MUMBAI (Commoditiescontrol) – Spot Guarseed and Guargum registered good rise for the week (Apr 15-20) inspired by mainly sharp run in crude oil followed by dwindling supply, rising U.S. rigs count, good demand at the lower level, strong cues from futures and growing optimism about export of Guargum.

Guarseed prices edged higher by over 4% at Rs 4,225/100kg at the benchmark Jodhpur market, while Guargum recorded growth of 3.67% at 9,100.

.png)

What Inspired Guar Rise?

Guarseed prices earlier since February were under heavy pressure due to several negative factors, but all those have now faded.

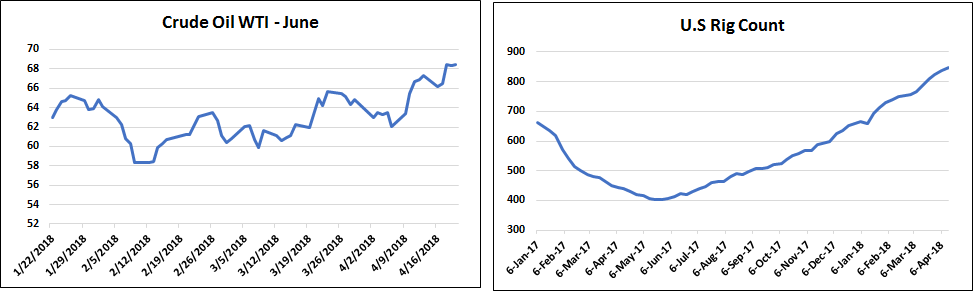

Crude Oil: The U.S. benchmark hit a 3 ½-year high earlier this week, and the contract ended the week 1.5% higher. June WTI crude, -0.40% which became the front-month contract the settlement, added 7 cents, or 0.1%, to $68.40 on Friday.

June Brent crude rose 28 cents, or 0.4%, to $74.06 a barrel on ICE Futures Europe, marking another finish at the highest since November 2014. It rose 2% for the week.

U.S. Rig Count: The total U.S. rig count rose by 5 to 1,013, identical to last week's gain, according to Baker Hughes' latest weekly survey.

Oil rigs account for the entire increase, gaining 5 to 820, while gas rigs are unchanged at 192; one rig is classified as miscellaneous.

.png) Guarseed Arrival: The daily arrival of Guarseed has dropped to 4,000-6,000 bags (100kg) during the week mainly due to slow farmers' selling at the lower level, while stockists having Guarseed remained reluctant with anticipation of better return ahead.

Guarseed Arrival: The daily arrival of Guarseed has dropped to 4,000-6,000 bags (100kg) during the week mainly due to slow farmers' selling at the lower level, while stockists having Guarseed remained reluctant with anticipation of better return ahead.

Good Demand was observed from crushers side at the lower level, stockists buying is not very robust at the moment due to volatile prices earlier last few months followed by liquidity crunch, but in case price sustain at the higher level then they may again start procuring in bulk quantity.

Overall outlook is positive, but the main issue is export demand. Guargum export should rise consistently in next 3-6 months to achieve good prices, other wise forecast of good monsoon and sufficient stock will again weigh on prices, so export of Guargum is key to determine future outlook.

Guargum Export: India Guargum export during April-February rose over 24% at 449,706 tonnes as against 361,833 tonnes during the same period a year ago, according to Agriculture & Agri Processed Food Authority of India (APEDA).

Guar Futures: The most-active May Guarseed futures rose over 2% to settle this week at 4,197.50/100kg on the National Commodity & Derivatives Exchange Ltd (NCDEX). Similarly, Guargum May contract gained more than 2% at Rs 9,140.

Conclusion: Guarseed and Guargum are likely to continue to trade strong till prices hold physcological level of Rs 4,000 in the spot market.

Technical View: NCDEX Guar Gum May: Cover Short Position| NCDEX Guar Seeds 10 Mt March: Expect Near Term Rise

(By Commoditiescontrol Bureau; +91-22-40015533)