MUMBAI (Commoditiescontrol) – The government has sharply raised minimum support price (MSP) of cotton to fulfill its 2018-19 budget promise of providing farmers 1.5 times of their cost of producing a crop.

However the government decision to hike MSP has brought cheers to the farmers, but at the same time has raised some serious concerns as higher floor prices may make Indian cotton and its derivatives uncompetitive in the global market.

The government on Wednesday, June 4 has increased medium and long staple MSP by 28.11% and 26.16% to Rs 5,150/100kg and Rs 5,450, respectively.

Against the backdrop of MSP hike, we (commoditiescontrol.com) have come out with an exclusive report in which we have tried to assess the all possible scenarios.

CCI May Gear Up For Huge Procurement

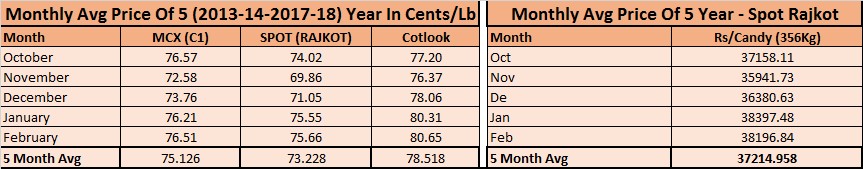

In order to get an idea about price behavior of cotton during the first five months of the season (during which around 50% of produce arrives at marketplaces) we have considered 5-year average price (month-on-month) for October to February period.

The five years monthly average price suggest that average cotton price during the first five months (Oct-Feb) stands at Rs 37,215/candy, while at new MSP, it will be around Rs 44,000 per candy.

In case the domestic price falls below the MSP level in the next season owing to the weakening of demand in the wake of lowering competitiveness of India’s produce in the global market, then Cotton Corporation of India (CCI) may have to gear up to procure the commodity on a massive scale.

According to 5 years average price of Cotlook A Index, regarded as the reliable barometer of world cotton values, cotton price ranges between 77-80.65 cents per pound between October-February, while Indian cotton in the next season at MSP of Rs 5,450/100kg is likely to be available at around 81 cents per pound (at current INR).

At this price, India’s exports of both textiles and readymade garments will be hit badly, though the fact that the rupee is depreciating will cushion the fall a bit. India exported USD 19.3 billion worth of cotton, cotton-based textiles and readymade garments in FY18.

Moreover, in October and November cotton average price during the last five years was at Rs 37,158/candy and Rs 35,942, respectively and thus farmers will not sell and wait for CCI procurement at MSP so that they can get the price fixed by the government.

Earlier, CCI had made its highest 89.35 lakh bales cotton procurement at MSP in season 2008-09.

Ginners May Find Tough To Get Kapas

In case prices fall below the fixed MSP, then CCI will have to get active to procure cotton and under this circumstance, the ginners may find it difficult to get and they will have to buy kapas at or above fixed MSP.

Will Higher MSP Hurt Export Next Season?

It is very tough to predict how cotton export will perform in the next season (2018-19) as international factors will also play vital role along with domestic fundamentals. There is already a lot of uncertainty amid an ongoing rift between U.S. and China related to trade war.

Meanwhile, China has put 25% tariff on U.S. products in retaliation of U.S. move. U.S. cotton is expected to turn uncompetitive to China after 25% tariff and this may prompt Chinese to cover /buy cotton from India.

Indian cotton usually remains at discount with U.S. cotton. India’s cotton average discount during the first five months (Oct-Feb) of last 5 years was at 5 cents per pound.

However in the next season there is higher possibility that Indian cotton will turn at premium as against it performed in previous years.

Even under that circumstance, China may prefer to buy Indian cotton as U.S. cotton with 25% tariff may cost between 96-100 cents per pound or beyond. However, traditional buyers of Indian cotton like Pakistan, Bangladesh, Vietnam and others may shift to U.S. as American cotton is expected to be available at competitive prices than India.

Cotton Acreage May Rise Even Better Than Expected

Before the announcement of hike in MSP, experts were pegging cotton acreage to be 5-10% higher than last year, but sharp hike in MSP has now prompted farmers to change their minds and cultivate more cotton.

Meanwhile, cotton planting has already been completed in Punjab and Haryana, while progressing in other states. Maharashtra, Gujarat and Telangana account 65% of total domestic production (CAB 2017-18 production estimates).

Cotton sowing in the country as on July 5 stood at 54.59 lakh hectares, down nearly 24% from 71.82 lakh hectares a year ago, according to agriculture ministry.

The slow progress in planting was attributed to the weakening of the monsoon in key cotton producing belts.

Domestic Textile Mills’ Margin Likely To Be Under Stress

The steep increase in MSP for cotton could impact profit margins of spinning mills. Exporters of cotton yarn and textile from India have expressed concern over losing low cost advantage in raw cotton as cotton prices had remained subdued in the last few months compared to global market.

Price volatility in cotton prices has already eroded the working capital and profit margins of the industry and restricted the growth rate between 6 and 8 per cent as against the potential growth rate of 12 to 16 per cent as predicted by many studies, Southern India Mills Association (SIMA) has said earlier.

A report by Icra Ltd also said that the MSP revision may elevate working capital requirements for mills. This, in turn, would warrant a calibration of the end product pricing, to accommodate the upward shift in cost trajectory. Larger mills that stocked up low price cotton may not feel the impact in the near term, but smaller ones would bear the brunt of high raw material cost.

In such a scenario, the key to spinning mills’ profits is high demand for yarn and the ability to pass on cost pressures.

Higher cotton price in the country may also prompt domestic mills to look for cheaper alternative in the form of imports; however a lot will depends on price parity with international market during the new season.

Conclusion

As far as global prices are concerned, there are several factors on scene which have kept the market well balanced both in favour of bulls and bears. On ICE Futures US, so far we have seen the stubbornly high open interest, as spec longs have shown resilience despite weakening of spot futures over the last four weeks. However if trade war leads to a slowdown in global trade and spills over to financial markets, this large spec net long position could quickly turn into a liability.

Any speculation about price outlook at this juncture seems inappropriate as external factor, like US-China trade war, has just started to take its real shape. It will be very interesting to see its impact on global cotton fundamentals (demand-supply) in the coming months. But current uncertainty will be really disastrous for both bulls/bears when the market will move against their positions. We need to be more careful at this juncture as there may be further turmoil to come until markets get some clarity on the scope of the potential economic fallout from a US-China trade war.

(By Commoditiescontrol Bureau)