MUMBAI (Commoditiescontrol) – India cotton prices slipped for the third straight week (Oct 1-6) on rising new crop supply and bearish tone in the international market. However the downside is now likely to be restricted after Cotton Association of India (CAI) has pegged domestic production estimates for 2018-19 (Oct-Sept) lower at 348 lakh bales (170kg) versus 365 lakh bales.

The new crop arrivals have been gradually improving, but slow selling by farmers and lower crop estimates are likely to keep supplies limited in the markets. Meanwhile, cotton prices in North India have slipped below the fixed MSP level, thus farmers may wait for start of buying from CCI, rather than selling the produce at lower rates to private players.

Cotton Corporation of India (CCI) is likely to start procurement operation this week in Punjab, Haryana and Rajasthan. The heavy rainfall earlier in September had resulted in higher moisture percentage in the crop, that has restricted CCI from buying as quality norms were not as fixed for the current year. The official said CCI has over 55 centres spread over three states in the north zone.

Procurement is also delayed due to ongoing disputes between ginners and Cotton Corp with respect to quality parameters laid down by the latter, trade officials said. Cotton Corp, in its tender, said ginners must supply minimum 33% lint processed from raw cotton supplied to them, and capped the trash content at 2% across centres but latter diluted it to 2.5%. Ginners in some of the 10 cotton-producing states are yet to reconcile their differences with the Cotton Corp, thereby delaying the procurement. However, the official said that the corporation was about to settle disputes with ginners.

Procurement of cotton is expected to start in other states in case price fall below MSP level.

Arrivals Increasing Steadily

The daily average cotton arrivals during this week increased at 42,000 bales versus 28,000 bales a week ago with 50% from North India, while rest is contributed by Maharashtra, Gujarat, Madhya Pradesh, Karnataka, Andhra Pradesh. Arrivals have yet to make its mark in Telangana.

The supply of cotton is expected to improve, but unlikely to reclaim last year’s peak level as crop is lower and farmers may opt to sell their produce slowly and steadily as there is assurance to them that CCI will buy their crops at fixed MSP level, which has become very attractive after sharp hike by the Centre in July this year.

Exporters and Mills Active

Exporters and mills have turned active to procure cotton. Mills are buying cotton as inventory with them have started to deplete, whereas some good overseas ienquiries prompted exporters to turn active to procure cotton to meet their futures commitments. India's cotton at present is still attractive despite sharp losses in U.S. cotton thanks to depreciating Indian rupee.

Lower India Crop Estimates

Cotton Association of India (CAI) has trimmed cotton production outlook for 2018-19 (Oct-Sept) by 4.66% year-on-year at 348 lakh bales, in its first estimate released on Saturday at seminar held in Aurangabad.

The production of cotton during the 2017-18 was estimated at 365 lakh bales, according to CAI August month release.

Production of cotton is pegged higher by 3.57% in north zone, but down 7.69% and 4% in central and south zone due to poor monsoon and some pest attack in few parts of Maharashtra.

India government too had estimated 2018-19 cotton production down at 324.83 lakh bales versus 348.88 lakh bales a year ago.

Tight Balance Sheet

India cotton balance sheet for the ongoing 2018-19 season is expected to be very tight due to lower crop estimates followed by thin ending stocks. CAI in its September report estimated ending stocks for 2017-18 at 23 lakh bales , while production at 348 lakh bales and import at 15 lakh bales, so the total availability of cotton for 2018-19 is expected to be around 386 lakh bales. If we put 330 lakh bales for domestic consumption aside, the remaining 56 lakh bales will be available for exports.

The availability of 56 lakh bales of cotton seems to be very tight for the season 2018-19 and thus any sharp fall in prices could be restricted. However mills may find stiff competition in the export market due to higher cotton rates.

According to industry experts, many small mills are already suffering due to higher raw material cost and slow domestic and overseas demand.

Conclusion

Cotton price is expected to find support around prevailing levels as any more fall in prices is expected to curb supplies from farmers. Farmers may prefer to sell their crop to CCI rather than to private players due to timely and assured payment. While, mills and exporters may have to buy cotton at relative higher levels compared to last season. However we should also need to keep a close eye on INR movement and U.S. market. Any significant appreciation in INR will make export uncompetitive.

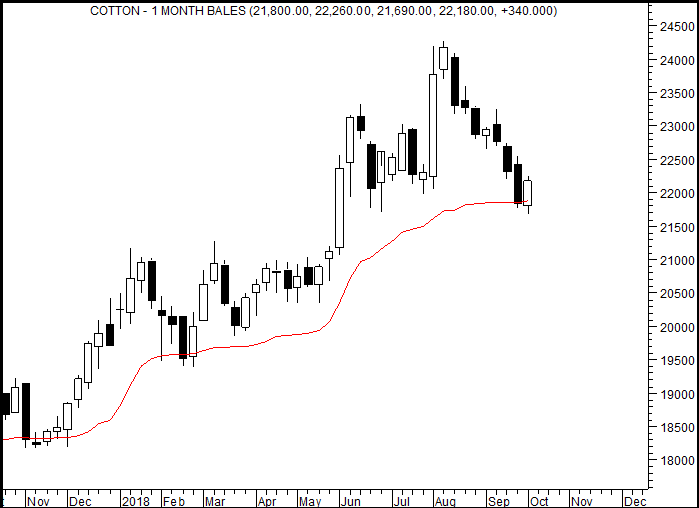

Technical Ideas - MCX Cotton October - Further Weakness Below 21690 Closing

Support has been witnessed on the WRV(Weekly Reversal Value). Support is at 21720-21690.

Further weakness and correction will be seen below 21690.

A rise towards higher range of 22397-22967 can be tested.

A rise and close above 22550 with bullish candle can mark a reversal from correction phase that is in progress since the peak of 24280.

(By Commoditiescontrol Bureau; +91-22-40015533)

|