MUMBAI (Commoditiescontrol)– ICE cotton futures dropped nearly 3% this week ended Friday (June 11-15) and most of the losses recorded during Friday’s trade after US-China trade tension escalated with China laid out plans for tariffs on American exports after US President Donald Trump gave the go-ahead for 25% tariff on $50 billion of goods imported from China.

China ended months of speculation that it would start levying duties against American exports, in retaliation for US duties on USD 50 billion worth of its goods. The US is "provoking the trade war," China's Foreign Ministry spokesman Lu Kang said Friday. Starting next month, China will levy duties on USD 34 billion of US products.

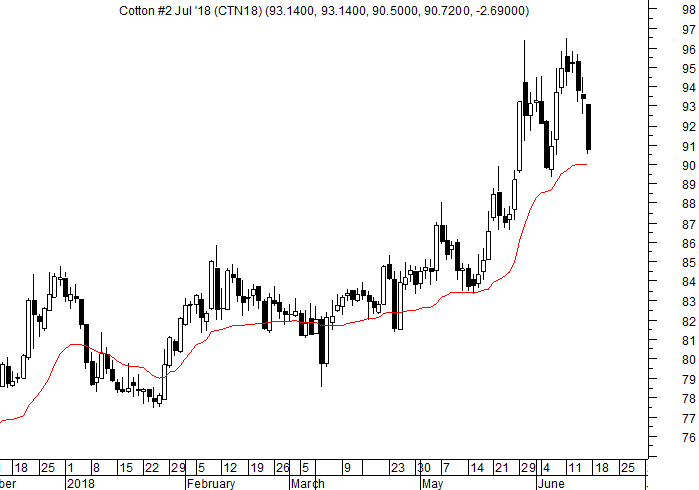

The most-active December cotton futures on ICE exchange fell this week by 2.96% to settle at 89.85 cents per pound after trading in the range of 89.52 to 93.69 cents per pound.

Open interest, as of June 14, showed 198,436 lots outstanding, rising 7.4% from prior week at 184,753 lots.

China on Friday slapped 25% tariff on U.S cotton (HS Code: 52010000) and 544 other items effective from Jul 6. China is the biggest consumer of U.S cotton and intensifying trade war is going to hurt fibre imports from there and thus futures reacted sharply.

In other major news, National Development and Reform Commission (NDRC-China) has informed that it has issued cotton import sliding tariff quotas for 2018. The number of cotton import quotas this time is 800,000 tons, all of which are non-state trade quotas.

.png)

USDA MONTHLY SUPPLY-DEMAND

In its latest report, the US Department of Agriculture (USDA) has scaled down its forecast for global cotton production in 2018-19 to 120.40 million bales (1 US bale = 218kg), compared to 121.19 million bales projected in May.

The 2018/19 world projections include lower production for China, Pakistan, and Australia offset in part for higher production for Brazil.

The report said that the world production is nearly 800,000 bales lower this month, while 2018/19 consumption is reduced only by 85,000 bales, as a 225,000-bale reduction for South Korea is largely offset by increases for Uzbekistan and Vietnam. The agency has scaled down its forecast for cotton consumption to 125.35 million bales as against 125.44 million bales. (Full Report)

ON CALL SALES

The on-call sales position(Where mills purchase bales on-call but do not fix prices and in turn sellers/merchants, hedge themselves creating a short position on the futures market), as of June 8, reached 16.01 million bales(480lb) tad down from prior week at 17.06 million bales.

As of June 08, unfixed call in July contract reduced 2.58 million bales versus 3.46 million bales a week ago, while increased in December contact at 5.10 million bales as compared with 4.57 million bales last week.

The latest CFTC revealed that trade net short positions remained significantly around season high level at 20 million bales, while money managed players net position was 9.2 million bales, down 0.87% from 9.34 million bales a week ago.

Trade are still optimistic and still holding a large amount of shorts with anticipation that negative news flows will provide them opportunity to cover shorts and has come with news about intensifying trade war between U.S and China as both countries has put tariff on list of items.

.png) U.S. cotton export sales during the week ended June 7, rose 112% week-on-week to 42,487 Running Bales (RBs), while shipment dropped 20% to 469,246 RBs, but eclipsed the weekly pace required in order to match the USDA’s revised (June) 16 million bales (480lb) export target.

U.S. cotton export sales during the week ended June 7, rose 112% week-on-week to 42,487 Running Bales (RBs), while shipment dropped 20% to 469,246 RBs, but eclipsed the weekly pace required in order to match the USDA’s revised (June) 16 million bales (480lb) export target.

Cancellations were at 50,100 RBs versus 49,100 a week ago.

The US is 108% committed and 83% shipped Vs the USDA’s export target. Shipments will need to average less than 3.89 RBs per week in order to achieve the target, projected by USDA.

Total sales against 2018-19 were off significantly at around 131,116 RBs; sales against 2018-19 currently stand at a running total of almost 5.05 million RBs.

Conclusion

The rise in open interest in December is an indication that shorts have took their fight in December. The trade net shorts have consistently hold their positions and not seen in panic even after sharp rise, but the trade war between U.S.-China has certainly put smile on their face as it is expected to provide them an opportunity.

The December cotton futures on June 8 touched 6-year high of 94.82 cents per pound and it is now likely to act as hurdle for players having long positions. However, one should also keep a close eye on West Texas, where crop is under stress due to dry weather.

TECHNICAL IDEAS - ICE COTTON WEEKLY - HIGHER RANGE IS TO BOOK PROFITS

Hold long position with a stop loss of 89.

Bearish candle has been formed which suggest that upside is locked.

Resistance is at 92.57-97.

Further rise can continue above 97 closing and till then use rise to exit long.

Lower range can be 88.65-82.65.

Near term correction to sideways volatility can be seen.

Correction towards the DRV is likely with volatility in near term to short term unless immediate rise and close above 97 is witnessed.

(By Commoditiescontrol Bureau; +91-22-40015533)