MUMBAI (Commoditiescontrol) – Major pulses, such as Tur Urad, Masoor, Chana and White Pea declined for the week ended Saturday (August 13-18) due to good rainfall in major states which is beneficial for kharif crop,

Dull millers buying also weighed on sentiments as sales counters in processed pulses remained sluggish and also traders/millers are confused that when and how will government will release procured stock at discounted price.

Government is holding major stock of Chana and Tur and very low quantity stock of other pulses, such as Urad, Moong and Masoor. Government will also procure kharif crop of Urad and Moong at minimum support prices to support farmers in the wake of election in some states.

Week Highlights

# Indian Rupee Crashes To All Time Low Of 70.37 Vs USD Amid Fears That Turkish Economic Crisis Could Lead To A Global Financial Meltdown.

# Sowing data not available this week as government offices remained closed due to sad demise of former PM Atal Bihari Vajpayee.

# Ukraine Pulses Crop Estimates 2018 Vs 2017 (MT). Chana: 55000 Vs 30000, Kidney Beans: 80000 Vs 65000, Green Masoor: 20000 Vs 12000, Red Masoor: 2000 Vs 2000, White Pea: 10.90 Vs 10.90.

# Heavy to very heavy rain at isolated places very likely for couple of days over Nagaland, Manipur, Mizoram & Tripura, Odisha, Konkan & Goa, Chhattisgarh and Coastal & South Interior Karnataka; heavy rain at isolated places over Assam & Meghalaya, Gangetic West Bengal, Madhya Pradesh, Madhya Maharashtra, Vidarbha, Coastal Andhra Pradesh, Telangana, Tamilnadu and Kerala.

.jpg)

.jpg) Burma Lemon Tur:

Burma Lemon Tur:

Tur Lemon variety of Burma origin remained weak by Rs 125 at Rs 3,400/100Kg at Mumbai market due to dull millers' buying activity, recovery in sowing in key producing regions and also rainfall in major states.

In Mumbai, Mozambique origin red and white tur eased by Rs 25 each at Rs 3,075/100Kg and Rs 3,275, respectively amid slack trade.

Domestic tur in bilty trade at Akola traded lower by Rs 100 at Rs 3,950-3,975/100Kg due to supply from overseas at cheaper rates, liquidation of procured pulse and adequate domestic stock left with government.

In Kanpur, Maharashtra origin (Hinghanghat/Nagpur), tur dal Phatka Sortex quality quoted lower by 100-125 at Rs 5,600, new semi-Sortex at Rs 5,500 and new regular variety at Rs 5,350-5,375 respectively.

Latur origin Phatka variety offered down by Rs 100 at Rs 5,700/100Kg for Mumbai delivery on weak undertone. Jalna origin phatka variety quoted lower at Rs 5,900/100Kg for Mumbai delivery. Khamgaon origin phatka variety also declined at Rs 5,700/100Kg for Mumbai delivery. Gujarat origin Wasat Phatka variety for Mumbai delivery ruled weak at Rs 6,200-6,500/100Kg.

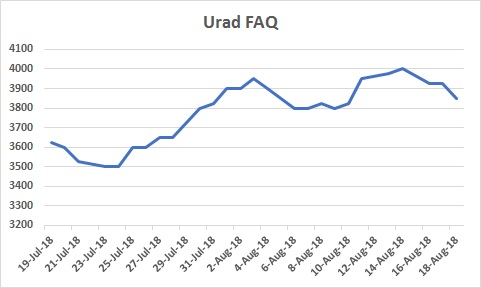

Burma Urad:

Burma Urad:

In Mumbai, Burma urad FAQ variety fell by Rs 125 to Rs 3,850/100Kg due to dull buying from millers, good rainfall in key growing areas, upcoming supply of urad at Chennai/Mumbai ports from Burma in current month.

Moreover, demand in processed Urad was reported slow from consumption centres. Bikaner origin branded Urad dal declined by Rs 100 at Rs 5,050-5,400/100Kg. Tiranga brand of Mumbai at Rs 5,550/100Kg. Parivar brand of Jalgaon at Rs 5,150/100Kg.

On the other hand, Burma urad FAQ and SQ traded mostly flat at Rs 4,000/100kg and Rs 5,100, respectively at Chennai in ready delivery as per condition. Urad FAQ/SQ traded unchanged in forward business at Rs 3,975/100Kg and Rs 5,150-5,175 for whole September delivery.

Traders holding old domestic stock of urad in Madhya Pradesh and Uttar Pradesh are bearing losses due to higher cost. They are also active to liquidate their stock at every rise in prices as new crop is likely to begin from September end-October 1st week.

According to market sources, prices of urad are likely to get support in the long-term amid reduced sowing in major states due to lower rates, concerns over acreage/area/quality and also on limited imports from overseas, compared to last year due to restriction imposed by the government.

Crop arrivals are likely to be delayed in Uttar Pradesh and Madhya Pradesh due to late sowing and erratic rainfall.

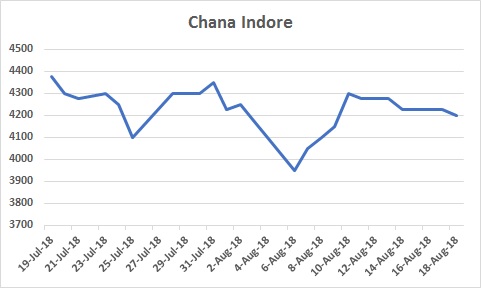

Chana Kantewala (Indore):

Chana Kantewala (Indore):

At Indore market, Chana prices drifted down by Rs 100 at Rs 4,200/100Kg amid dull physical demand as sales counters in processed chana/besan remained slow and also on weak cues from futures.

Similarly, Australia origin Chana in ready business at Mumbai and Mundra ports fell by Rs 25 at Rs 4,200/100kg and Rs 4,300, respectively on thin millers' buying against limited stock of imported chana. Quality of the commodity in Mumbai was reported average. MMTC was active in selling procured chana at Mundra port.

At National Commodity and Derivatives Exchange (NCDEX), Chana September month contract on Friday settled lower by 0.7 per cent or Rs 32 at Rs.4,330/100Kgs.

Technically, for NCDEX Chana September Contract, expect higher range of 4399-4484 to be tested. Support is at 4352-4314. Weakness is below 4119. Accumulate at 4314 or below with a stop loss of 4119.

Chana stocks at NCDEX accredited warehouses stood at 54,441 metric tonnes as on 17th August, up from 54,180 metric tonnes in the previous session, the exchange data showed. Akola:51765, Bikaner 1328, Jaipur 1348.

Australian chana dal priced lower by Rs 100 at Rs 5,000/100 Kg amid dull buying activity. Domestic chana dal of Pistol brand fell by Rs 100 at Rs 5,300, Samrat brand at Rs 5,600 and Angel brand at Rs 5,600. Chana besan also quoted weak by Rs 50 at Rs 3,100/50Kg. Vatana besan remained down marginally at Rs 2,750/50 Kg. Vatana dal steady Rs 4,850.

Kabuli Chana of 42-44 and 44-46 counts traded weak by Rs 100 at Rs 6,500/100Kgs and Rs 6,300, respectively at Indore due to slack local buying, following weak cues in chana prices. Prices are likely to get support in next few weeks ahead of festival season. Ample stock in the country due to higher production this season and dull overseas demand due to price parity may however limit the gains.

Kabuli Chana dollar variety ruled lower by Rs 200 at Rs.5,000-5,800/100Kgs as per quality at Indore.

As per market talks, dal mills have increased the procurement from local and outstation markets expecting a jump in demand ahead of festivals and likelihood of higher prices by about 10-15 per cent in coming months.

.jpg) Imported Masoor (Mumbai):

Imported Masoor (Mumbai):

Canada origin masoor in Container and vessel along with Australia masoor declined by Rs 100-200/100Kg in Mumbai amid sluggish millers' buying support as sale counter in Masoor dal remained weak.

Canada crimson variety masoor in vessel and container quoted weak by Rs 100 each at Rs 3,600-3,700/100Kg and Rs 3,700-3,800, respectively. Stock of Canada masoor old in vessel was low and offered as per quality. MMTC were active in selling procured old masoor stock at Rs 3,525/100Kg, down Rs 75 in Mumbai.

Similarly, Australia Masoor nugget variety also fell by Rs 200 at Rs 3,800-3,900/100Kg as per quality against limited stock.

As per market sources, trade of Canada Masoor reported around 10000-15000 tonnes for August shipment at $380-$390 CNF basis. There was parity to import from Canada at current level of Rs 3,531/100Kg.

Meanwhile, Nafed has also commenced sale of Masoor in Madhya Pradesh from August 9, procured under PSS during rabi 2018, which is likely to keep prices under pressure.

However, demand in processed Masoor was reported limited from consumption centres. Canada Masoor Khopoli spot priced down by Rs 100 at Rs 4,650/100Kg.

.jpg) Imported White Pea (Mumbai):

Imported White Pea (Mumbai):

Canada origin white pea at Mumbai, Hajira and Mundra ports, Russia White Pea at Mundra port along with Ukraine White Pea at Mundra/Hajira port remained weak for the second straight week by Rs 50/100kg amid dull millers' buying as per quality.

Canada White Pea traded weak at Rs 4,300/100Kg at Mumbai, Rs 4,151 at Mundra and Rs 4,221 at Hajira port. Russia origin Baltic variety moved down at Rs 4,100 in Mundra. Ukraine White Pea quoted at Rs 4,150-4,200 at Mumbai and Rs 4,175 at Mundra and Hajira.

Meanwhile, millers and traders preferred to purchase chana due to shortage of White Pea stock.

Demand in Matar dal/besan remained sluggish at prevailing rates.

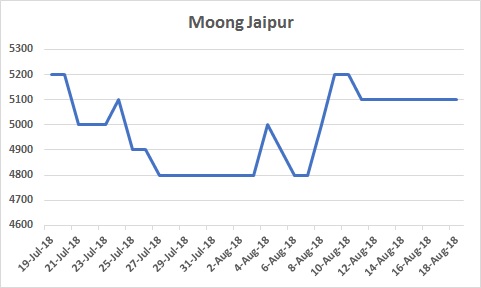

Moong (Jaipur):

Moong (Jaipur):

Moong prices traded flat at Rs 4,800-5,100/100Kg as per quality in Jaipur market on limited millers' buying support despite increased sowing figure due to higher MSP.

Similarly, Moong dal prices traded unchanged at Rs 6,300-6,350/100Kg as per quality.

On the other hand, new moong traded lower in Karnataka, Andhra Pradesh and Maharashtra.

Prices of the new moong crop are trading much lower than the minimum support price of Rs 6,975/100Kg announced by the Centre. Farmers in Karnataka are demanding from the government to spell out the procurement strategy for the season and begin purchasing from the markets.

Prices of new moong are likely to get support as government may start procurement in near future at minimum support price to support farmers due to election year ahead despite improving sowing figure due to higher MSP of Rs 6,975/100Kg, compared to last year of Rs 5,575/100Kg.

As per market talk, the latest spell of rains over this week are likely to make harvest difficult. Trade sources said if the current spell of rains continue for more than a week then it may hurt the standing crop.

(By Commoditiescontrol Bureau; +91-22-40015513)