MUMBAI (Commoditiescontrol) – The bulls have got the momentum and posted another win this week with the most-active December contract surged over 4%, or 339 cents to settle at 87.84 cents per pound influenced by bullish revision in cotton supply-demand balance sheet numbers by USDA and positive U.S weekly export sales data.

MUMBAI (Commoditiescontrol) – The bulls have got the momentum and posted another win this week with the most-active December contract surged over 4%, or 339 cents to settle at 87.84 cents per pound influenced by bullish revision in cotton supply-demand balance sheet numbers by USDA and positive U.S weekly export sales data.

The sharp revision in 2018-19 ending stock followed by increased production figures has provided bulls the much-needed catalyst to push prices and they have enchased as ICE cotton after USDA data settled up by 4.73% to 88.54 cents per pound, highest single day percentage gain since July 11, 2016.

USDA in its July supply-demand has raised China domestic consumption for 2018-19 by 2.4% to 92.53 lakh tonnes, or 544.29 lakh bales (170kg each) from its previous estimates. The dry weather and abandonment forced USDA to cut U.S. production estimates by 5.13% to 40.28 lakh tonnes (236.94 lakh bales).

However the total cotton world production for 2018-19 after the revision revised lower by just 0.24% to 261.51 lakh tonnes (1538.29 lakh bales). Lower production estimates in U.S is offset by better crop in India and Brazil. USDA has revised India and Brazil production estimates higher by 0.17% and 5.51% to 62.49 lakh tonnes (367.59 lakh bales) and 20.68 lakh tonnes (121.65 lakh bales).

World cotton export was also raised from June estimates by 0.40% to 89.79 lakh tonnes (528.18 lakh bales) as lower U.S. export was offset by estimates of increase in shipment from Brazil, India and other countries.

Lower side revision in world production and higher consumption forecast prompted the agency to cut global ending stock at 169.48 lakh tonnes (996.94 lakh bales), down 6.24% from 180.76 lakh tonnes (1063.29 lakh bales) forecast in June month and down by 8.37% from 184.97 lakh tonnes (1088.06 lakh bales) in 2017-18.

India 2018-19 Cotton End Stock Overstated!

United States Agriculture Department (USDA) has estimated India's 2017-18 ending stock at 161.76 lakh bales, which seems to be overstated and needs to be revised at least by around 60-80 lakh bales, resulting in lower world end stock. (Full Report)

US export sales got a boost from a lower market last week, as net new sales for the week ended July 5 for the current marketing year 2017-18 stood at 123,494 running bales. Shipments of 274,648 running bales were slower by 35% from last week, which was probably due to the 4th of July holiday.

For the current marketing year U.S. now have commitments of 17.4 million bales (480lb), of which 14.7 million bales have so far been exported.

Sales for next marketing year have risen to 6.2 million bales, while there are an additional 1.15 million statistical bales on the books for the 2019-20-season. This means that export commitments spanning from now into the 2019-20-season are totalling over ten million statistical bales.

On Call Sales

The total unfixed on call sales during the week ended July 6 showed addition of 254,000 bales to 14.28 million bales. Unfixed on call sales in December saw reduction of 157,400 contracts to 5.22 million bales, whereas positions increased in forward contracts.

The latest CFTC (July 10) revealed that trade are net short by around 16 million bales, whereas managed money are net long by 11.27 million bales. Trade have however reduced their positions week-on-week, but still the numbers are significantly on the higher side with most of them still resilient to give up and may be hoping that intensifying trade war between U.S. and China will provide the much need gate to exit. Other week-on-week managed fund have increased net long positions and they have the reason to do so as latest USDA have provided much needed catalyst to them.

ZCE January cotton settled this week 3.94% higher to 16,870 yuan per tonne. It traded in the range of 16,250-17,040 yuan per tonne.

By Jul 13, 1.55 million tons of reserved cotton have been totally sold, with trading proportion at 60%. On June 4, Chinese government announced to not allow traders to take part in the auction, leading to lower trading proportion.

Conclusion

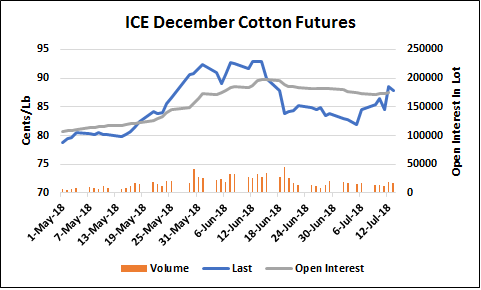

Open interest in December contract was a bit on the higher side week-on-week, but the same was not in case of volume as it fell compared to last week. The dull side volume is some cause of concern as low participation indicating uncertainties. Support is placed at 82 cents, whereas the 94.82 cents made on June 9 will be act as resistance and until these levels didn’t breached it will be difficult to predict market. Volatility in the coming days can't be ruled out as all expected positive factors have been dicounted now. The cloud on fundamentals has been cleared to some extent after recent USDA’s report, but the impact of U.S.-China trade war still needs to be assessed.

TECHNICAL IDEA - ICE COTTON DECEMBER

Last week, we had indicated for a contrarian long strategy as near term upside was likely.

A rise of 4% was seen last week with bullish candle.

Stochastic on weekly chart exit the oversold zone and the same is being shown in the chart therefore traders can accumulate at 87.09-84.89 with a stop loss of 84.

Expect higher range of 90.05-95.21. Higher range can be used to take profits.

.png)

(By Commoditiescontrol Bureau; +91-22-40015533)