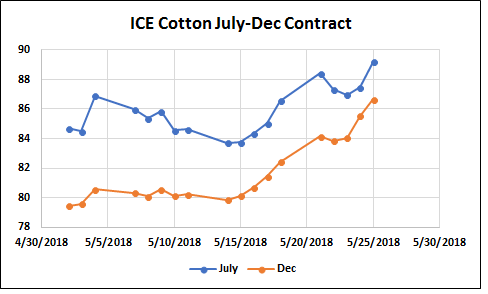

MUMBAI (Comoditiescontrol) - U.S. cotton futures rallied this week, with July contract gained 266 points, or 3.07% to close at 89.21 cents/lb due to higher mix fixation and concern over crop due to adverse weather conditions in major cotton producing countries. Open interest in July contract has narrowed, but expanded in December contract indicating that fresh long positions are being added in new cotton contract.

MUMBAI (Comoditiescontrol) - U.S. cotton futures rallied this week, with July contract gained 266 points, or 3.07% to close at 89.21 cents/lb due to higher mix fixation and concern over crop due to adverse weather conditions in major cotton producing countries. Open interest in July contract has narrowed, but expanded in December contract indicating that fresh long positions are being added in new cotton contract.

May 21 (Monday): The most-active July cotton futures settled up 1.87 cent, or 2.16 percent, at 88.42 cents per lb to hit four-year highs on buying from Chinese hedge funds, amid expectations of an increase in exports from the United States after trade war fears with China receded.

May 22 (Tuesday): ICE July cotton futures settled down 1.07 cent, or 1.21 percent, at 87.35 cents per lb weighed down by profit-taking and amid rainfall in Texas – the major cotton growing region in the United States.

May 23 (Wednesday): ICE cotton contract for July expiry settled down 0.39 cent, or 0.45 percent, at 86.96 cents per lb ahead of a weekly export sales report due on Thursday.

May 24 (Thursday): ICE cotton contract for July expiry settled up 0.5 cent, or 0.57 percent, at 87.46 cents per lb. It traded within a range of 86.64 and 87.85 cents a lb.

May 25 (Friday): ICE cotton contract for July expiry settled up 1.75 cent, or 2.00 percent, at 89.21 cents per lb boosted by mill fixations and amid worries that unsupportive weather may impact new crop production in major global cotton producing countries.

.png) STRONG CHINA RESERVE SALES

STRONG CHINA RESERVE SALES

China state reserve successfully conducted 100% auction of cotton for the fifth straight day on Friday due to strong demand from local buyers amid concern about the crop in Xinjiang region. The state reserve has put total 150,013 tonnes of cotton during the week with daily average at 30,003 tonnes and has managed to liquidate entire cotton put for auction during the week.

Xinjiang region has received heavy precipitations in the recent weeks and has stocked worry about production, however not significantly as replanting can be done, but will raise cost of production.

The adverse weather conditions have prompted Chinese buyers to procure cotton from the state reserve for the inventory purpose to meet their long term demand. Further buyers are also inclined for state reserve cotton as it is available at affordable rates. Demand was also increased for reserve cotton due to increase in spread between ZCE cotton and average transaction auction price.

ZCE cotton rose nearly 8% so far since May 15 with open interest clocked at 389,450 lots. Earlier on May 18, the open interest reached to record level of 445,162 lots.

The state reserve has so far sold this season around 572,953.65 tonnes of cotton with a total turnover of 54.55 percent.

.png) U.S. WEEKLY EXPORT SALES

U.S. WEEKLY EXPORT SALES

Total net sales and shipment during the week ended May 17 dropped by 67% and 3% at 51,610 running bales (RBs) and 420,917 RBs, respectively. Shipments continued to eclipse the weekly pace required in order to match the USDA’s revised 15.5M bale export target with 10 weeks remaining.

The US is 111.3% committed and 76.1% shipped against the USDA’s export target. Shipments will need to average 3.69K RBs per week in order for the USDA’s of 15.5 million bales (480lb) target to be realized. Total sales against 2018-19 were at nearly 1.52K RBs; sales against 2018-19 currently stand at a running total of almost 4.40 million RBs.

CFTC – ON-CALL SALES

The latest on-call report showed that still 4.65 million bales unfixed on July contract as of May 18, which is a sizable amount since only about 3 weeks remain to square these fixations away. Additionally, there are already 11.83 million bales in unfixed on-call sales from December onwards, which will act as a strong layer of support below the market.

The CFTC report revealed, dated May 18, showed Money managed players net long positions at 90,526 lots from 89,260 lots previous week. On the other hand, the trade shorts rose 3% to 190,439 lots.

TECHNICAL IDEAS - ICE JULY COTTON

Hold long position with a stop loss of 83. Resistance will be at 90.52-93.77.

Support can be at 88.57-87.27.

A sustained rise and close above 90.35 can extend the rise towards 97.

.png)

(By Commoditiescontrol Bureau; +91-22-40015533)