Report for Date: 21/11/2016

MCX Silver (Price figures below are in Rs/INR per Kg)

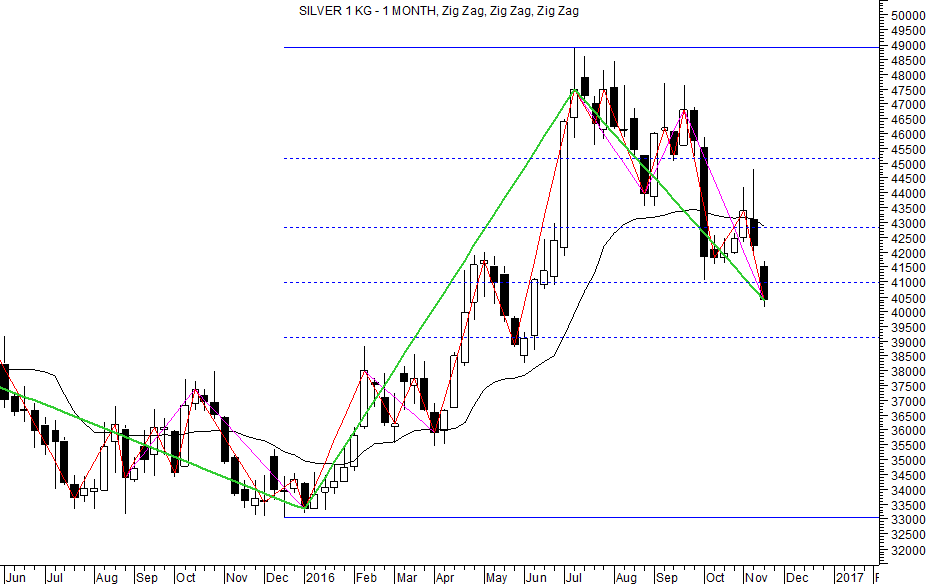

Traders short and holding the same can maintain the stop loss at 42195.

Resistance is at 40733-41335-41680.

The gap on weekly is at 41680-42195.

Till the gap is not crossed on the closing reversal can resume for near term rally.

Retracement level of the last major rise from 33030 to 48932 is placed at 39079.

Exit long and sell on rise to 40733-41335 with a stop loss of 42195.

Lower range for the week can be 39785-38235.

Last higher bottom was at 38270 and the demand zone attached with it is 38270-39291.

Expect support at the demand zone as 61.8% retracement is within the range of demand zone.

The 61.8% retracement as mentioned above is at 3907.

If lower range of 39784-38235 is attained first then avoid selling on the rise to higher range.

TREND INFORMATION WITH WEEKLY LEVELS

|

STRATEGY

|

CLOSE

|

DRV

|

TREND*

|

Trend

Price

|

Trend

Date

|

L1

|

L2

|

CP

|

L3

|

L4

|

|

Hold Short

|

40388.0

|

42886.4

|

DOWN

|

42194.0

|

11.11

|

38235

|

39785

|

40733

|

41335

|

42885

|

*Trend will remain Down as long as last close is below the pink color DRV. Trend will be Up as long as Price is above DRV.

PRICE, VOLUME AND OPEN INTEREST STRATEGY

|

Last Close

|

Price G/L%

|

Volume

|

V -G/L%

|

Open Interest

|

OI -G/L %

|

Candle

|

Position

|

|

40388.0

|

-4.3

|

2068050

|

-43.1

|

11555

|

-3.2

|

Negative

|

Unwinding

|

TECHINCAL INDICATORS TABLE

|

RSI

|

1-ROC-RSI

|

Stochastic

|

1-ROC-

Stochastic

|

MACD

|

1-ROC

MACD

|

RS

|

1-ROC

RS

|

|

41.53

|

-11.66

|

25.35

|

-19.36

|

134.08

|

-66.25

|

26.19

|

-37.13

|

Disclaimer: There is risk of loss in trading in derivatives and the report is not to be construed as investment advice. The information provided in this report is intended solely for informative purposes. The author, directors and other employees of CC Commodity Info Services cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above.