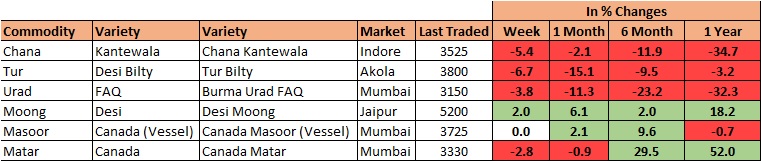

MUMBAI (Commoditiescontrol) – Major pulses, such as Tur, Urad, Chana and White Pea widened losses for the week ended Saturday (June 04-09) amid sluggish millers' trade activity as sale counters in processed pulses were lacklustre. While, other raw pulses, such as Masoor and Moong remained unchanged on slow business volume.

Week Highlights

# India Kharif Pulses Sowing As On Aug 08 In Hect.Vs Last Year. Tur : 39000 Vs 160001, Urad : 35000 Vs 58000, Moong : 47000 Vs 36000, Other Pules: 50000 Vs 81000.

# Maharashtra Government Announces Rs 1,000/100Kg Subsidy For Farmers Of Chana, Tur Who Had Registered To Sell Their Crop But Failed.

# Centre Extends Chana Procurement In Maharashtra till June13.

#Madhya Pradesh government procurement of chana from June 13 to June 30 as there are still huge stock lying with farmers, waiting to sell it to government.

# Southwest Monsoon has further advanced into most parts of Central Arabian Sea, most parts of Konkan, some more parts of Madhya Maharashtra, Marathwada, Vidarbha, Chhattisgarh, Odisha and Northwest Bay of Bengal.

Burma Lemon Tur:

Burma Lemon Tur:

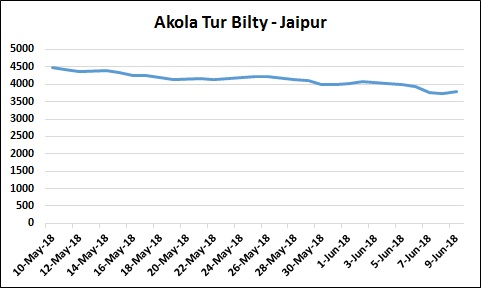

Tur Lemon variety of Burma origin continued to trade lower by Rs 250 at Rs 3,375/100kg after Maharashtra government announced subsidy of Rs 1000/100kg for farmers in the state who had registered to sell their tur but failed. Due to this announcement farmers would speed up their sales in the market. Moreover, sale counters in tur dal were reported dull due to ongoing Ramzan and mango season.

In Mumbai, Mozambique origin white tur was weak by Rs 100 at Rs 3,050/100Kg and red Tur by Rs 100 at Rs 2,800/100Kg.

Similarly, domestic new tur in bilty trade at Akola traded lower by Rs 250 at Rs 3,775-3,800/100Kg.

Sellers were active in both raw/processed tur at domestic markets. Sentiments in tur were pressurised due to selling of tur dal and procured tur stock by government, approval for import of tur from overseas at cheaper prices and early arrival of monsoon in the country. Stockists were out of the market due to tight liquidity and inconsistency in government policies. But, farmers are likely to reduce sowing area by 15-20% under pulses due to lower rates and may choose soyabean, cotton and sugarcane over rain-fed pulses like Tur, Urad and moong.

Prices of tur are likely to get support at lower rates as import from Burma is not possible as cost is not competitive compared to domestic crop. Importers had received license from government, but they preferred to sell their license to other importers at $40 per tonne as they are not interested to import pulses from Burma. Only, import from Africa is currently possible due to lower rates, but millers do not prefer crushing Africa origin tur due to its average quality.

Arusha tur offered at $400 per ton, Shegai tur at $435, Sudan tur at $440-450 and Mozambique tur (Quality Damage) at $310-315 on CNF basis Nhava- Sheva for ready shipment.

But, sentiments are likely to be changed with the onset of monsoon. Prices may get support from 3rd week of June with the end of Ramzan and decline in consumption of Mango due to rain. Tur dal prices will also get support at lower prices due to costly vegetables.

In Kanpur, Maharashtra origin (Hinghanghat/Nagpur), tur dal new Phatka Sortex quality declined by Rs 175 at Rs 5,500, new semi-Sortex at Rs 5,400, new regular variety at Rs 5,300 respectively on negligible trade activities from wholesalers and retailers even at lower rates.

Latur origin new Phatka variety priced lower at Rs 5,300-5,600/100kg in sluggish trade. Jalna origin new phatka variety also remained weak at Rs 5,600-5,800/100Kg. Gujarat origin Wasat Phatka variety also offered down at Rs 5,850-6,000/100Kg.

Burma Urad:

Burma Urad:

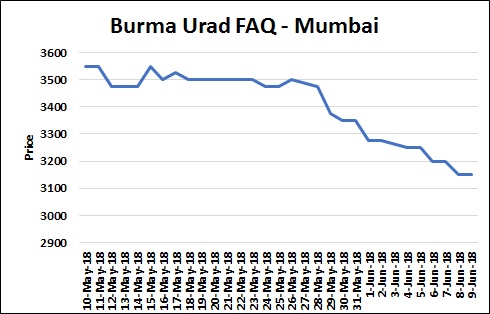

In Mumbai, Burma urad FAQ variety extended losses by Rs 125 at Rs 3,150/100Kg due to early arrival of monsoon in the country, approval by government for import of Urad from overseas and liquidation of procured stock by government agencies and adequate stock position in the country.

Moreover, demand for processed urad from consumption centres remained lacklustre at prevailing rates.

Technical Mumbai Urad FAQ variety : Expect slide towards 3025-2800.Resistance will be at 3775 and 4000. Expect the last bottom range of 3025-2800 to be tested.

Bikaner origin branded Urad dal offered weak at Rs 4,300-4,600/100Kg. Tiranga brand of Mumbai at Rs 5,200/100Kg.Parivar brand of Jalgaon at Rs 4,800/100Kg.

Similarly, at Chennai, Urad SQ/FAQ variety also remained weak in ready delivery at Rs 4,250-4,300/100Kg and Rs 3,325-3,350, respectively due to negligible trade despite sellers were active in the market.

Sellers were active and liquidating Urad SQ and FAQ variety at Rs 3,900/100Kg and Rs 3,050, respectively for whole July delivery.

.jpg) Chana Kantewala (Indore):

Chana Kantewala (Indore):

At Indore market, Chana prices traded lower by Rs 125 at Rs 3,525/100Kg amid sluggish buying support from mills at prevailing rates and weak cues from futures market.

The prices were pressurised further after Maharashtra government announced subsidy of Rs 1000/100kg for farmers in the state who had registered to sell their Chana but failed. Due to this announcement farmers would speed up their sales in the market.

In addition, absence of demand from retailers and wholesalers for Chana dal exerted pressure on the price of the commodity.

Similarly, Australia origin Chana at Mumbai and Mundra ports priced lower by Rs 150 each at Rs 3,250/100Kg and Rs 3,300, respectively.

Chana stocks at NCDEX accredited warehouses stood at 37,925 metric tonnes as on 8th June, up from 37,341 metric tonnes in the previous session, the exchange data showed. Akola:35008, Bikaner 1771, Jaipur 1146.

Technically, for NCDEX Chana July Contract, traders short and holding the same can maintain the stop loss at 3597. Resistance is at 3481-3530-3597. Exit long and sell on rise from 3481-3530 with a stop loss of 3597.Expect lower range of 3449-3368.

Australian chana dal prices eased at Rs 3,950/100 Kg amid slack trade activity. Domestic chana dal of Pistol brand also ruled weak at Rs 4,100, Samrat brand at Rs 4,500 and Angel brand at Rs 4,400. Chana besan also remained weak at Rs 2,671/50Kg. On the other hand, Vatana besan traded flat at Rs 2,150/50 Kg and Vatana dal at Rs 3,825.

Kabuli Chana of 42-44 and 44-46 counts traded weak by Rs 150 to Rs 5,750/100Kgs and Rs 5,550, respectively at Indore due to poor domestic/overseas demand, ample stock in the country and price parity. Although supply so far this month was poor mainly due to farmers' strike.

Similarly, Kabuli Chana dollar variety slipped down at Rs.4,500-5,000/100Kgs at Indore on slack trade and regular arrivals.

Sentiments in chana weighed further after government announcement subsidy for farmers in Maharashtra who had registered to sell their Chana but failed. On the other hand, Madhya Pradesh government has extended chana procurement till June 20 from June 09. Continued downtrend on chana futures also pressurised the prices in spot markets.

Prices are likely to get support after Ramzan at lower rates as price difference between chana and white pea has been reduced. Since the available matar stocks have been exhausted, buyers may shift to chana, which is a close substitute for White Pea. The festival season in the country will start from August and will last till Diwali, which will also support chana prices. Meanwhile, Indian government has put White Pea in restricted category with April-June import limit at only 1 lakh tonne and likely to extend the limit further to support chana prices.

Imported Masoor (Mumbai):

Imported Masoor (Mumbai):

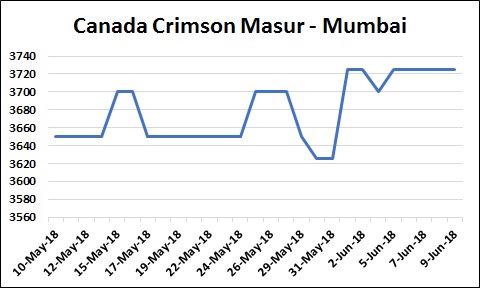

Canada origin masoor in Container along with Australia Masoor stayed steady in Mumbai amid slow millers' trade activity despite no supply pressure from overseas and slow arrivals of new domestic crop.

Also, sellers were not interested to liquidate the commodity at existing prices amid depleting stock of imported masoor.

Canada crimson variety masoor in container priced at Rs 3,725-3,825/100Kg. Canada masoor new in vessel quoted at Rs 3,725. Stock of Canada masoor old in vessel were low and offered as per quality.

Australia Masoor nugget variety quoted at Rs 3,950-4,025/100Kg as per quality against limited stock.

However, demand in processed Masoor was reported thin from consumption centers. Canada Masoor Khopoli spot priced at Rs 4,350/100Kg.

In forward business, Canada crimson variety masoor offered at $420 per ton in container on CNF basis Nhava- Sheva for June-July shipment. Australia nugget variety masoor offered at $440 per ton in container on CNF basis Nhava- Sheva for June-July shipment.

NAFED Procures (Rabi 2018) 219653.41 MT Masoor As On 7 June At MSP Prices Of Rs 4250. Madhya Pradesh:216994.91, Uttar Pradesh:2658.50.

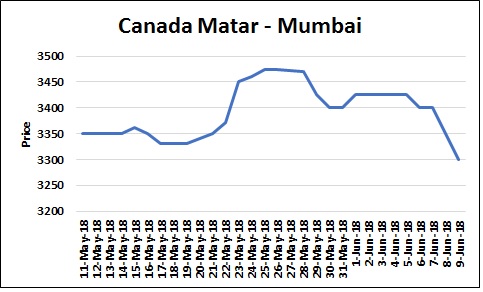

Imported White Pea (Mumbai):

Imported White Pea (Mumbai):

Imported White Pea of all origin, such as Canada, Russia and Ukraine at Mumbai port remained weak by Rs 50-75/100Kg as per quality due to dull trade activity at existing rates and fresh supply from overseas.

Canada White Pea offered at Rs 3,331/100Kg at Mumbai, Rs 3,200-3,250 at Mundra and Rs 3,301 at Hajira port. Russia origin Baltic variety quoted at Rs 3,200-3,250 at Mumbai and Rs 3,121 in Mundra. Ukraine White Pea priced at Rs 3,250 at Mumbai.

Further demand in Matar dal/besan was thin at higher rates due to fresh overseas supply of White Pea, but to a lesser extent. The prices are expected to ruled firm due to reducing stock and higher supply pressure from overseas in the wake of quantitative restriction imposed by the Indian government.

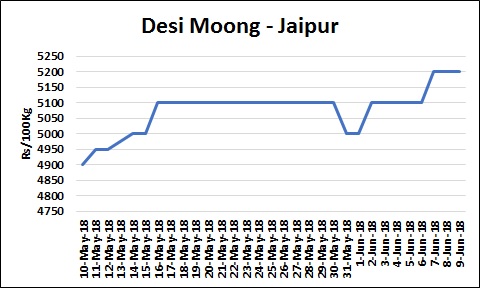

Moong (Jaipur):

Moong (Jaipur):

Moong prices quoted steady at Rs 4,800-5,200/100Kg as per quality in Jaipur market during the week on limited millers' buying at prevailing rates.

Similarly, Moong dal prices also ruled stable at Rs 6,000/100Kg as per quality.

According to market sources, prices of moong are likely to trade range-bound due to adequate stock position and regular supplies of summer crop in Madhya Pradesh, Uttar Pradesh and Gujarat.

Meanwhile, government agencies are also active to sale their procured stock in Rajasthan, Madhya Pradesh, Andhra Pradesh, Karnataka and Maharashtra.

Kenya Moong offered at $650 per ton, Tanzania Moong at $600-620 and Mozambique Moong at $610-615 on CNF basis Nhava- Sheva for ready shipment.

(By Commoditiescontrol Bureau; +91-22-40015513)