: 4.09 Vs 4.65, Urad: 1.68 Vs 1.56, Moong: 0.47 Vs 0.36, Other Pulses:1.69 Vs 1.81.

# Source says government may extend curbs on import of yellow peas till March 2019. Presently Restriction of 1 Lakh Ton Till Dec End.

#FSSAI Said Imported Pulses & Beans Are Safe For Consumption As Tests Conducted In Last 1 Month Found No Residue Of Glyphosate (Harmful Chemical Used To Kill Grasses).

# Canada Matar 2018-19 Vs 2017-18 (LT). Open Stock:6.5 Vs 3. Output:37.3 Vs 41.1,Export:26 Vs 30.9, Domestic Use:9 Vs 6.25, End Stock:9 Vs 6.5.

# Canada Masoor 2018-19 Vs 2017-18 (LT). Open Stock:8.8 Vs 3.1, Output:22.30 Vs 25.59, Export: 19 Vs 15.4, Domestic Use:4.9 Vs 4.9, End Stock:7.3 Vs 8.8.

# Tur/Chana Farmers In Maharashtra To Get 480 Crore Grant.

# France Matar Export In September Totalled At 13,000 MT, Down 42% From 22,415MT In August, But Up 20% From 10,845 In September 2017. Season To Date Export Down 56% Vs Last Year.

# Govt Approves 11 States To Buy Pulses & Oilseeds At MSP Under PSS For Kharif. Rajasthan, Gujarat, Madhya Pradesh, Maharashtra, Karnataka and Andhra Pradesh Are Among Them & Most Of Them Started Procurement.

# Madhya Pradesh Govt Aims To Buy 5.34 LT Kharif Pulses. Urad: 345,000 MT, Tur: 158,000, Moong: 31,000. Urad, Mung Buying Began Last Month & Will Continue Till Dec End.

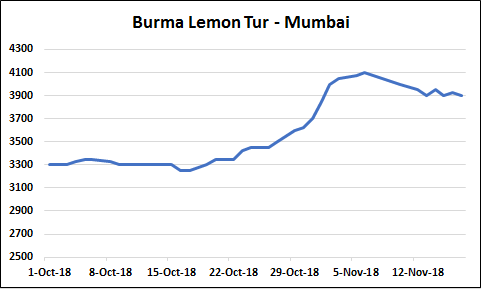

Burma Lemon Tur: Burma Lemon Tur:

Tur Lemon variety of Burma origin declined by Rs 75-100 at Rs 3,900/100Kg in Mumbai due to dull millers buying amid limited sale counters in processed tur.

Similarly, domestic tur in bilty trade at Akola also fell by Rs 50-75 at Rs 4,325-4,350/100Kg on slackened trade activity.

In addition, unexpected supply of around 1 lakh tonnes from overseas till current month end coupled with liquidation of procured stock by the government agency and supply of new crop most likely from December may pressurise sentiments ahead.

Arrivals of new Tur witnessed at Solapur, Dudhani and Naryanpeth markets. The quality of arrived tur was average/small with a moisture content of 15% and claim condition of 15%. Millers and stockists kept themselves on the sidelines and refrained from purchasing new Tur due to its average quality and higher rates as compared to dry and cheaper old Tur amid continious liquidation of old stock by the government agency at lower rates.

Stockists and millers are likely to become active at lower range/levels for good quality.

Latur origin Phatka variety eased at Rs 6,400-6,600/100Kg for Mumbai delivery on weak undertone. Khamgaon origin phatka variety priced weak at Rs 6,200-6,400/100Kg, Jalna origin phatka variety at Rs 6,500-6,800/100Kg. While, Gujarat origin Wasat Phatka variety also priced flat at Rs 6,500-7,000/100Kg (Mumbai Delivery).

However, lower than expected new crop output, compared to last year and consistent decline in stock lying with Nafed may support prices at lower rates in the long-term. Movement in Tur prices will depend mostly on government procurement of new crop.

.png) Burma Urad: Burma Urad:

Burma urad FAQ variety fell by Rs 150 to Rs 4,600/100Kg at the Mumbai on sluggish buying by mills amid ongoing domestic arrivals at major markets.

On the other hand, in Chennai, Urad FAQ new traded lower by Rs 50 at Rs 4,450/100Kg in ready delivery as per condition on weak undertone as sellers were active in the market due to regular supply. While, Urad SQ new remained flat at Rs 5,800/100Kg in ready business as per condition.

Meanwhile, the Madras High Court has extended further the date of hearing till November 26 on a plea challenging the DGFT notification to restrict import.

Further supply at Chennai port and ongoing delivery for deals traded/finalised earlier in forward business are pressurising sentiments.

Demand in processed Urad remained thin from consumption centres. Bikaner origin branded Urad dal ruled flat at Rs 6,500-6,800/100Kg for Mumbai delivery, Tiranga brand of Mumbai at Rs 6,900/100Kg for Mumbai delivery and Parivar brand of Jalgaon at Rs 6,700/100Kg for Mumbai delivery.

Statewise Rabi Urad Sowing Up 7.69 % As On Nov 14 Vs Same Period Last Yr (LAKH HA). Andhra Pradesh: 0.41 Vs 0.29, Tamil Nadu:1.06 Vs 0.94, ODISHA: 0.18 Vs 0.31, Total:1.68 Vs 1.56.

According to market sources, prices are likely to slip or decline a bit due to ongoing arrivals in major states, regular supply at Chennai port and also on upcoming arrivals of domestic crop from Chandausi and southern markets (Andhra Pradesh/ Tamil Nadu) in December. Overall, prices may be attractive at lower rates due to dry weather, reduced sowing in major states and not much carry over stock left with government/ private traders and particularly tight availability of good quality urad.

.png) Chana Kantewala (Indore): Chana Kantewala (Indore):

At Indore market, Chana fell sharply by Rs 450 at Rs 4,350/100Kg following weak cues from futures, upcoming supply from Tanzania, sluggish buying from mills amid lacklustre demand and sale counters in Chana dal and besan.

Moreover, Nafed activeness in liquidating procured stock at existing prices pressurised sentiments.

Similarly, Australia origin Chana in ready business at Mumbai and Mundra port fell by Rs 300-350 at Rs 4,500/100kg and Rs 4,550, respectively.

Burma origin chana also traded lower by Rs 250 at Rs 4,550/100Kg on slack millers' buying at higher rates.

Statewise Rabi Chana Sowing Down 21.5 % As On Nov 14 Vs Same Period Last Yr (LAKH HA). Maharashtra:5.43 Vs 10.37, Rajasthan:7.56 Vs 9.66, Karnataka:6.81 Vs 11.83, Madhya Pradesh:23.36 Vs 23.63, Uttar Pradesh:3.45 Vs 3.38, Andhra Pradesh:1.83 Vs 2.76, Telangana:0.63 Vs 0.48. Total: 50.23 Vs 64.

At National Commodity and Derivatives Exchange (NCDEX), Chana benchmark December contract settled weak 1.6 per cent or Rs 72 at Rs.4,480/100Kgs. Earlier in the day, the contract moved in the range of Rs.4,474 and Rs.4,577 on Friday.

Chana stocks at NCDEX accredited warehouses stood at 23,524 metric tonnes (Akola: 23,474, Bikaner 20, Jaipur 30) as on 15th November, down 23,534 metric tonnes from the previous session, the exchange data showed.

Australian chana dal traded sharply lower at Rs 5,700/100 Kg for Mumbai delivery amid dull trading volume. Similarly, domestic chana dal of Pistol brand offered weak at Rs 5,900 for Mumbai delivery, Samrat brand at Rs 6,300 for Mumbai delivery, Angel brand at Rs 6,300 for Mumbai delivery. Chana besan also remained weak at Rs 3,300/50Kg. While, Vatana besan priced flat at Rs 3,000/50 Kg and Vatana dal at Rs 5,500.

In Mumbai, Sudan origin kabuli declined by Rs 300 at Rs 4,400/100Kg amid dull buying support from besan flour millers. Similarly, Kabuli chana of Burma traded lower by Rs 300 at Rs 4,600/100Kg.

Kabuli Chana dollar variety at Indore priced weak at Rs.5,000-5,500/100Kgs as per quality at Indore.

The long term outlook of chana will very much depend on progress of rabi crop sowing, which has already begun but is lagging behind as compared to last year and also on government decision whether to extend curbs on import of yellow peas till March 2019.

.png) Imported Masoor (Mumbai): Imported Masoor (Mumbai):

Canada origin masoor in Vessel and Container along with Australia Masoor remained weak by Rs 100/100Kg in Mumbai due to dull millers trade, following weak trend in Tur and fresh supply from Canada at Kolkata against deals which were finalised by the importers at lower prices earlier.

Moreover, selling of procured Masoor by the government agency in Madhya Pradesh and Uttar Pradesh and upcoming supply from Canada are likely to pressurise sentiments further.

Canada crimson variety masoor in vessel and container fell by Rs 100-150 each at Rs 3,750-3,850/100Kg and Rs 3,900-4,000, respectively.

MMTC were active in selling procured old Canada masoor stock declined at Rs 3,600/100Kg, down Rs 50 in Mumbai.

Similarly, Australia masoor nugget variety also slipped by Rs 100 at Rs 4,000-4,100/100Kg as per quality against limited stock availability.

Demand in processed Masoor remained slack from consumption centres. Canada Masoor Khopoli spot traded lower at Rs 5,100/100Kg.

Statewise Rabi Masoor Sowing Down 20.63 % As On Nov 14 Vs Same Period Last Yr (LAKH HA). Madhya Pradesh:3.84 Vs 4.46, Uttar Pradesh:2.51 Vs 3.35, Bihar:0.16 Vs 0.51, Total: 6.81 Vs 8.58.

.png) Imported White Pea (Mumbai): Imported White Pea (Mumbai):

Canada origin white pea at Mumbai, Hajira and Mundra ports, Russia White Pea at Mundra port along with Ukraine White Pea at Mundra/Hajira ports declined by Rs 100-150/100Kg as per quality due sluggish trade, regular supply in container at Chennai port and upcoming supply in break bulk vessel at Kolkata port.

Canada White Pea traded at Rs 4,700/100Kg at Mumbai, Rs 4,500-4,625 at Mundra and Rs 4,600 at Hajira port. Russia origin Baltic variety quoted at Rs 4,451 in Mundra. Ukraine White Pea ruled at Rs 4,600 at Mumbai and at Rs 4,551 at Mundra and Hajira.

Demand in matar dal/besan remained limited at prevailing rates.

Statewise Rabi Matar Sowing Down 12 % As On Nov 14 Vs Same Period Last Yr (LAKH HA). Madhya Pradesh:1.69 Vs 2.38, Uttar Pradesh:2.17 Vs 2, Total:4.09 Vs 4.65.

In India, government had earlier extended curbs on matar import till December end and likely to extend further til March 31. But buyers from China were active and purchasing White Pea from Canada due to parity and cheaper prices compared to soymeal.

Earlier, India was main buyer of White Pea in international market, but in future, it will not easy for India to get White Pea from overseas if Indian government allows import of White Pea ahead in the wake of dry weather and increasing pulses prices, while China will be main buyer due to higher consumption.

.png) Moong (Jaipur): Moong (Jaipur):

Moong traded lower by Rs 200-300 at Rs 5,300-5,500/100Kg as per quality at Jaipur market amid slow buying by the mills at higher rates, ongoing arrivals and also on weak trend in all other pulses.

Demand and sale counters in processed moong remained slow at existing rates. Moong dal prices remained flat at Rs 7,000-7,100/100Kg, depending on the variety.

Farmers in Rajasthan are purchasing good quality moong from producing centres and selling it to the government agency at higher MSP.

However, government agency is still not active in purchasing moong in big quantity at MSP in Rajasthan.

Statewise Rabi Moong Sowing Up 30.55 % As On Nov 14 Vs Same Period Last Yr (LAKH HA). Andhra Pradesh:0.08 Vs 0.06, Tamil Nadu:0.24 Vs 0.17, Odisha:0.11 Vs 0.09, Total:0.47 Vs 0.36.

Canada Green Pea (Mumbai):

Canada origin green pea at Mumbai quoted unchanged at Rs 7,000/100Kg (cleaned) as per quality due to limite trade activity and fresh supply from overseas at Chennai port.

(By Commoditiescontrol Bureau; +91-22-40015513)

|