REPORT For Date 09/07/2018

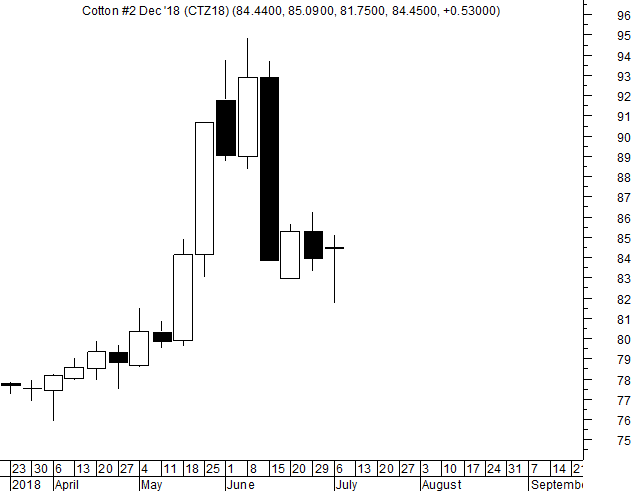

NY COT EXCHANGE Cotton No.2 (Price figures in cent/5000lbs):

Traders short and holding the same can maintain the stop loss at 86.22.

Long Legged Doji has been formed which suggest support at lower level as recovery has been witnessed from the low of 81.75 to close the week at 84.45.

Support will be at 83.86-82.44 during the week.

Further weakness is below 81.75 closing with bearish candle.

Cover short position at the support as near term rise towards 85.78-89.12 could be seen.

A breakout and close above 86.22 can mark a reversal for a swing bottom which take bring back the bullish mode to test back the recent peak of 94.82 with supply zone of 88.4-94.82.

Contrarian long strategy can adopted by traders by understating the risk of 81.75 as the stop loss.

Accumulate at support of 83.86-82.44 with a stop loss of 81.75.

Add further if breakout above 86.22 is witnessed with low of the week as the stop loss.

Sell is below 81.75 and till then cover short position.

TREND INFORMATION WITH INTRA-DAY LEVELS

|

CLOSE

|

DRV

|

TREND*

|

Trend

Price

|

Trend

Date

|

L1

|

L2

|

CP

|

L3

|

L4

|

|

84.45

|

N/A

|

DOWN

|

N/A

|

N/A

|

79.10

|

82.44

|

83.76

|

85.78

|

89.12

|

*Trend will remain Down as long as last close is below the pink color DRV. Trend will be Up as long as Price is above DRV. Positional Traders: If trend is up then traders long can hold long position with closing stop loss of DRV: Close >DRV. If trend is down then traders can hold short position with a closing stop loss of DRV: Close <DRV.

PRICE, VOLUME AND OPEN INTEREST STRATEGY

|

Close

|

PRICE G/L%

|

VOLUME

|

% V INC/DEC

|

OPEN INTEREST

|

% OI INC/DEC

|

CANDLE

|

POSITION

|

|

84.45

|

0.6

|

67029.0

|

-0.1

|

175315.0

|

-3.4

|

Indecisive

|

Unwinding

|

Disclaimer: There is risk of loss in trading in derivatives and the report is not to be construed as investment advice. The information provided in this report is intended solely for informative purposes. The author, directors and other employees of CC Commodity Info Services cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above.