MUMBAI (Commoditiescontrol) – Selected Pulses, such as Chana, Masoor, White Pea along with domestic tur moved up for the week ended Saturday (July 9-14) amid improved millers demand as sale counters in processed pulses were reported better. On the other hand, Moong and Urad prices remained weak amid slack trade at higher rates against adequate stock.

Week Highlights

# Kharif Sowing In Lakh Ha (July 13). Moong: 17 Vs 18, Urad: 16 Vs 14, Tur: 22 Vs 23, Others: 4.6 Vs 11.9, Total Pulses: 61 Vs 67.

# Export Incentive For Chana Extended By three months till June 20, 2018.

# Pulses Import At Chennai Port In Jun 18 Vs Vs Jun 17 (MT). Chana: 480 Vs 7488, Matar: 192 Vs 4056, Tur: 1296 Vs 5016, Urad: 3888 Vs 38016.

.jpg)

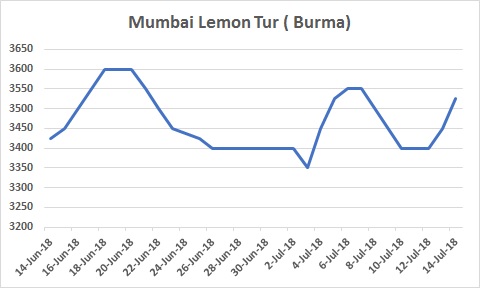

Burma Lemon Tur:

Burma Lemon Tur:

Tur Lemon variety of Burma origin remained almost flat at Rs 3,525 amid limited trade activity and expectation of fresh supply from overseas. However, millers who had got licence from the government to import will be crushing tur for their requirement and hence, imported tur is unlikely to arrive in the market.

On the other hand, domestic new tur in bilty trade at Akola traded higher by Rs 125-150 at Rs 4,050-4,100/100Kg due to better millers' buying activity at lower rates, slow domestic arrivals and expectation that enquiries in Tur dal are likely to be strong at lower rates due to costly vegetables.

But, upcoming supply from overseas at cheaper rates in the near future, liquidation of procured (old crop) pulse and adequate domestic stock left with government may limit the gains. Sentiments in tur would be pressurised as sowing of Tur is likely to pick up momentum in key producing belts due to good rain and hike in MSP.

In Kanpur, Maharashtra origin (Hinghanghat/Nagpur), tur dal Phatka Sortex quality priced flat at Rs 5,500, new semi-Sortex at Rs 5,400, new regular variety at Rs 5,300 respectively.

Latur origin Phatka variety priced firm at Rs 5,750/100Kg for Mumbai delivery. Jalna origin phatka variety at Rs 5,950/100Kg for Mumbai delivery. Khamgaon origin phatka variety at Rs 5,650/100Kg for Mumbai delivery. Gujarat origin Wasat Phatka variety spot offered at Rs 6,050-6,350/100Kg, but no trade was reported due to dispute.

.jpg) Burma Urad:

Burma Urad:

In Mumbai, Burma urad FAQ variety declined by Rs 25 at Rs 3,425/100Kg due to dull buying at existing rates, fresh supply from Burma in Chennai port at cheaper prices, liquidation of procured stock by government agencies and adequate stock position.

Bikaner origin branded Urad dal remained flat at Rs 4,600-4,900/100Kg. Tiranga brand of Mumbai at Rs 5,250/100Kg.Parivar brand of Jalgaon at Rs 4,850/100Kg. Demand in processed Urad was reported slow at higher rates from consumption centres.

At Chennai, Urad SQ/FAQ new variety godown stock declined by Rs 150 each at Rs 4,850/100Kg and Rs 3,850, respectively in ready delivery as per condition.

Urad FAQ/SQ variety quoted lower by Rs 75-100 at Rs 3,575/100Kg and Rs 4,575, respectively for whole July delivery.

Also, Urad FAQ/SQ quoted weak by Rs 75-100 at Rs 3,450/100Kg and Rs 4,500, respectively for whole August delivery.

According to market sources, prices of urad are likely to get support at lower rates in the long-term amid concerns over acreage/area under the crop as sowing may shift to Moong due to higher MSP.

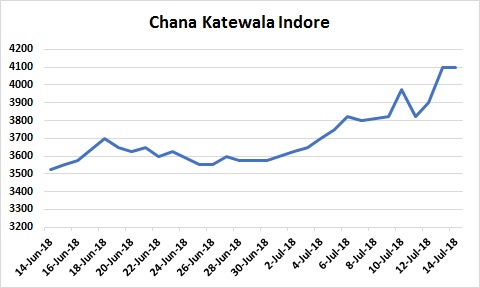

Chana Kantewala (Indore):

Chana Kantewala (Indore):

At Indore market, Chana prices moved up for the second straight week by Rs 300 at Rs 4,100/100Kg following firm cues from futures, better millers' buying, positive trend in White Pea as no sellers were active and low domestic arrivals.

Sales counters in processed chana and besan were improved at existing prices.

Similarly, Australia origin Chana in ready business at Mumbai and Mundra ports gained by 500 each to Rs 4,050 and Rs 4,150, respectively. Stock of imported chana were declining day by day in the wake of no overseas supply due to increased parity owing to higher import duty. Quality of commodity in Mumbai was reported average. MMTC were active in selling procured chana at Mundra port.

At National Commodity and Derivatives Exchange (NCDEX), Chana August month contract settled higher 3.4 per cent or Rs 132 at Rs.4,028/100Kgs. Earlier in the day, the contract moved in the range of Rs.3,888 and Rs.4,030.

Chana stocks at NCDEX accredited warehouses stood at 50,102 metric tonnes as on 13th July, up from 48,167 metric tonnes in the previous session, the exchange data showed. Akola:47497, Bikaner 1398, Jaipur 1207.

Technically, for NCDEX Chana August Contract, hold long position with a stop loss of 3773. Resistance will be at 3936-4024. Lower range is at 3888-3848. Traders can take profits from 3936-4024.

Australian chana dal traded higher by Rs 350 at Rs 4,800/100 Kg amid good trade volume. Domestic chana dal of Pistol brand also moved up by Rs 450 at Rs 5,100, Samrat brand at Rs 5,400 and Angel brand at Rs 5,400. Chana besan also ruled firm at Rs 2,930/50Kg. Vatana besan gained at Rs 2,460/50 Kg. Vatana dal up at Rs 4,300.

Kabuli Chana of 42-44 and 44-46 counts traded higher by Rs 250 at Rs 6,500/100Kgs and Rs 6,300, respectively at Indore due to local buying, slow arrivals following good rise in chana prices on futures and in the spot markets. Ample stock in the country due to higher production this season and dull overseas demand due to price parity will limit the gains.

Kabuli Chana dollar variety priced firm at Rs.5,800-6,100/100Kgs as per quality at Indore on fresh trade.

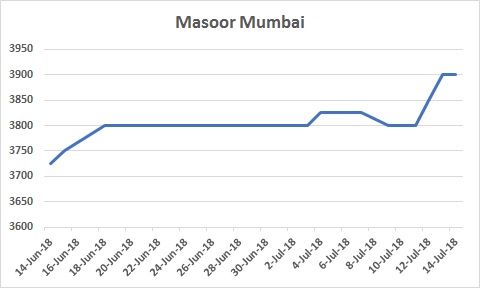

Imported Masoor (Mumbai):

Imported Masoor (Mumbai):

Canada origin masoor in Container and vessel along with Australia Masoor remained firm by Rs 100/100Kg amid improved millers buying, no supply pressure from overseas, slow arrivals of domestic crop and firm trend in other pulses.

Also, sellers were not interested to liquidate the pulse at existing prices amid depleting stock of imported masoor.

Canada crimson variety masoor in container and vessel quoted moved up by Rs 100 each at Rs 3,900-4,000/100Kg and Rs 3,800-3,900, respectively. Stock of Canada masoor old in vessel was low and offered as per quality. MMTC were active in selling procured old masoor stock at Rs 3,500/100Kg in Mumbai.

Similarly, Australia Masoor nugget variety moved higher by Rs 100 at Rs 4,100-4,200/100Kg as per quality against limited stock.

However, demand in processed Masoor was reported limited from consumption centers. Canada Masoor Khopoli spot priced higher at Rs 4,850/100Kg.

.jpg) Imported White Pea (Mumbai):

Imported White Pea (Mumbai):

Canada origin white pea at Mumbai, Hajira and Mundra ports, Russia White Pea at Mumbai/Mundra port along with Ukraine White Pea at Dahej port moved up by Rs 100-150/100kg due to better local buying as Indian government extended quantitative restrictions on peas import for next 3 months till 30 September.

Canada White Pea traded higher at Rs 4,000/100Kg at Mumbai, Rs 3,800 at Mundra and Rs 3,850 at Hajira port. Russia origin Baltic variety gained at Rs 3,700 at Rs 3,750 in Mundra. Ukraine White Pea priced at Rs 3,850-3,900 at Mumbai.

Also, sellers were not interested to liquidate the good quality pulse amid depleting stock of imported white pea, increase in consumption as compared to chana and slow supply pressure from overseas.

Meanwhile, demand in Matar dal/besan was good at prevailing rates.

.jpg) Moong (Jaipur):

Moong (Jaipur):

Moong prices remained weak by Rs 100-200 at Rs 5,000-5,100/100Kg as per quality in Jaipur market during the week on slack buying at higher rates.

Similarly, Moong dal prices also ruled weak by Rs 100 at Rs 6,300/100Kg as per quality.

Meanwhile, government agencies are also active to sale their procured stock in Rajasthan, Madhya Pradesh, Andhra Pradesh, Karnataka and Maharashtra.

(By Commoditiescontrol Bureau; +91-22-40015513)